The CFPB, 5 Years In Consumer Complaints

A little over five years in, the CFPB has collected over 670,000 consumer complaints about just about any financial services-related topic there is. Beyond those raw numbers, though, what do all those complaints in the database really mean? PYMNTS/What’s Next In Data Analytics Collaboration took a deep dive into the CFPB complaints numbers to get a clearer picture of where the complaints come from, how often they get resolved and what those resolutions look like most of the time. Some of the results just might surprise you.

The Consumer Financial Protection Bureau was first founded a little over five years ago — on July 21, 2011, to be exact. It was given birth as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act, a piece of legislation that gave it a lot of power and authority to decide what’s bad and what’s good.

It’s been pretty busy over the course of its five-plus years as a regulator. A number of its decisions have been quite controversial, and its governance structure — the director as judge, jury and fine-levier — gives banks little choice but to admit no wrongdoing and write a big check.

Some of its findings and fines have uncovered egregious business practices, such as what we’ve seen more recently at Wells Fargo. Its hot-off-the-presses prepaid ruling has the industry reeling over its treatment of prepaid overdrafts as lines of credit and not, in fact, overdrafts. And its pending decisions related to payday lending and arbitration remain hotly debated.

But, to a large degree, this is all old news. What isn’t is the kind of stuff that the CFPB gets pinged with every day as part of the its Consumer Complaint Database. Complaints, as defined by the CFPB, are things that are not “up to a customer’s satisfaction,” and a consumer then calls or writes the CFPB looking for help.

Since the database went live five years ago, 638,757 complaints have been logged. And 97 percent of the time that a complaint is filed, consumers have received timely responses to those complaints.

But we wanted to know more. So, thanks to our What’s Next in Data and Analytics team, we dug into all 638,757 of them to get a clearer snapshot of what consumers were complaining about and who was on the receiving end of most of those complaints.

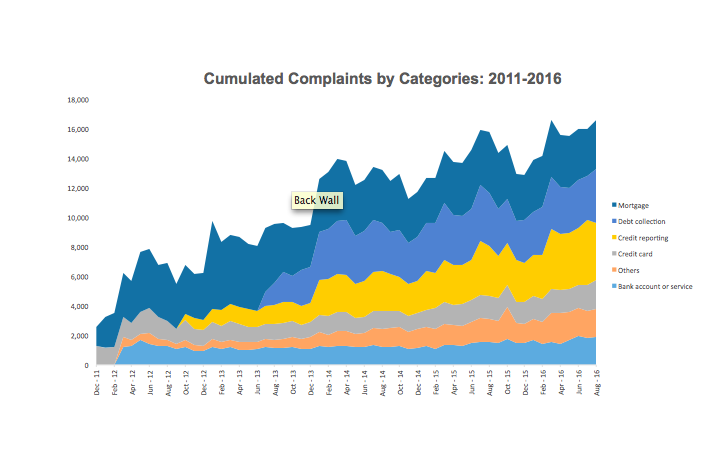

A General Trend Toward Growth

The first big piece of news? There are more complaints.

Probably not much of a big surprise. More people know about the CFPB, more people know that it is an avenue for their grievances and so more people are speaking out.

But what’s worth noting here is that, when the CFPB first opened its doors, it was only open for business to hear complaints on mortgages and credit cards.

Only a year later, in 2012, did it add payday lending, prepaid cards, bank accounts and credit reporting agencies. In 2013, it further expanded to debt collection.

Hot — And Not So Hot — Button Issues

So, what kinds of complaints do consumers take to the CFPB? A few expected and unexpected surprises here.

Mortgage-related complaints lead the pack and have since the agency’s inception. Given that the CFPB was created in response to an international financial crisis that was touched off by questionable mortgage underwriting practices, it’s not terribly surprising that mortgages and mortgage products have been, and continue to be, the complaint leader to this day.

