PYMNTS Intelligence: How eCommerce Marketplaces Can Leverage Digital Identity Protocols to Prevent Fraud

Online retail fraud is a quickly growing problem, with bad actors attempting to steal customers’ data, corporate funds and goods on a daily basis. A recent study found that more than 17% of all global eCommerce transactions during the 2021 holiday shopping season were fraudulent, a 25% increase from the rest of the year. This jump represented a microcosmic example of fraud trends around the world during the past several years, with more online shopping resulting in more entry points for fraud.

Merchants are scrambling to protect themselves and their customers from fraud, not just to avoid stolen data and funds but to preserve customer loyalty and prevent abandonment due to perceived cybersecurity weakness. Many eCommerce marketplaces leverage digital identity protocols such as multifactor authentication (MFA), which has an impressive fraud prevention record but comes with its own drawbacks. This month, PYMNTS Intelligence explores the nature of eCommerce fraud in recent years and how techniques such as MFA have their ups and downs when keeping businesses and customers safe.

How Fraud Affects eTailers

Fraudsters ply a staggering variety of tactics against eCommerce merchants, but the one that seems to worry fraud prevention professionals the most is identity theft. A recent survey found identity theft to be merchants’ most common fraud concern, cited by 71% of respondents. Bad actors committing identity fraud exploit eCommerce websites, stealing customers’ identities, and then leverage those stolen identities to make illicit purchases, often by implanting fake checkout pages that can harvest customers’ email addresses and payment information. When businesses have difficulties in authenticating customers, it can exacerbate this fraud. Half of all eCommerce companies in the U.S. report having trouble authenticating customers on browsers, and 58% struggle to verify mobile users, even when using systems that incorporate artificial intelligence or machine learning.

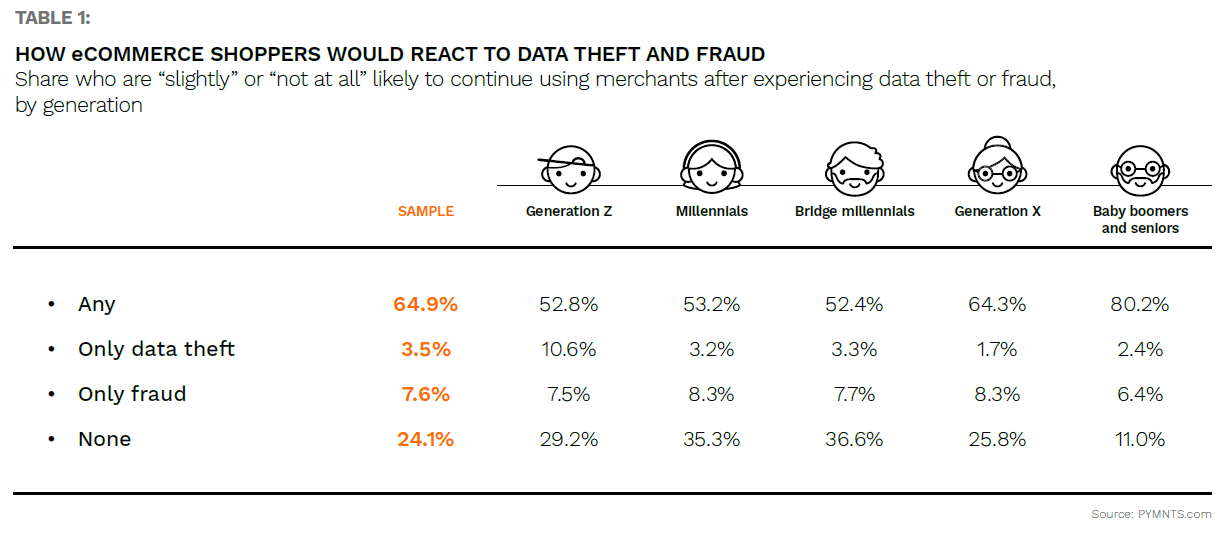

Digital fraud’s impact is not limited to stealing funds and data, as it can also have long-term ramifications for customer loyalty. Customers are likely to abandon eTailers entirely after experiencing data theft or fraud. In fact, 65% of consumers in a recent PYMNTS study said they would be “slightly” or “not at all” likely to continue using merchants after having their data stolen. Eighty percent of Baby boomers and seniors were the most likely to abandon merchants after a security incident. This willingness to switch merchants after security incidents may increase, as 48% of eCommerce shoppers said they were more worried about data security now than before the pandemic began. Thirty-six percent of consumers already base their choice of payment method on the likelihood of theft, and this number shows no sign of declining.

Robust digital identity protocols are some of the most effective ways for eCommerce merchants to stop fraud and maintain customer loyalty.

Deploying Digital Identity to Prevent Fraud

One of the most efficacious methods for preventing identity fraud is MFA, which works by requiring more than one identifying detail when logging in or making a purchase. The rule of thumb for effective MFA is to provide verification by “something you know, something you have and something you are,” representing, for example, a password, an SMS code sent to customers and a biometric identifier, respectively. The typical MFA system requires two of these factors, and studies have found that MFA can prevent more than 99.9% of attacks that rely on stolen credentials.

However, there are some potential drawbacks of implementing MFA. Customers naturally desire the most seamless login method possible, and MFA requires an extra step that can add friction. Studies have found that many consumers decline this extra step if it is optional, even choosing a different eTailer if they face too much friction at checkout. Customers have also expressed data privacy concerns with giving large companies their personal cell phone numbers or tying their data to their smartphones, as the loss of a device then means the loss of the ability to verify one’s identity.

MFA’s efficacy rate speaks for itself, however, and the savings in preventing data breaches, fraudulent purchases and lost customer loyalty could more than make up for any customer hesitancy. MFA’s proliferation in other environments, such as workplaces, is bringing more and more customers into the fold every day, and eTailers could see this hesitancy slip away as MFA becomes more mainstream.