Small Business Survival May Hinge on Digital Payment Features

The holiday shopping season is so important to retailers that it has become a matter of survival for many. One in four businesses believes recent holiday sales will determine whether they make it in 2023. Small to midsized businesses (SMBs) are investing in new tools, including payment solutions, to make the most of the holidays, as shoppers value SMBs and 85% of consumers believe small merchants offer at least one advantage over larger companies.

The warm sentiment for small businesses has owners optimistic and trying to keep pace with customers. Half of SMBs are adding third-party payment solutions, and more than half are obtaining sales increases via expanding their social media footprints. Considering retail’s economic and competitive environment, SMBs must adapt.

This edition of the “B2B And Digital Payments Tracker®” explores the size and scale of the opportunity for SMB retail and how merchants can drive growth with new payment technologies.

Around the B2B and Digital Payments Space

As consumer preferences change and digital payment options become a staple of the customer journey, retailers are turning to technology to meet these demands. Nearly 4 in 10 U.S. retailers are looking to innovate post-purchase tasks such as fulfillment or shipping, 37% are investing in technology for inventory management and sales forecasting and 34% are bringing technology to their checkout experiences to remove friction.

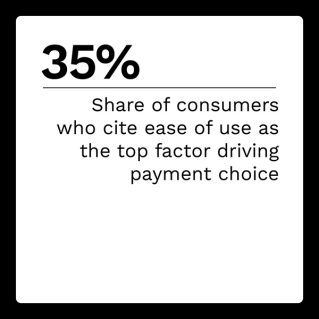

Retailers are chasing of seamless payment experiences that fueled the most recent holiday shopping season, with digital wallet use rising from 17% to 21% this past year and one-click payment use up from 65% to 67%. Buy now, pay later (BNPL) is also on the rise, especially for those who have used it previously. Ease of use is the most important factor for customers, with 35% saying it drives their payment choice.

For more on these and other stories, visit the Tracker’s News and Trends section.

An Insider on How SMBs Should Leverage Payment Technologies for Scale

Small businesses have always differentiated themselves through a more personalized experience, and now they are extending that, aiming to compete in a digital era by offering consistent and curated experiences across all channels. Ensuring that payment does not hinder the buying experience is key, and offering customers more ways to pay is a win-win for all.

To get the Insider POV, we spoke with Andrea Gellert, head of marketing at Clover, to find out the questions merchants should ask themselves when considering new payment options and how payment technologies can streamline and achieve scale for their entire businesses.

How SMBs Can Use Payments Innovation to Spur Growth

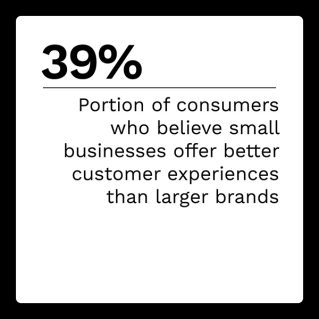

Time and again, customers demonstrate loyalty to SMBs, such as the 94% of shoppers who believe small businesses are vital to their communities and the nearly 4 in 10 who say smaller companies provide better customer experiences than larger ones. Consumers’ payment needs are evolving at an unprecedented rate, with security and choice of payment method now the two most important factors to shoppers. In addition, more than one-quarter of consumers — 27% — consider it very or extremely important to be able to pay with a mobile wallet, such as PayPal or Apple Pay. SMBs can leverage the goodwill working in their favor if they meet customers where they are on payment options.

To learn more about where SMBs’ payment opportunities exist, read the Tracker’s PYMNTS Intelligence.

About the Tracker

This edition of the “B2B and Digital Payments Tracker®,” a collaboration with American Express, examines how SMB retailers can tap new payment opportunities to drive sales and customer loyalty.