Nor is the inhabitant of the number two spot much of a massive shock. Debt collectors have been the second leading major generator of consumer complaints since the CFPB added them as an area that consumers could complain about in June 2013. Generally speaking, people don’t much like debt collectors, and as many analysts before us have noted, consumers are likely to complain about them pretty much no matter what.

The number three spot, though, is where things may come as a bit of a surprise. Credit reporting agencies briefly held the two spot upon being added in early 2012, before being promptly booted by debt collectors.

But they’ve been comfortably earning the consumer ire bronze medal ever since. Moreover, when you look at the list of complaints by individual company, the credit rating agencies really get their chance to shine.

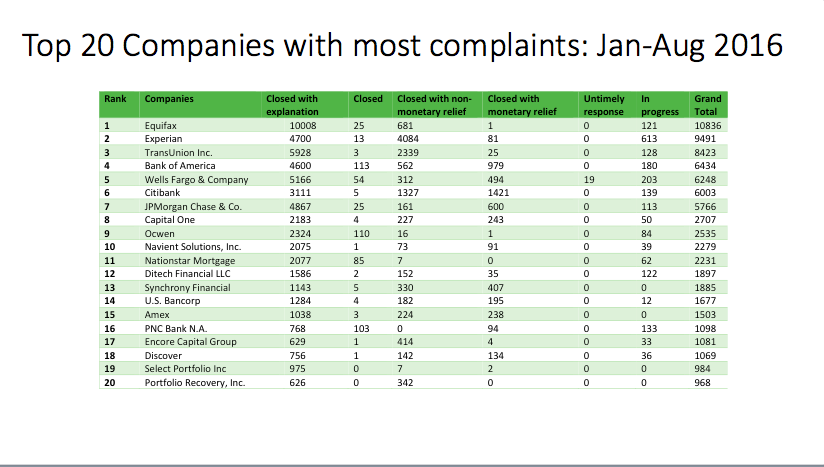

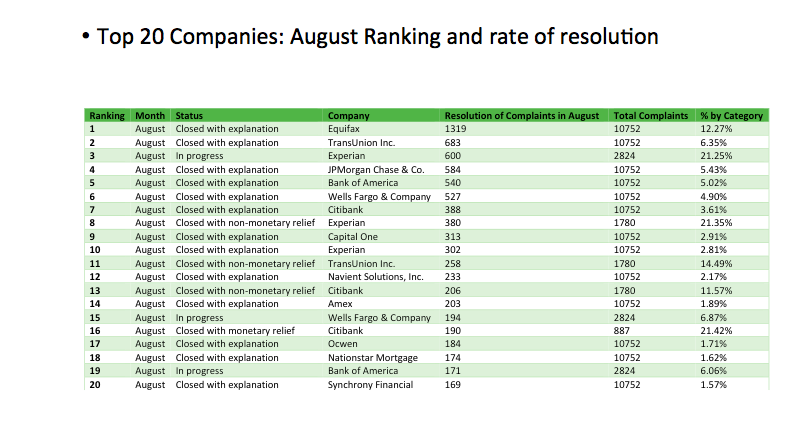

The number one most complained about firm to the CFPB is Equifax, number two is Experian and number three is TransUnion.

For those who are curious, the other spots are mostly taken up by big banks. In order: Bank of America, Wells Fargo, Citibank, JPMorgan Chase, Capital One, Ocwen and Navient Solutions.

Not drawing much in the way of consumer complaints? The much maligned payday lending vertical. It is the category with the second fewest complaints — only bank accounts draw less consumer annoyance.

