PYMNTS Intelligence: SMBs Prefer Digital Tools Over In-Branch Banking

The rapid digitization of the banking industry is transforming the types of products and services corporate clients are demanding from their financial institutions (FIs). Though businesses have been slowly adopting digital banking solutions for years, the demand for these digital offerings is greater than ever. Businesses do not just expect online banking tools; in many cases, they actually need them to stay competitive in a digital-first world.

The rising demand and need for digital tools is especially true for small- to medium-sized businesses (SMBs). A recent Bank of America study found that 85% of its small business customers are utilizing digital channels, while digital engagement has increased by 15% from last year. This increased use translates to a growing share of sales coming in through online channels. The Bank of America report noted that small business digital sales are now up 300% compared to pre-2020 levels and account for nearly half of total sales. A survey from Citizens similarly found that 86% of businesses now use digital banking channels, offering further evidence of how widespread digital usage has become for SMBs.

This month’s PYMNTS Intelligence examines recent changes in corporate clients’ requirements for online versus in-branch banking as well as how banks can use embedded and open banking to meet these expectations.

In-Branch Still Important, But Less so Than Online

Because SMBs now have a strong preference for digital solutions, the desire for in-branch banking has dropped. A report from EY, for example, found that 68% of SMBs are seeking to manage as many aspects of their businesses through digital touch points as possible, and of 12 factors that SMBs consider when selecting a financial services provider, having a physical presence in the form of an office or branch ranked last in importance. The reduced focus on in-branch banking is reflected in the share of SMBs reporting visits to their FIs’ physical branches. EY found that in the past 12 months, there was a 38% decrease in SMBs visiting their FIs’ physical branches and a 24% decrease in ATM usage.

Nevertheless, human interactions are still vital to SMBs’ banking needs. In the Citizens survey, two-thirds of consumers and businesses reported they prefer to ask a real person for financial advice. The in-branch experience offers SMBs a perfect venue for this type of human interaction, though consumers are also increasingly open to videoconferencing options, with 86% of Citizens’ survey respondents expressing that they were comfortable using videoconferencing technology to interact with their banking partners. The willingness to participate in videoconferencing explains why in-branch visits have dropped despite a desire for a human touch.

Online Offerings Are Must-Haves

No matter how appealing a bank’s in-branch services are, if the institution lacks online offerings, it will be unable to meet its SMB customers’ needs today. According to one recent report, 77% of small businesses with more than 50 employees would not do business with an FI that did not offer online account openings, regardless of whether this reflected the SMB owner’s particular preference.

In addition to online account opening, SMBs want a broad spectrum of digital services, ranging from remote check deposit to instant notification for large purchases or activity that seems fraudulent to online crediting and loan provisioning solutions. There is also widespread desire for cash management tools and other web-based treasury solutions. The problem is that many FIs, especially community banks, lack the infrastructure to support these types of online tools. Perhaps as many as half of all community banks are not currently able to deliver these services.

Banks Can Leverage Embedded Banking and Open Banking to Meet SMBs’ Needs

FIs need to offer an array of digital tools to meet their SMB clients’ banking needs effectively. Fortunately, there is an abundance of white-label solutions that even the least digitally-savvy banks can purchase from FinTechs and other third-party providers to integrate into their digital offerings, thereby empowering SMB clients to make payments, manage cash flow and conduct other financial activities online.

