Many U.S. colleges and universities are eager to roll out the red carpet to recruit international students – and why not? International students tend to pay tuition in full, providing higher education institutions with steady revenue streams. And universities with strong international enrollment can tout their diverse student population, boosting cross-border recruitment year after year.

But for international students and their families, tuition payments can be an unexpected hassle that must be addressed to pursue a degree in the U.S. Many overseas families learn that the cross-border tuition payments process is highly complicated compared to what domestic students face. Problems with transparency can prevent families from fully understanding their financial obligations, and students often end up assuming the responsibility of learning the international tuition payment process on top of their academic workload.

Recognizing that these payment frictions could hinder their ability to recruit international talent, several U.S. universities are working to ease cross-border payment frictions for international families by streamlining the process and communicating payment expectations earlier.

Recognizing that these payment frictions could hinder their ability to recruit international talent, several U.S. universities are working to ease cross-border payment frictions for international families by streamlining the process and communicating payment expectations earlier.

In fact, shifts in how payments are delivered across borders is not limited to the education market. Introducing the brand-new Global Payments Architecture Report, a bi-monthly publication that delves into the latest developments transforming the education, healthcare, import/export and other B2B markets.

Lessons on International Tuition

Advertisement: Scroll to Continue

Community colleges are popular choices for international students attending U.S. schools.

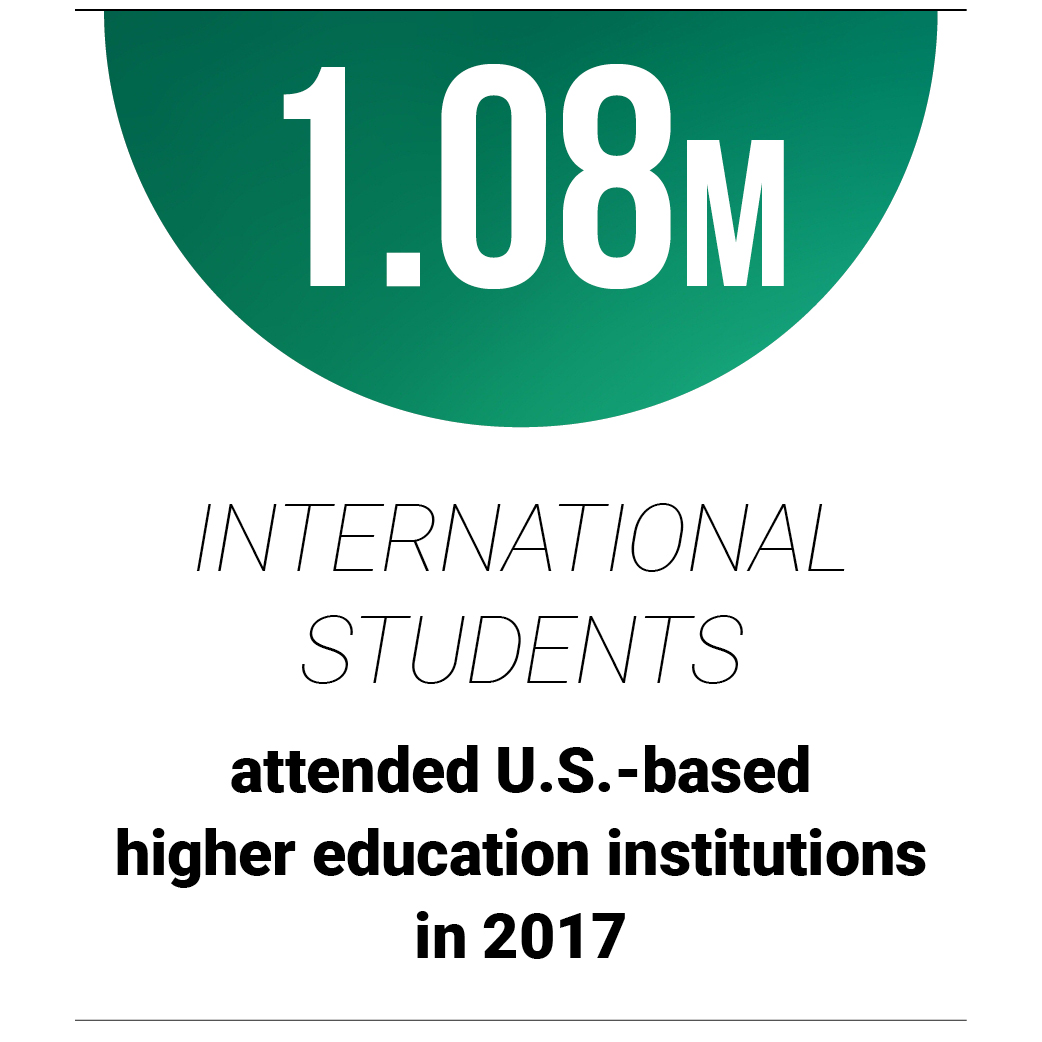

Approximately 96,500 – or nearly one in 10 – international students studying in the U.S. enrolled at 1,100 U.S. community colleges during the 2016-2017 academic year, according to a recent report from the Institute for International Education (IIE).

For the communities that host colleges and universities, a large international student population can boost the local economy with most cross-border students paying tuition in full, providing a valuable revenue source.

And it’s not just the U.S. economy that’s being invigorated by students from abroad. Last year, Australia saw AUD $32 billion pumped into the nation’s economy because of soaring international student attendance. University World News recently reported that approximately 600,000 international students attended higher education institutions in Australia in 2017, a 22 percent jump from the previous year.

Streamlining the Flow of Cross-Border Tuition Payments

Many international students and their families learn the hard way that paying for international education can be a friction-filled process.

High among these frictions are issues with foreign currency conversions and fees. Very often, students themselves have to take on the burden of sorting out the challenges of cross-border tuition payments in addition to staying on top of their academic agendas.

Some universities have streamlined the tuition payment process to make it easier for international students to navigate the complexity of international tuition payments — which may encourage more of those students to come. Among these schools is the University of Colorado Denver, a public institution that hosts international students from 73 countries. For the May feature story, PYMNTS spoke with Michelle Larson-Krieg, director of international student and scholar services at CU Denver, about how the university is helping its international students navigate the complexities of cross-border payments through transparency and education.

Larson-Krieg noted that higher education institutions with sizable international student populations should take steps to help make the cross-border tuition payment process as smooth as possible for students and families. Doing so, she said, can help these colleges and universities continue to recruit top academic talent from overseas.

Larson-Krieg noted that higher education institutions with sizable international student populations should take steps to help make the cross-border tuition payment process as smooth as possible for students and families. Doing so, she said, can help these colleges and universities continue to recruit top academic talent from overseas.

“There’s a need for as much transparency as there can be, and probably additional training and recognition that this could be the first time someone is dealing with something [of this scale],” Larson-Krieg told PYMNTS.

About the Report

The Global Payments Architecture Report, powered by Flywire, examines how various players are enabling cross-border payments delivery, and how these developments are transforming the education, healthcare, import/export and other B2B industries.