TRENDING: Prepping Banks For AI’s Pandora’s Box

From artificial intelligence to blockchain to new mobile app features and offerings, banks and financial institutions are investing more in innovations to give customers a better experience and gain an edge over their competition.

But use of new technology can come with ethical implications, from human job loss to data privacy concerns. Are FIs treating their customers ethically and handling their data responsibly, and will they continue to do so?

In the May edition of the Digital Banking Tracker™, PYMNTS explores the latest developments in the banking world – and the challenges these innovations pose.

Around the Digital Banking World

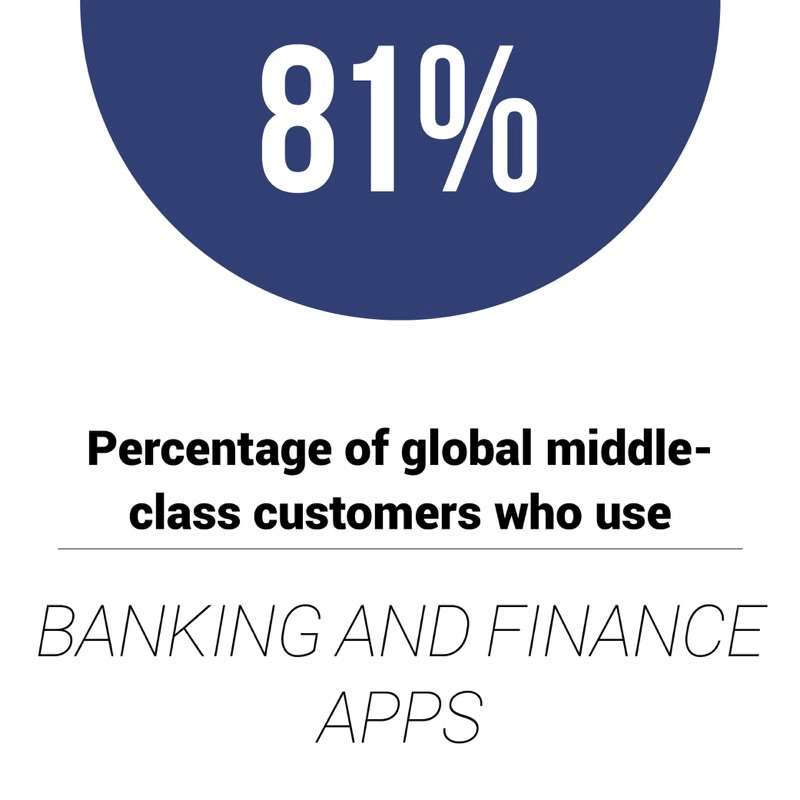

With internet access improving around the world, FIs are looking to give consumers improved access to their services.

This includes The United Bank of Egypt, which recently launched a mobile service designed to give the country’s unbanked citizens access to its financial tools. The new offering, which targets the 33 percent of Egyptian adults without bank accounts, is designed to enable users to pay bills, transfer money, reload prepaid cards or even withdraw cash at partner retail locations.

Similarly, Spain’s Santander Bank debuted a new mobile app of its own.

The company unveiled what it calls the first blockchain-based solution to enable customers around the world to make cross-border payments. Developed in partnership with FinTech startup Ripple, the app – known as One Pay FX – is designed to calculate post-conversion amounts, notify customers about the payment value before transfer and enable international money transfers to be completed on the same day they are initiated.

To see the rest of the latest headlines from around the Digital Banking space, check out the Tracker’s News and Trends section.

Building a Responsible AI Roadmap

Beyond offering mobile apps to consumers, FIs are also increasingly setting their sights on artificial intelligence (AI)-powered products and features, with hopes to use the tech to power new insights and analysis for their customers.

But while AI may offer a host of potential benefits to companies and customers alike, the tech may invite just as many potential issues – including ethical dilemmas surrounding human job loss and data privacy concerns. To tackle these ethical dilemmas, Bank of America and the Harvard Kennedy School’s Belfer Center for Science and International Affairs recently formed the Council on the Responsible Use of Artificial Intelligence, in hopes of formulating a strategy for addressing AI developments and their challenges.

In the latest Digital Banking Tracker, PYMNTS caught up with Dan Schrag, co-director of the Belfer Center’s Science, Technology and Public Policy program, to gain greater insight into the Council’s mission. With players in several industries turning to AI to develop more efficient solutions, Schrag believes the council will enable a broader conversation among the leaders in the space, helping them to better understand the opportunities as well as the possible problems.

“There needs to be a discussion of what is responsible, what is the appropriate use of these technologies and where the limits are,” he said.

To read the full story, download this month’s edition of the Digital Banking Tracker.

. . . . . . . . . . . . . . . .

About the Tracker

The Digital Banking Tracker™, powered by Feedzai, brings you the latest news, research and expert commentary from the FinTech and consumer banking space, along with rankings of over 300 companies serving or powering the digital banking sector.