How Banks Can Help Ease B2B Payments Friction

Much like consumers, businesses increasingly need secure, streamlined payment methods that are better suited to their needs.

This means that financial institutions (FIs) need to maintain the flexibility necessary to customize the range of payment processes they offer to clients as their businesses expand.

Enterprise customers can also pinpoint key payments frictions by asking about specific barriers to scale, as these obstacles can range from the B2B payments user experience to a lack of supplier portals.

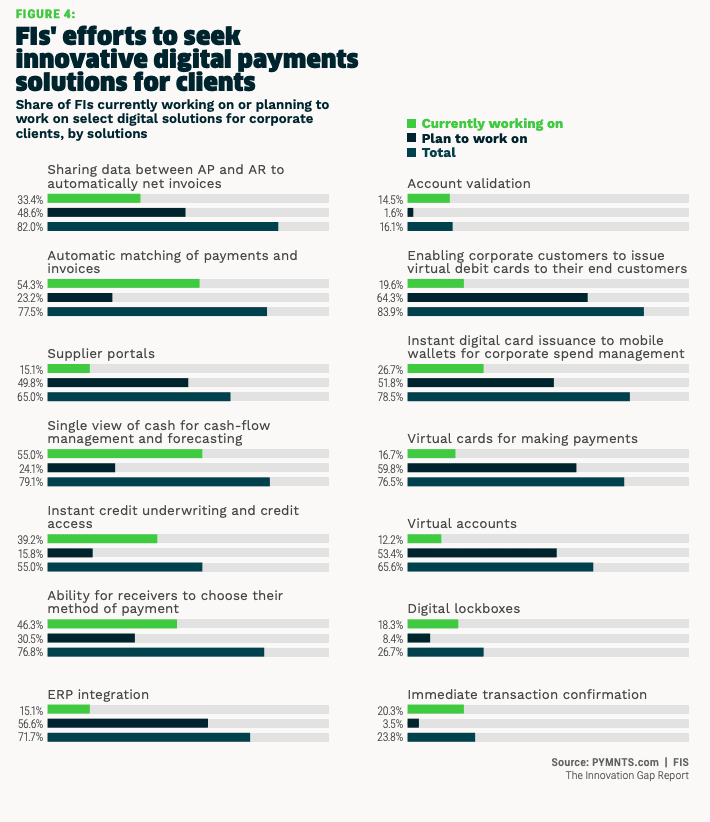

These collaborations between FIs and their corporate customers can ultimately lead to faster payments innovation. PYMNTS’ research found that 79% of FIs are currently working on solutions to offer clients a single view of cash for real-time cash flow management.

The lack of dedicated supplier portals is another important payment friction for corporate clients, with 65% of FIs looking for solutions to this problem or planning to do so. Thirty-one percent of corporate clients pointed to a lack of payment options as another crucial pain point, and around three-fourths of FIs said they are working on or planning on solving this problem.

The lack of dedicated supplier portals is another important payment friction for corporate clients, with 65% of FIs looking for solutions to this problem or planning to do so. Thirty-one percent of corporate clients pointed to a lack of payment options as another crucial pain point, and around three-fourths of FIs said they are working on or planning on solving this problem.

PYMNTS’ research makes it clear that FIs must focus on four specific innovation areas to better address clients’ B2B pain points:

- Offering a centralized view of cash flow and liquidity

- Streamlining business user authentication

- Simplifying invoice reconciliation

- Providing vendor onboarding tools that can rapidly scale with the addition of new businesses

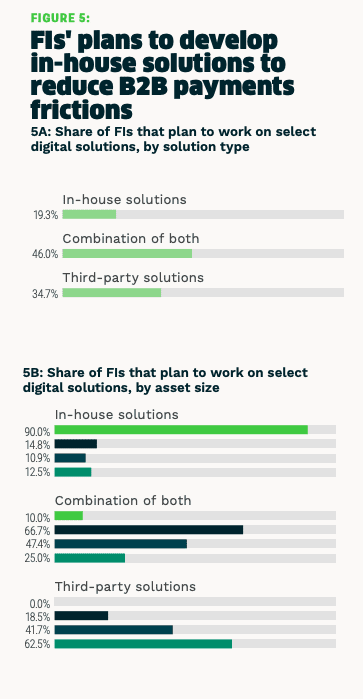

Sometimes, both FIs and their corporate clients can benefit from working with technology solutions providers to identify and address these payment frictions. Many FIs know they need to modernize, although there are several differences in how they plan to deal with related issues.

PYMNTS research shows 92% are innovating or planning to innovate new digital solutions to cut down on clients’ key B2B payments frictions, but just 19% plan to do this in-house.

FIs with more than $100 billion in assets are a key departure from this trend, with 90% saying they’ll develop solutions in-house.

For more on PYMNTS’ findings, download the Innovation Gap Playbook, an FIS collaboration.