Other Tidbits

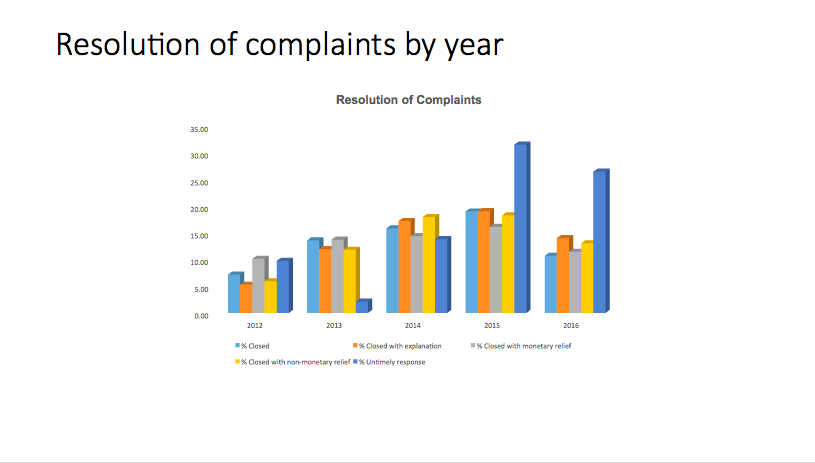

There are some other interesting data highlights that stand out. The CFPB notes on its site, for example, that 97 percent of complaints brought by consumers have received a timely resolution. That is not inaccurate — looking over the entire life of the complaints database — but has been somewhat belied by recent data that shows untimely responses have spiked over the last two years.

Complaints are closing somewhat differently recently than they have in recent years. Though the overall trend — that complaints are usually closed without monetary relief but with an explanation — has been consistent, there are some slight variations over time.

In 2012 and 2013, for example, monetary awards were more common resolutions to complaints — though far from the majority of outcomes. Also, early resolutions from 2011–2014 were generally done in a timely manner more often than they were not.

Monetary awards seems to be slightly down in 2015 and 2016, and untimely responses to consumer complaints seem to be spiking. There is no immediate explanation as to why that might be the case.

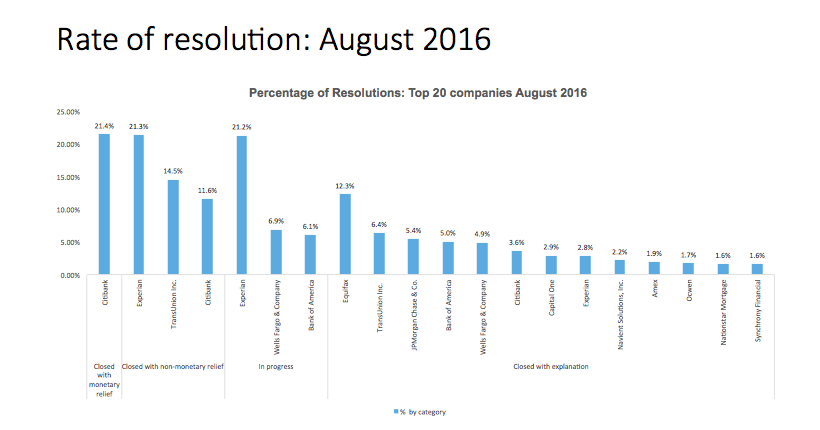

As for who is paying the awards? Banks mostly. Though credit reporting agencies and debt collectors rack up the most complaints, they tend to resolve their issues through nonmonetary means.

Monetary relief, notably, is rare. Though many complaints are logged, most of them are closed when the offending firm offers the consumer an explanation.

So, five years and over half-a-million consumer complaints later, what have we learned?

Well, there is the obvious: Give people a platform to vent their frustrations, and they will do so in gradually greater amounts as time goes by, especially as the number of areas to opine on grows. We also learned that no one likes their debt collector very much — that has been established conventional wisdom since the time of the Bible.

But there were also some surprises.

As it turns out, given the choice between an evil, predatory payday lender and the credit rating agencies that control most consumers’ every financial interaction, by their complaint loads, consumers are voting for the payday lenders.

It is also worth noting, given the number of consumer complaints that were settled with a simple explanation, that not every complaint necessarily indicates an instance of wrongdoing.

Sometimes, it is just a sign a consumer has not fully understood a product and just needs someone to explain it to them.