Facial Recognition Use Cases Expand Across MENA Amid Growing Demand

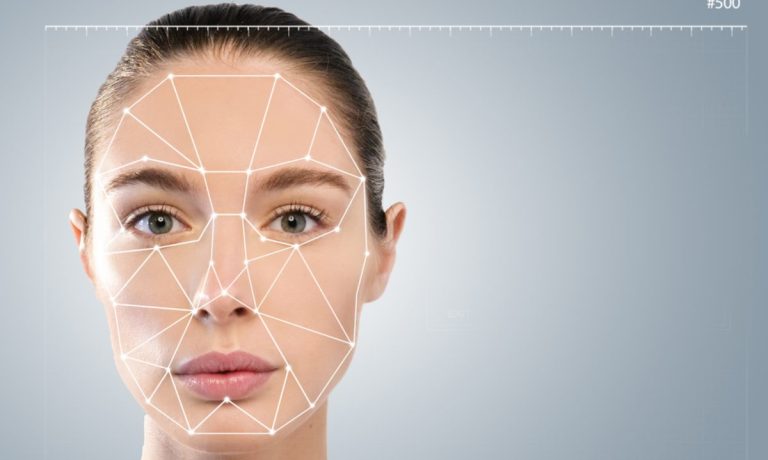

Facial biometrics technology is transitioning from mobile-focused to a more widely relevant authentication solution.

The concept of unlocking a smartphone with facial recognition has been around for several years. Apple’s FaceID was launched in 2017, for example, and in the years since a growing number of banking and payment apps have enabled facial biometrics as a method of identity verification.

Read more: FIs Embrace Biometric Payment Cards To Improve Security, Enhance User Experience

For in-store payments, facial biometrics is also becoming increasingly commonplace.

When PYMNTS spoke to John Miller, the CEO of facial verification technology firm Pop ID in March, he explained that although smartphones are where biometrics have gained the most popularity with consumers so far, “our goal is to be like Apple Pay, except without the phone.”

Read also: Pay-With-Face Identity Verification Seeks New Users in Need of Rapid, Secure Payments

For soccer fans at the ongoing FIFA World Cup in Qatar, that vision seems like a reality following a partnership between Pop ID and Visa, offering soccer enthusiasts what may be their first encounter with facial biometrics as an in-person payment authentication solution.

Marking the first time Visa has deployed Pop ID’s “Pay With Face” technology in Qatar, the pilot, taking place at three Flat White Specialty Coffee branches, will allow anyone who’s enrolled in the scheme to pay without needing to reach for either their card or their phone by simply looking into a camera at checkout.

For its take on the hands-free checkout technology, Mastercard announced that it would be incorporating Pop ID’s solution as part of its Biometric Checkout Program, which brings together facial- and fingerprint-based biometrics in the name of card- and phone-free payments.

Alongside Pop ID, Mastercard has tapped some of the leading names in biometrics including NEC, Payface, Aurus, PaybyFace and Fujitsu to help scale the new solution as it enters the payments mainstream.

Expanding Use Cases for Facial Biometrics

The more frictionless experience provided by biometrics also holds value in other non-payments use cases.

As coffee drinkers in Qatar trial the nation’s first application of in-store facial biometrics, across the Persian Gulf in the United Arab Emirates (UAE) the Dubai International Financial Center has incorporated the technology into its new digital vault platform — tejouri.

Built on the Hedera public ledger, tejouri is a cryptographically secure digital storage solution that enables users to access sensitive documents from anywhere in the world, with access controlled by facial biometric authentication.

Using facial identification developed by the Bahrain-based artificial intelligence (AI) startup FACEKI, tejouri marks a turning point for biometric authentication as consumer use cases expand beyond payment authentication.

In an interview with PYMNTS, Hamza Al-Ghatam, CEO at FACEKI, said that while biometrics use is still in the early stages, “there are a lot of [untapped] industries and fields that can benefit from such a technology” beyond the financial sector.

Those benefits include a combination of security and convenience and the incorporation of iris recognition and 3D scanning to ensure systems are not misled by a photo.

Ultimately, as the biometrics infrastructure is laid down, mobile devices are likely to become less essential for authentication, just as physical cards and documents no longer hold the critical role they once did.

Imagine a world where anyone can turn up at an airport, buy a ticket, pass through security and board a flight without even a smartphone or passport on them. That technology exists to make this futuristic vision a reality, and payments are leading the charge.

For all PYMNTS EMEA coverage, subscribe to the daily EMEA Newsletter