Safeguarding Personal Information Key to Banking Subprime Consumers

As technological advancements continue to revolutionize the financial industry, data privacy and security continues to take center stage, shaping consumer preferences and challenging financial institutions (FIs) to deepen their commitment to ensuring the confidentiality and protection of personal and financial data.

In the “Credit Union Membership and Credit Profiles” report, PYMNTS drew on insights gathered from a survey of over 4,000 U.S. consumers and 100 credit union (CU) executives to examine consumers’ opinions about product innovation and how those views affected their thoughts about their financial services providers.

Findings captured in the joint PYMNTS-PSCU study revealed that trustworthiness and data security are top priorities for CU members, with 67% emphasizing the former and 61% emphasizing the latter. Additionally, asset protection is a crucial deciding factor for 59% of consumers.

The research further revealed that consumers across all credit backgrounds are eager for more innovative banking experiences. In Q1 2023, approximately 28% of respondents expressed a willingness to switch institutions to gain greater access to innovative products and services. This represented a 9 percentage point increase since Q4 2018.

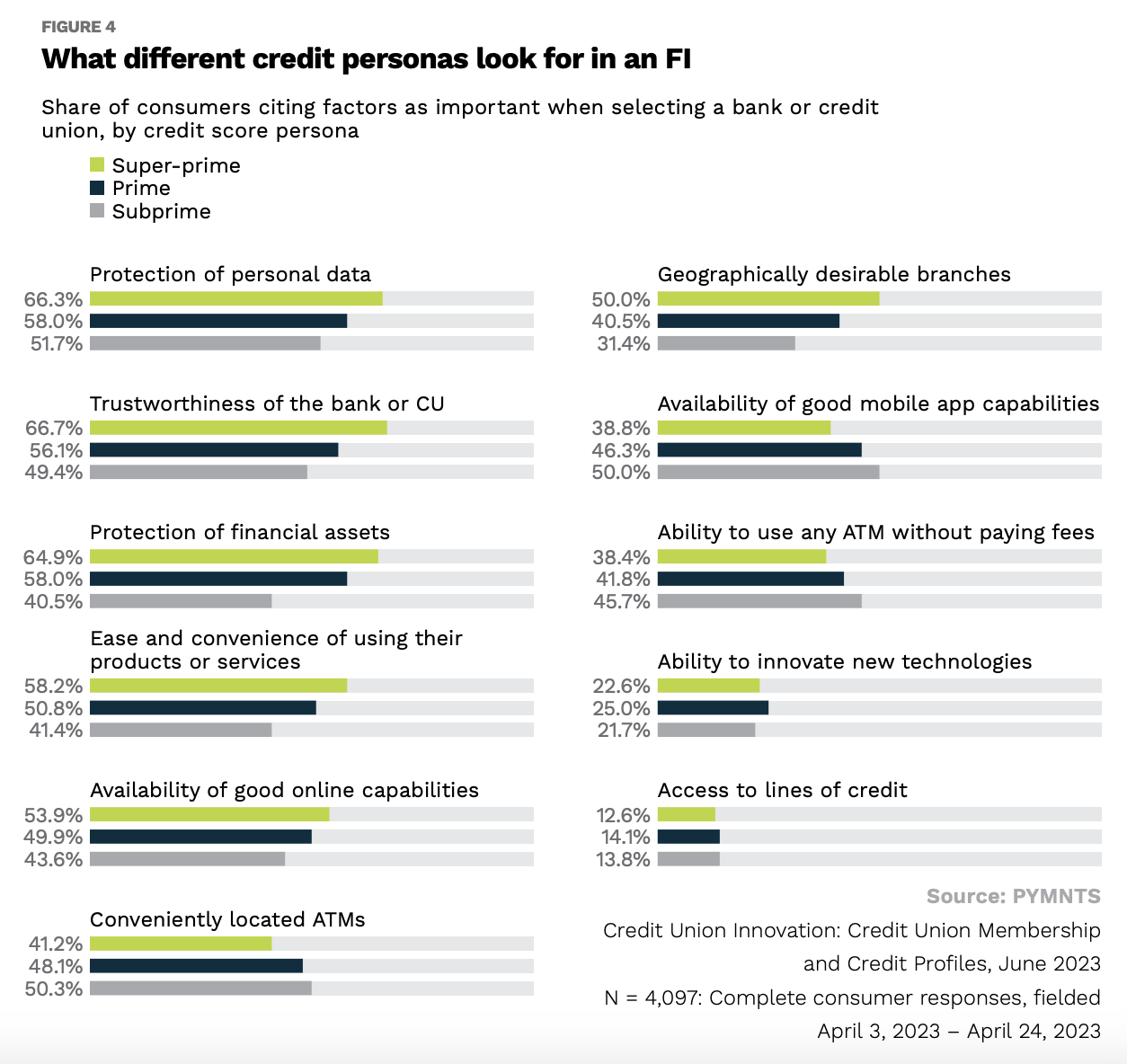

Specifically, 67% of individuals classified as super-prime consumers — those with credit scores exceeding 750 — identify trust as a pivotal element influencing their decisions on where to keep their accounts. Similarly, 66% of those falling within this highest credit score category consider data security a crucial factor, closely followed by 65% who express the same sentiment regarding asset protection.

In contrast, subprime consumers — individuals with credit scores below 600 — are 15 to 24 percentage points less inclined to regard these aspects as vital in their selection of a bank or CU. Instead, these consumers lean towards prioritizing seamless mobile experiences and the absence of fees for ATM usage. Nevertheless, it is worth noting that 51% of subprime consumers still acknowledge the significance of data security in their decision-making process.

However, there is a disconnect between what CU executives value and what members want. Only three in five credit union executives view security and compliance as vital in their payments innovation strategies — a misalignment that underscores the need for CUs to better understand and address consumer expectations.

Moreover, despite the growing consumer demand for banking innovation, CUs tend to have a reactive approach, with 64% choosing to follow rather than lead, the report noted. This cautious stance is primarily attributed to operational difficulties, budget constraints and data insufficiencies.

Overall, CUs eager to stand out in the retail banking space and retain their members must address their operational challenges and more aggressively embrace innovation. Failure to do so exposes these institutions to the risk losing members to megabanks and FinTechs that proactively innovate to deliver better digital experiences. Additionally, CUs need to prioritize data security and privacy, as well as enhance their overall digital offerings to meet evolving consumer expectations.