Payment Processors Adapt Strategies to Woo Main Street SMBs

Small-to-mid-sized businesses (SMBs) on the main streets of the United States heavily rely on payment processors to facilitate their transactions.

While PayPal and Square dominate the market, in the recent survey, Main Street Health in Q3 2023 from PYMNTS Intelligence and Enigma revealed that 85% of Main Street SMBs are highly satisfied with their current payment processors. However, this leaves a battle for market share among the remaining 15% of Main Street SMBs.

Meeting the Unique Needs of Main Street SMBs

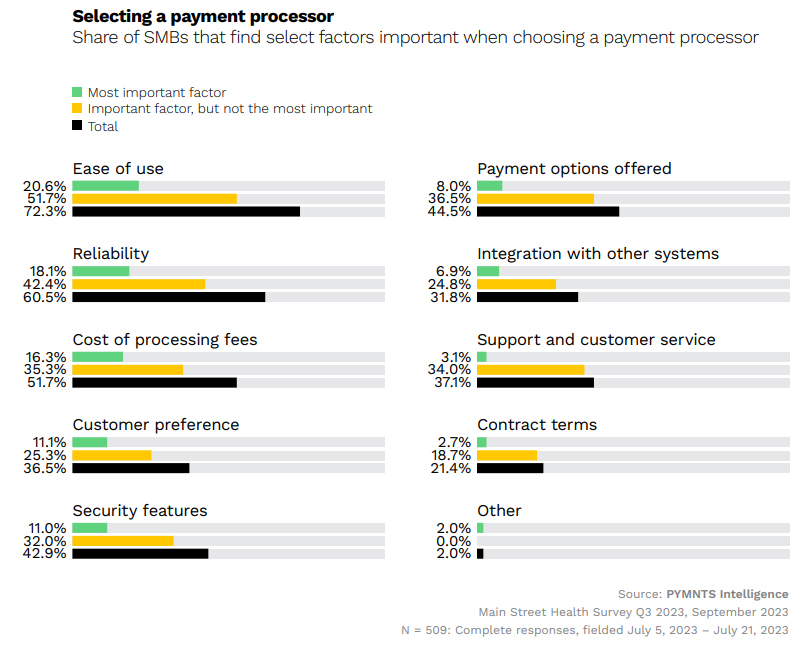

To deepen their presence in the market, payment processors must prioritize the services, features and functionalities that Main Street SMBs value. The survey highlighted the differences in preferences across various segments, including construction, professional services, hospitality and retail.

Lower transaction fees emerged as the leading factor that would motivate Main Street SMBs to switch payment processors, with 59% of SMBs stating this as a significant factor. Ease of use was also mentioned by 42% of SMBs as a motivating factor for switching. Retail trade, professional services, consumer services/hospitality, and construction SMBs all expressed interest in switching if offered lower transaction fees.

Competitive Advantage for Payment Processors

Payment processors that can offer competitive transaction fees, ease of use, reliability, and multiple payment options are likely to establish and retain a strong customer base among small businesses. Leading processors such as PayPal, Square and QuickBooks have already built loyal customer bases by focusing on these key factors.

Hospitality and consumer services SMBs were found to be the most likely to switch payment processors, making them the next battleground for processors to win customers. These SMBs reported the lowest levels of satisfaction with their current processors. Hospitality SMBs prioritize fraud prevention and customer support, while consumer services SMBs seek processors that offer multiple payment options.

Differentiation Through Add-On Services

Payment processors can differentiate themselves by offering add-on services such as banking, credit, marketing, reporting and data analytics. Construction SMBs and younger SMBs expressed interest in fraud detection and prevention, banking and credit services and marketing support, per the report.

Overall, payment processors need to understand the specific needs and preferences of Main Street SMBs to attract and retain their business. By offering competitive pricing, ease of use, reliability and additional services, payment processors can position themselves for success in this market.

For all PYMNTS B2B coverage, subscribe to the daily B2B Newsletter.