Free shipping can be key to securing customer loyalty, but grocers struggle with the cost.

The Context

Shipping perishable foods and/or delivering them via courier can be extremely costly. As such, though grocers know that free shipping can be a powerful draw, many have determined that it is not a cost they are willing or able to bear.

Some have sought to offer shoppers a compromise. Take, for instance, Kroger, the United States’ largest pure-play grocer, offering next-day delivery for a set monthly or annual cost ($7.99 or $59, respectively) and same-day delivery for higher monthly/annual costs ($12.99/$99, respectively).

“We launched Boost, the industry’s most affordable membership nationwide in July. Early results are exceeding our expectations with incremental engagement and overall household spend,” CEO Rodney McMullen said on a call with analysts earlier this month discussing the grocer’s fourth-quarter 2022 financial results.

Yet, some players in the space do not believe that free delivery on small orders makes sense from a unit economic standpoint even when consumers are engaged in a paid membership program. Earlier this year, Amazon raised its free grocery delivery threshold for Prime members to an unusually high $150 about a year after adding a new $9.95 delivery fee for Prime members purchasing from Whole Foods.

With these moves, the eCommerce company may improve profit margins per order, but it risks alienating its customers.

Advertisement: Scroll to Continue

By the Numbers

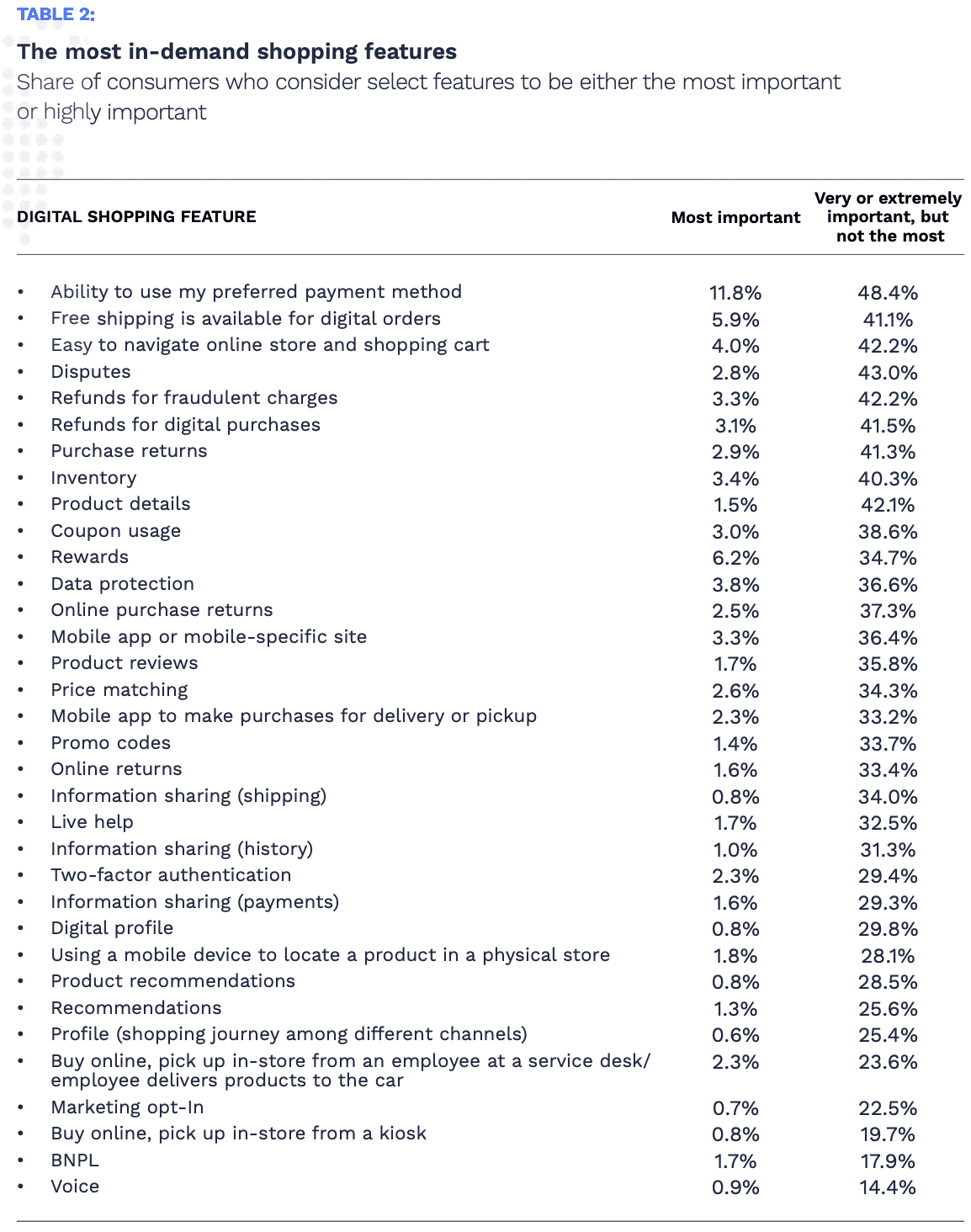

Research from PYMNTS’ study The 2023 Global Digital Shopping Index: U.S. Edition, which draws from a survey of more 2,800 U.S. consumers, reveals that nearly half of all shoppers (47%) see free shipping for digital orders as important to their eCommerce experience. Plus, those who use digital technologies more often — persona types that the report dubs “digital enthusiast” and “digital mainstream” shoppers — are all the more likely to seek out the option.