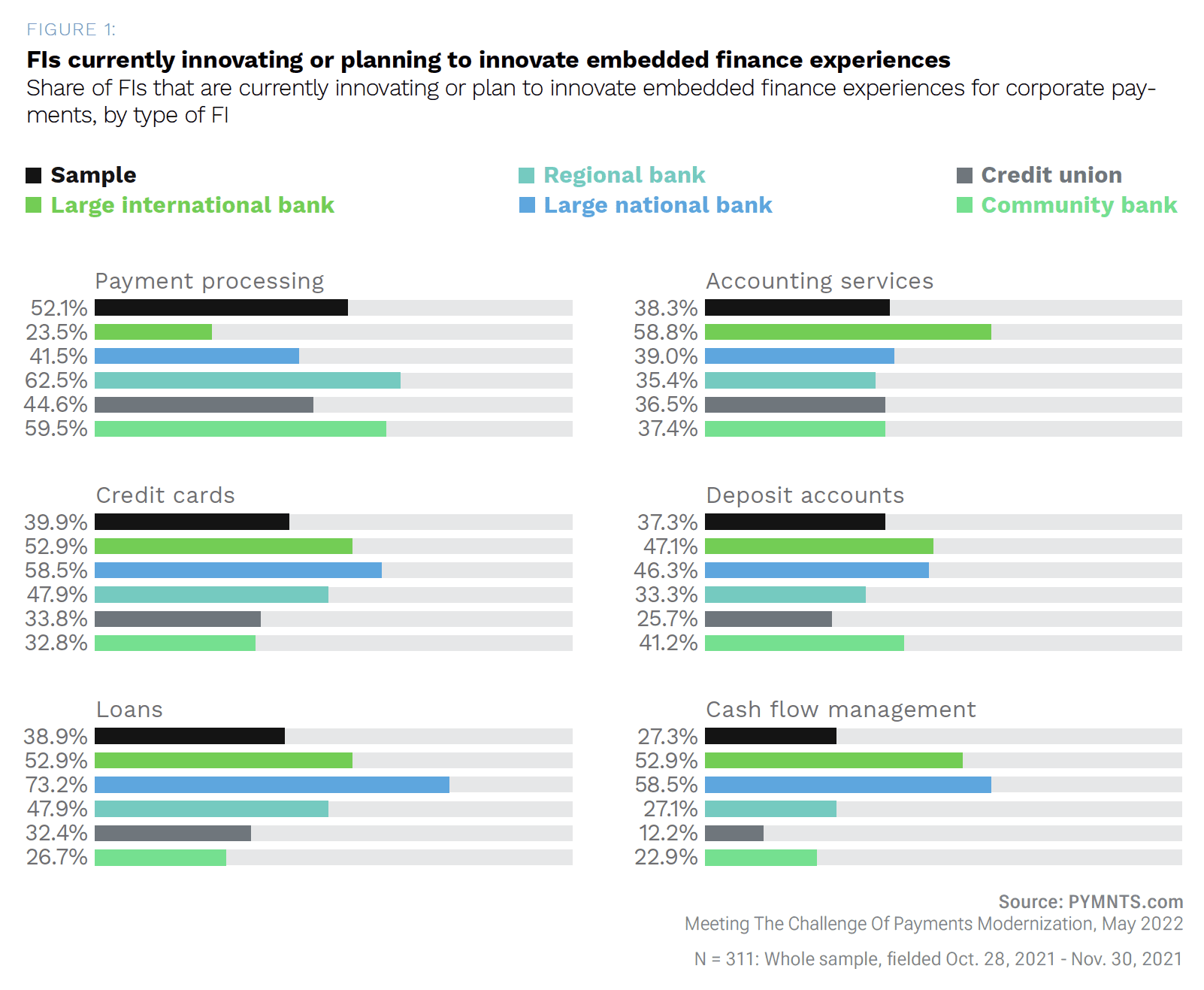

Another report details how open banking also provides an opportunity to utilize data to address SMBs’ major pain points. When done correctly, open banking can help SMBs transact faster and more securely while navigating the day-to-day challenges businesses face. Given the promise of both open banking and embedded banking, it is no surprise that a majority of FIs plan to lean into these types of solutions for their business clients. PYMNTS’ data, for example, shows that nine in 10 FIs are now pursuing or plan to pursue embedded finance solutions to address B2B payments frictions.

As small business owners look to technology to help them compete as well as better manage their operations, this innovation will ultimately fuel their growth. Banks can grow along with them by providing the right combination of services SMBs need to survive and thrive in a digital-first marketplace.