PayFacs Serve Logistics Sector Through Digital Wallets

Innovations in embedded finance have captured the attention of decision makers in the logistics and wholesale trade space.

As a result, payment facilitators (PayFacs), independent software vendors (ISVs) and marketplaces are all working with these providers to help them integrate embedded finance capabilities, such as digital wallets and installment plans, into their websites and product apps.

As PYMNTS Intelligence found in “The Embedded Finance Ecosystem: Logistics and Wholesale Trade Edition,” a collaboration with Carat from Fiserv, those embedded finance facilitators working with logistics and wholesale firms are putting their innovation efforts into four key areas: operational enhancement, risk management and compliance, customer experience and strategic business growth.

Broken down further, the report — which reflects insights from surveys with 282 executives working at PayFacs, ISVs and marketplaces — showed digital wallets appear to be a top priority for all three embedded-finance facilitators. Eighty-three percent of PayFacs serving the space are prioritizing digital wallet innovations; so are 57% of marketplaces. Although about half of ISVs are already offering digital wallet solutions, they say they plan to innovate digital wallet capabilities even further.

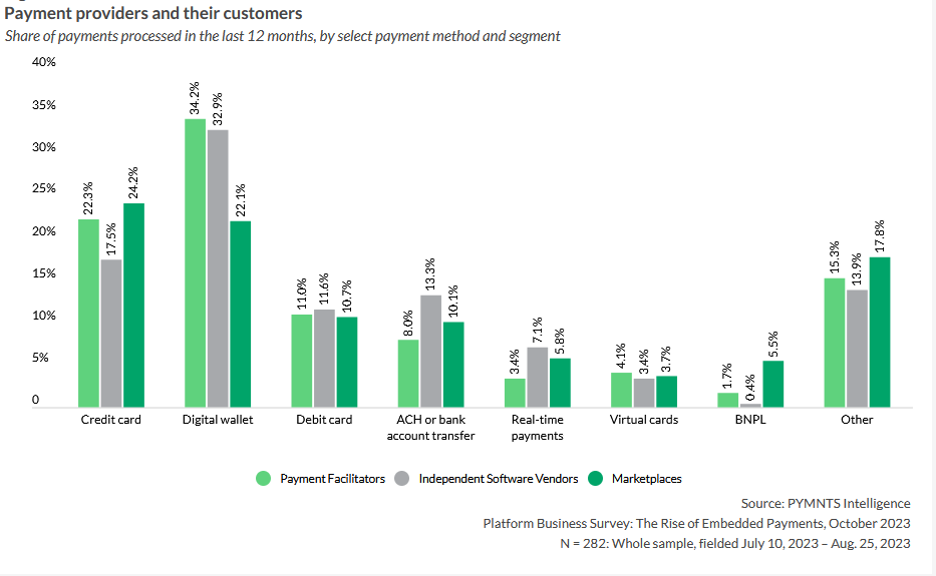

That concentration on digital wallets is paying off. Exclusive data not included in the report reveals the degree of success each of the three embedded finance facilitators are having. As the image above shows, over a 12-month period, PayFacs serving logistics and wholesale trade firms were able to process 34% of their payments through digital wallets, while 33% of ISVs report the same.

More traditional payments — credit and debit cards, ACH — were the next most common payment method for all three facilitators. However, each had some degree of success in processing payments using newer payment methods: ISVs processed 7% of payments in real-time, while 6% of marketplaces did the same. Marketplaces, meanwhile, were able to complete almost 6% of payments using buy now, pay later (BNPL) options.