Cross River Bank on FIs’ Growing Brand Necessity of Embedded Banking

With a digital transformation sweeping through the business world, the banking needs of small to midsized businesses (SMBs) are rapidly changing. Instead of continuing to utilize physical processes and analog solutions, SMBs are increasingly relying on and expecting online channels and digital solutions. A recent survey found that more than two-thirds of SMBs seek to manage as many aspects of their businesses digitally as possible.

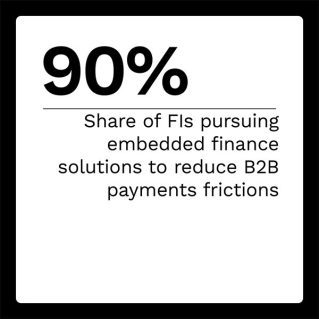

The growing need for digital solutions is changing SMBs’ relationships with their financial institutions (FIs). In-branch banking is no longer important for most SMBs. Businesses instead want online products and services. SMBs’ preference for digital is so strong that it determines which FIs they choose to work with. FIs must meet these digital needs, yet many lack the infrastructure to do so. Fortunately, FIs that lack the ability to create digital solutions on their own can leverage embedded FinTech and banking solutions to meet their SMB clients’ digital needs.

The “Next-Gen Commercial Banking Tracker®,” a PYMNTS and FISPAN collaboration, explores SMBs’ evolving expectations for in-branch versus online banking and how FIs can meet these expectations with embedded and open banking solutions.

Around the Next-Gen Commercial Banking Space

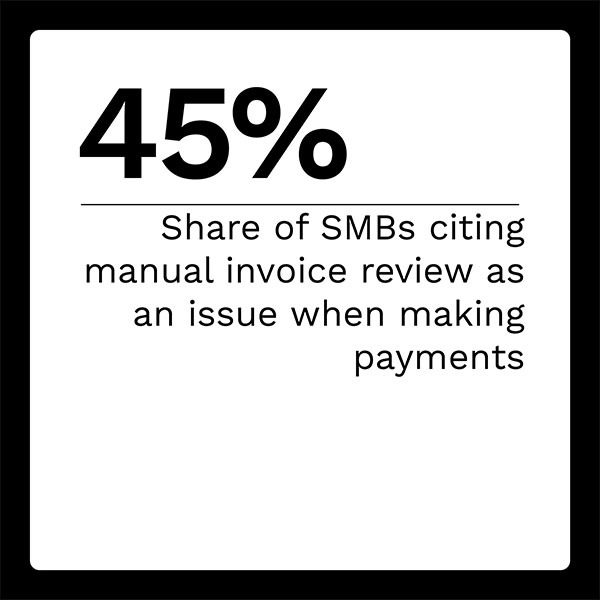

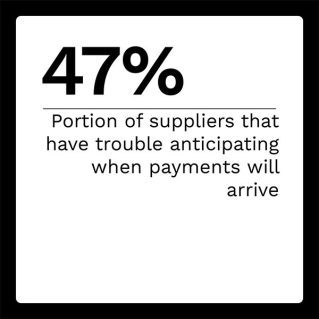

When it comes to business-to-business (B2B) payments, invoicing remains a major pain point. A PYMNTS survey of SMBs found that 45% of businesses cited manual invoice review as an issue while making payments, with 19% reporting that as their primary problem. Of the 18 problems included in the survey, manual invoice review ranked first. Supplies are also experiencing invoice-related difficulty. The survey found, for example, that nearly half of the suppliers had trouble anticipating when payments would arrive.

When it comes to business-to-business (B2B) payments, invoicing remains a major pain point. A PYMNTS survey of SMBs found that 45% of businesses cited manual invoice review as an issue while making payments, with 19% reporting that as their primary problem. Of the 18 problems included in the survey, manual invoice review ranked first. Supplies are also experiencing invoice-related difficulty. The survey found, for example, that nearly half of the suppliers had trouble anticipating when payments would arrive.

An admonishment of banks from regulators in the United Kingdom serves as further evidence that FIs are not adequately meeting SMBs’ banking needs. The U.K. Financial Conduct Authority (FCA) recently warned banks that unless they improve their service to SMBs struggling with debt, these banks may face stringent regulatory action. The warning came after the FCA reviewed customer files and discovered repeated instances of bad customer outcomes and routine failures to treat customers fairly.

For more on these and other stories, visit the Tracker’s News and Trends section.

Cross River Bank on Addressing Consumer Needs With Embedded Banking

Digital banking trends now dominate the industry and FIs must provide customers with all the capabilities and products they need, from mobile wallets to lending technology and everything in between. Embedded banking can help FIs ensure customers have the banking features they want and need.

In this month’s Feature Story, Anthony Peculic, head of cards and banking as a service (BaaS) at Cross River, explains the importance of embedded banking to meet customers’ digital banking needs.

SMBs Prefer Digital Tools Over In-Branch Banking

While businesses have gradually adopted digital banking solutions for years, the demand for these digital offerings has reached a tipping point. Businesses, especially SMBs, do not just expect digital banking tools; they need them. A recent Bank of America study found that 85% of its small business customers utilize digital channels. Compared to pre-2020 levels, small businesses’ digital sales are now up 300%, accounting for nearly half of total sales.

The increasing need for digital solutions is changing the types of products and services SMBs want and need from their FIs. With businesses primarily interested in online solutions, in-branch banking is now of secondary importance. Many banks lack the in-house expertise and infrastructure to provide a comprehensive digital offering. For these banks, embedded banking and open banking solutions are essential. FIs can easily purchase white-label solutions from FinTechs and other third-party providers and integrate these solutions into their digital offerings.

To learn how embedded and open banking can help banks solve their struggle to meet SMBs’ needs, read the Tracker’s PYMNTS Intelligence.

About the Tracker

The “Next-Gen Commercial Banking Tracker®” examines the latest trends in SMBs’ in-branch and online banking needs and how FIs can use embedded and open banking to help SMB customers.