BBVA’s Four-Step Guide To Digital-First Transformations

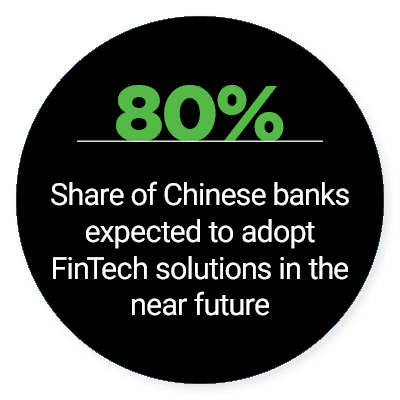

The banking industry is undergoing a sea change in the new decade, with online and mobile banking growing ever more popular among customers, and challenger banks and FinTechs disrupt the market with new technologies. Many banks are embracing digital-first technologies to stay competitive, leveraging tools such as cloud computing, data analytics and videoconferencing systems for bank tellers.

The banking industry is undergoing a sea change in the new decade, with online and mobile banking growing ever more popular among customers, and challenger banks and FinTechs disrupt the market with new technologies. Many banks are embracing digital-first technologies to stay competitive, leveraging tools such as cloud computing, data analytics and videoconferencing systems for bank tellers.

These digital pushes are far from ubiquitous, however, with many banks unwilling to make the massive financial investment involved in acquiring these new technologies. Those that are willing to pull the trigger are reaping the benefits, however, with studies finding an effectiveness increase of up to 70 percent.

In the February Digital-First Banking Tracker, PYMNTS explores the latest in the world of digital-first banking, including shifting customer opinions on the value of instant banking services, initiatives to help hearing-impaired customers, and the challenges that keep many banks face when undergoing their own digital pushes.

Developments From Around The World Of Digital-first Banking

Developments From Around The World Of Digital-first Banking

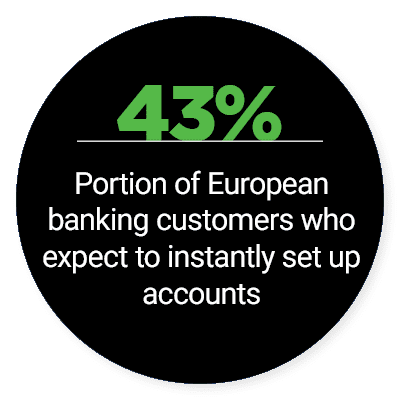

Customers are growing more and more accustomed to faster banking services, with a recent study from digital banking solutions provider Five Degrees finding that 43 percent of bank customers desire the ability to instantly set up banking accounts. Only half of banks that are currently using legacy technology are taking steps to meet this customer demand, which only digitally advanced financial institutions (FIs) are capable of providing.

Digital-first technologies are also being used for charitable purposes. The U.K. bank Nationwide Building Society recently installed a contactless payment window at one of its ATMs, which customers can use to instantly donate to a local charity helping the homeless. The ATM’s location was picked due to the fact that homeless individuals often gather nearby, allowing sympathetic customers to donate without handling cash.

Another unique implementation of digital-first technology comes from Chase Bank, which recently opened a concept location in D.C. aimed at providing banking services to the deaf and hard-of-hearing. The branch leveraged an on-demand video interpreting service, captioned digital screens and employees fluent in American Sign Language to provide these services. The location is currently unique in the U.S., but Chase said it would open a second branch location of this type in the near future.

For more on these and other digital-first banking news items, download this  month’s Tracker.

month’s Tracker.

Inside BBVA’s Four-Step Approach To Digital-First Banking

Banks face a variety of challenges when undergoing digital transformations — if it were easy, every bank would be doing it. For BBVA USA, the biggest obstacle was ensuring that customer-facing processes and back-end operations were working in parallel. Still, an extensive prioritization initiative helped the bank ensure a smooth transition. In this month’s Feature Story, BBVA’s head of retail banking Murat Çağrı Süzer offers PYMNTS an inside look at the FI’s four-step transformation and how the bank kept all of its moving parts working together.

Deep Dive: Digital-First Banking Brings Benefits As Well As Challenges

Deep Dive: Digital-First Banking Brings Benefits As Well As Challenges

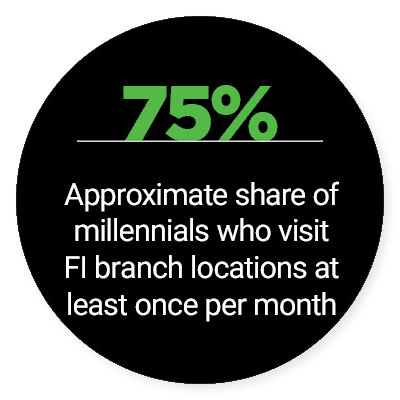

The growing popularity of online and mobile banking has reduced the number of times bank customers visit their local branches. However, they still play a key role in customers’ financial lifestyles when it comes to applying for loans, obtaining credit cards and opening new accounts. Digital-first bank technology can help with all of these needs, but there remain several obstacles that keep more banks from undergoing these transformations. This month’s Deep Dive explores how cost and increased competitive pressure from FinTechs keeps many banks from enjoying the personalized services and consistent omnichannel experiences that digital-first baking provides, and how these challenges can be overcome to meet customers’ evolving desires.

About the Tracker

The Digital-First Banking Tracker®, done in collaboration with NCR Corporation, is your go-to monthly resource for updates on digital-first banking.