FedEx Woes Show Amazon Gaining Ground in eCommerce, Logistics

Last week, FedEx’s announcement that package volumes are declining around the world, that revenues would be below expectations and that it would idle some operations sent shockwaves through the stock markets.

As of Monday morning (Sept. 19), markets seemed headed into another day of rocky trading, with markets in the red at the open, then mixed and now positive.

And yet, though the FedEx news should be taken as shorthand for the general state of the world economy, and a read across for consumer and business transactions, the shipping giant’s struggles aren’t entirely related to the economic slowdown.

Amazon, it seems, is making inroads into what has traditionally been the logistic giant’s turf.

The two are jockeying for middle-mile and last-mile positioning at a time when supply chains are still feeling lingering aftershocks of the pandemic. And other big retailers including Walmart and Target have scaled back their own inventory-building actions (which of course impacts shipping volumes).

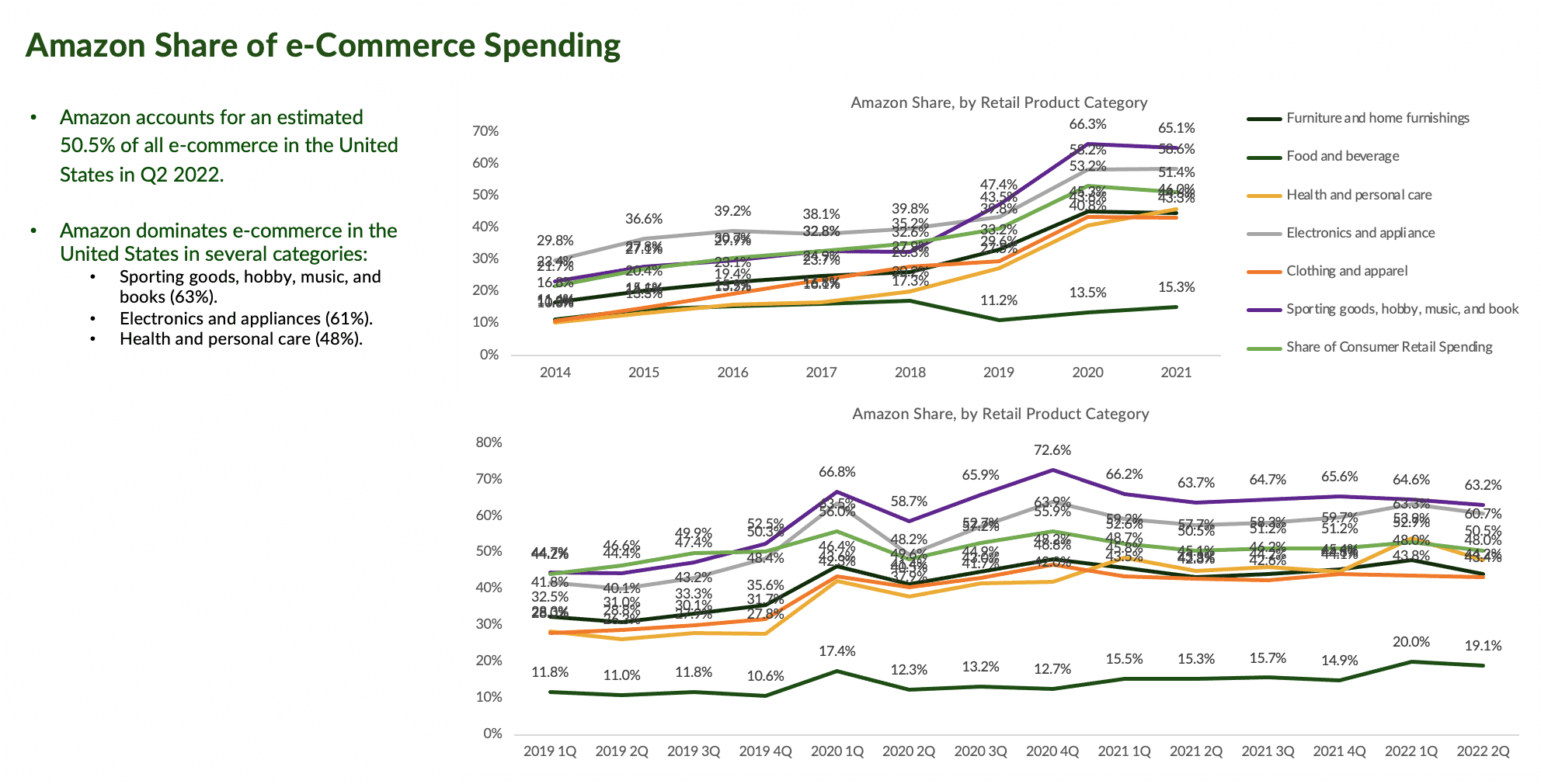

PYMNTS’ own data show that Amazon now accounts for more than 50% of U.S. eCommerce volume, with especially significant dominance in categories such as sporting goods and in electronics.

Source: PYMNTS

The research illustrates the fact that the online platform has gained critical mass. But beyond bringing buyers and sellers together, Amazon has been busy fine tuning its own fulfillment operations, which of course includes the ways and means of getting goods where they need to go.

Amazon recently announced new value-added services for delivery service partners (DSPs), including a boost in pay and new benefits programs, which may go a long way toward cementing driver loyalty, which would be critical headed into the all-important holiday shopping season.

Amazon also announced late last month that, through Amazon Warehousing & Distribution, it would enable sellers to use “new, purpose-built facilities” for bulk inventory storage and automated distribution.

Read also: Amazon’s Logistics Fine-Tuning Spotlights Last-Mile Focus

The battle between FedEx and Amazon was fully joined before the pandemic, when FedEx officially ended its ground delivery contract with Amazon back in 2019. And in the last several months, Amazon has been expanding its operations more fully into air freight and drones.

In a Bank of America note detailed in Seeking Alpha, analyst Justin Post wrote that “1) Amazon no longer ships with Fedex; 2) Amazon has well over 50% of volumes in the US, 3) Amazon likely has a higher-income avg consumer than Big-3 competitors (Walmart, Target, EBAY), and saw no discernable trade-down in Q2 away from discretionary items; 4) With Amazon’s wide third party selection and fast delivery speeds, we expect some share gains from competitors that may be using Fedex.”

Walmart’s volume headwinds may well wind up becoming more pronounced in the months and the quarters ahead.