It’s hard to pin down just how much a digital transformation is worth — what the quantifiable opportunity really is as new business models evolve.

That’s especially true as payments, especially B2B payments, finally and fully catch up to long-awaited digital potential.

Consulting firm Bain & Company estimated this week that embedded finance — where financial services become part of the very fabric of companies’ consumer- and enterprise-facing offerings across all manner of verticals — could be worth $7 trillion by 2026.

That figure would be leagues above the $2.6 trillion in United States financial transactions that are done, presently, through embedded means.

Forecasting is an imprecise science — and, in fact, is more art than science. Bain’s estimates may prove low, may prove high, and four years from now is a long way away.

But the trend is undeniable. Bain noted that the banking transactions that would be embedded into software, eCommerce and platforms in general should spur financial institutions (FIs) to embrace those technological shifts. Along the way, the potential is there for a range of firms (and FIs) to bring eWallets, buy now, pay later (BNPL) and other lending options directly to consumers at the point of transaction.

FIs Can Help Revamp B2B

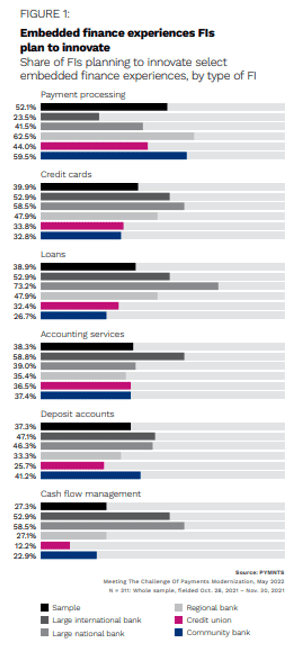

PYMNTS spotlighted FIs’ plans in an edition of the “Embedded Finance Tracker,” done in collaboration with Galileo. FIs spanning all stripes, from international players to community banks, are setting sights on revamping everything from payment processing to offering cash flow and accounting related services and loans.

Read more: Embedded Finance Brings Consumer Convenience to B2B Payments

Those last few metrics are especially germane to changing B2B payments because they spotlight some of the existing and stubborn pain points within commercial transactions. Cash flow remains the lifeblood of enterprises, as Bain noted that in the U.S., B2B payments accounted for $27.5 trillion in transaction value in 2021, and 90% of that value is tied to accounts payable (AP) and accounts receivable (AR).

Embedded finance will have the salubrious effect of moving B2B transactions well beyond the confines of the paper check and the paper invoice. PYMNTS found that more than 80% of banks offer clients the ability to use their own enterprise resource planning (ERP) systems to access accounts and make payments to suppliers or vendors — or plan to offer it. That would streamline the interactions up and down supply chains where checks still account for more than 50% of B2B payments.

Other opportunities lie with addressing the trade gap that exists as businesses’ funds are locked up in receivables.

In one example, in a partnership between BigCart and OpenText, BigCart’s payment solutions will now be offered to businesses running OpenText’s cloud-based supply chain management software, giving more than 1.1 million trading partners access to embedded offerings.

See more: Embedded Solutions Tackle SMBs’ Trade Finance Challenges

For all PYMNTS B2B coverage, subscribe to the daily B2B Newsletter.