MercadoLibre Earnings Show Power Of ‘Digital Front Door’ For Developing Regions

Latin American (LATAM) eCommerce marketplace operator and payments platform MercadoLibre released stellar Q4 2020 financials this week, underscoring the sizzle and scale of online marketplaces now serving as the “digital front door” through which people in developed and developing regions are accessing desirable new digital-first experiences.

In cash-heavy economies like those found throughout LATAM, online marketplaces are starting to harness the immense economic potential, providing a framework for the move to digital-first.

As PYMNTS reported on March 2, “MercadoLibre said that net revenues rose to $1.3 billion — in U.S. dollars, up nearly double from the same quarter a year ago,” adding that “unique active users grew by 71.3 percent year-over-year, reaching 74 million.”

Additionally, the latest earnings statement said “total payment volume (TPV) through Mercado Pago reached $15.9 billion, a year-over-year increase of 83.9 percent in USD and 134.4 percent on an FX neutral basis. Total payment transactions increased 131.0 percent year-over-year, totaling 659.3 million transactions for the quarter.” Mercado Pago is the company’s payments unit.

Beyond the obvious triumph of eCommerce growth in the LATAM region — a story playing out the world over in places like the Association of Southeast Asian Nations (ASEAN) region — MercadoLibre’s success can also be seen as a ringing buyer/seller endorsement of online marketplaces as an end-to-end business model.

It all makes the LATAM region a fascinating use case in how eCommerce and payments can not only invigorate economies but also allow regional players to expand more assertively cross-border by leveraging the network effects and digital exactitude inherent in online marketplaces.

Digital Front Doors Access Modernization Faster

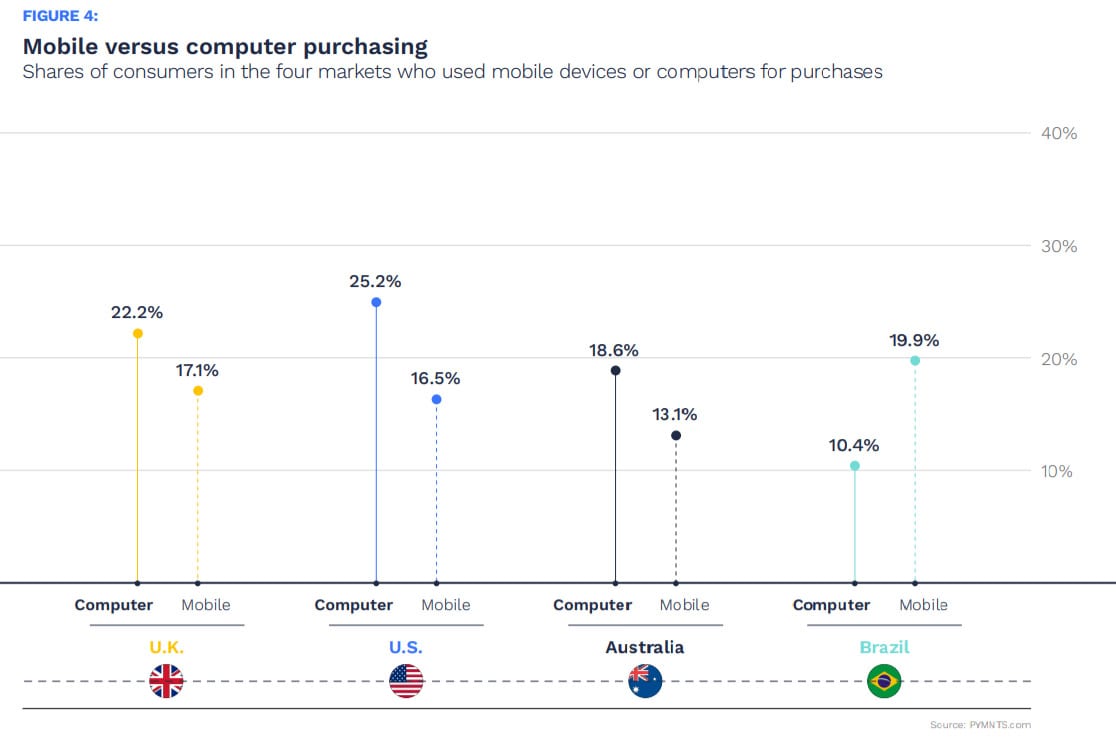

MercadoLibre is Argentina-based. Neighboring Brazil is also a hotbed of eCommerce and payments activity. In the March 2021 Global Digital Shopping Index: Brazil Edition, a Cybersource collaboration, PYMNTS surveyed more than 2,000 consumers and 500 merchants in the country, concluding that “consumers in Brazil are highly mobile-oriented, suggesting that the wide penetration of smartphones is serving as an on-ramp to digital commerce for large shares of the population.” Whether on-ramp or front door, the common theme is access.

In Brazil, 60 percent of all consumers have smartphones — 85 percent among those aged 18 to 34 — which is closing in on the penetration rates in advanced economies like the U.S.

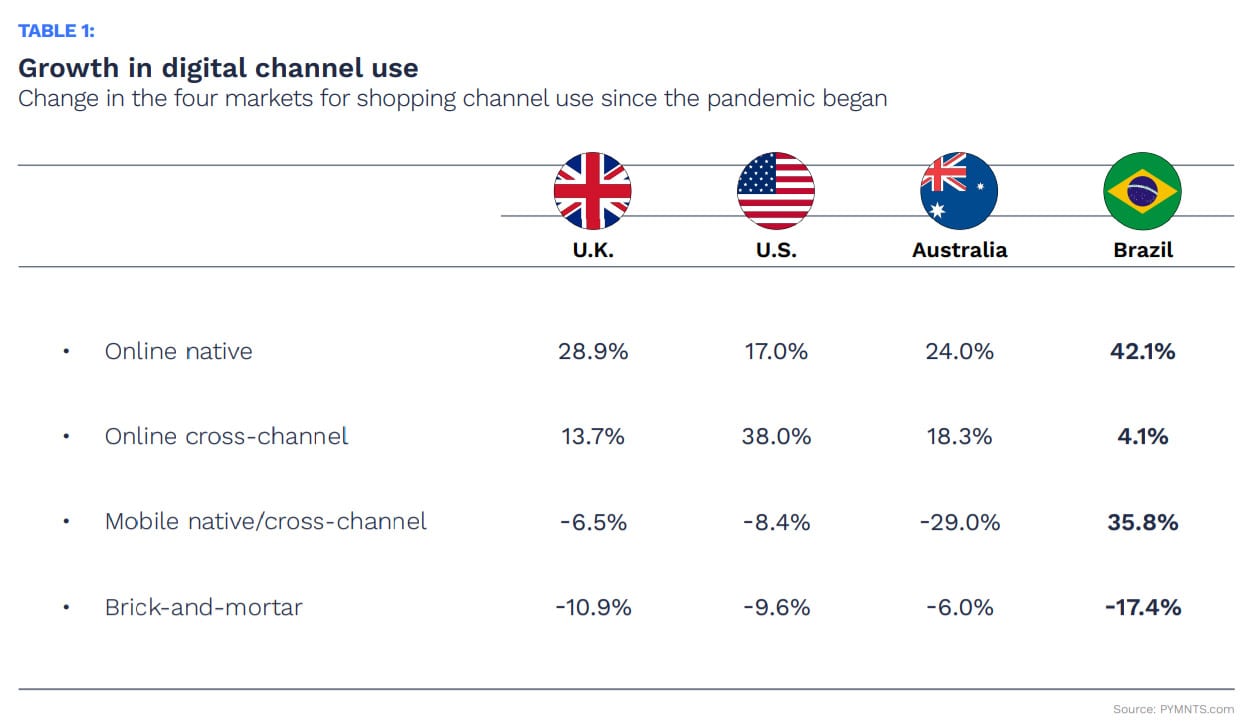

Noting that only 25 percent of Brazilian consumers are estimated to have bank accounts, the Global Digital Shopping Index: Brazil Edition states that “the preference for in-store shopping has plunged 17 percent since the pandemic’s onset in Brazil, representing the largest drop-off in any of our studied markets. The preference for buying goods digitally among Brazilian consumers has increased 33 percent since the start of the pandemic, however.”

The findings bear out digital work that merchants and financial institutions (FIs) in the region are now undertaking.

Per the Index, “Two areas stand out as priorities for merchants considering their innovation agendas over the next three years: mobile ordering and pickup. Improving store pickup through curbside or in-store options — a key component of cross-channel commerce — is the most-cited priority for Brazilian merchants as 52 percent of them, on average, plan to invest in this area,” adding that “Mobile order-ahead is the second-most cited priority, with 49 percent of merchants, on average, planning to invest in it. This includes large shares of middle- and low-ranked merchants.”

Mobile Commerce, Open Banking Advancing Digital Agendas

While clearly focused on opportunities in its own backyard, MercadoLibre is currently a regional marketplace player with global ambitions. And it’s making the moves to get there.

Speaking with PYMNTS in 2020, Mercado Pago Chief Operating Officer Paula Arregui said, “open banking is undoubtedly the new paradigm toward which the most modern societies are advancing. However, it is not simply a technology or a regulation. There is an inequality in terms of the acceptance and regulation of open banking.”

Those kinks remain to be worked out, and that’s happening. In tandem with that is the steady expansion of mobile commerce in the region as part of the overall digital shift there.

Turning again to Brazil as a regional case study, the February 2021 Global Digital Shopping Index: Brazil Edition notes that “the use of mobile-native and cross-channel options surged 36 percent in Brazil, — a dramatic departure from the other studied markets, where online channels have been favored over mobile ones. Online shopping has also increased dramatically in popularity in Brazil, although consumers there are far more inclined toward online-native journeys, which grew by 42 percent, versus cross-channel ones, which grew by just 4 percent. This likely reflects the fact that online-native services are less developed in Brazil.”

[INSERT FIGURE 4: Mobile versus computer purchasing, PG. 18, Cybersource Feb. report]

[INSERT FIGURE 4: Mobile versus computer purchasing, PG. 18, Cybersource Feb. report]