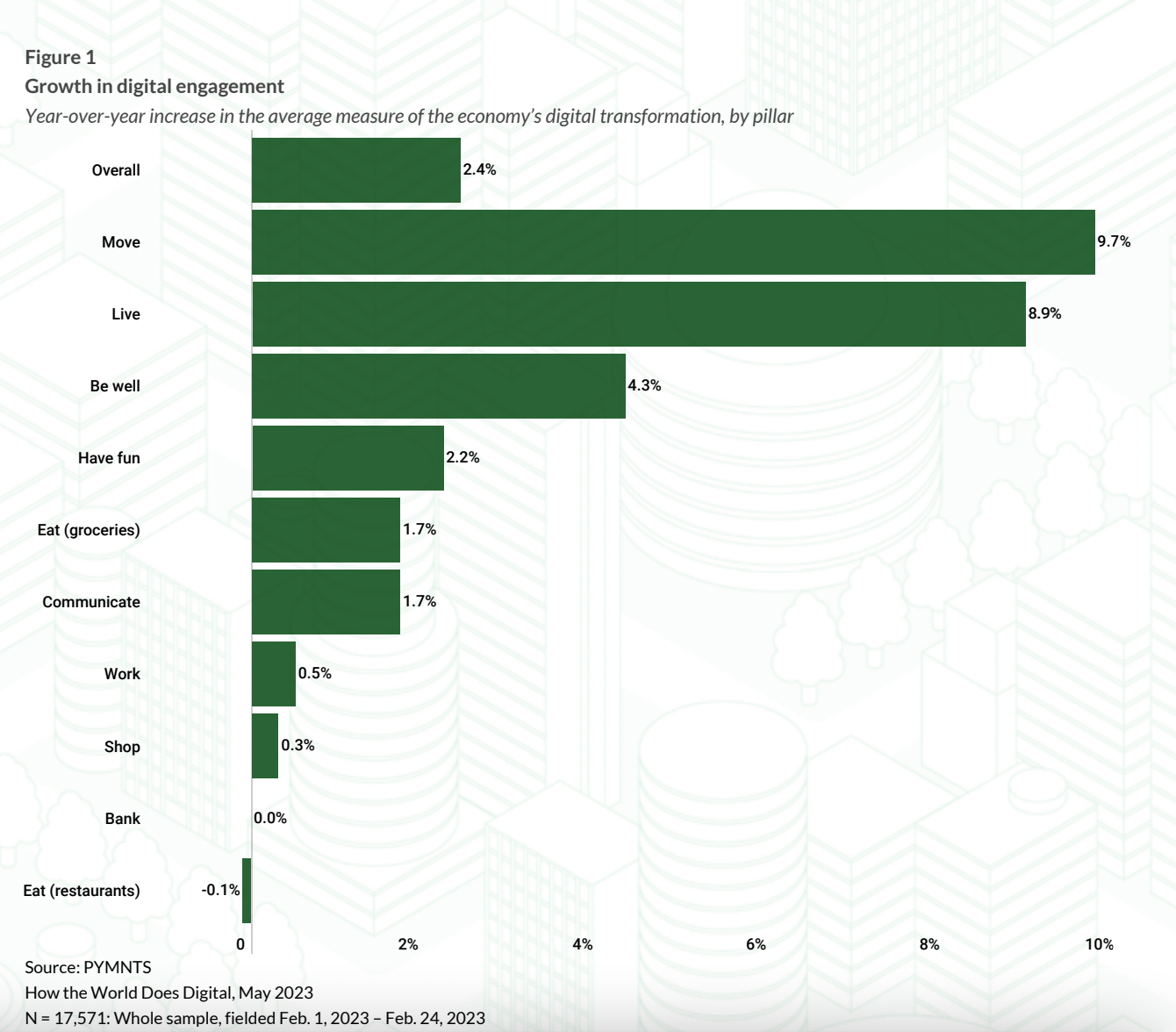

Grocery’s Global Digital Growth Lags Behind Other Industries by 29%

As consumers increase their digital engagement across all parts of their lives, online grocery adoption is growing more slowly than other parts of people’s day-to-day routines.

By the Numbers

According to data from PYMNTS’ recent study “How the World Does Digital: Daily Digital Engagement Hits New Heights,” which draws from a survey of more than 17,500 consumers in 11 markets that account for 50% of the world’s GDP, digital engagement overall grew 2.4% year over year in the first quarter of 2023. Yet digital engagement in grocery grew only 1.7%.

The Data in Context

Part of this slow growth may come down to consumers’ caution when shopping for groceries amid ongoing economic challenges, especially given that price-conscious consumers tend to opt for brick-and-mortar, as Barbara Connors, vice president of commercial insights at 84.51°, the marketing insights subsidiary of grocery giant Kroger, told PYMNTS in an interview last fall.

“We know that very price sensitive customers are those that have lower engagement with eCommerce and are lower on the adoption curve, and those are the customers that are most likely to go into a store,” Connors said. “And one of the reasons is because they are looking for sales, deals and coupons, and it is easier for them to do that in-store than online.”

Still, while the industry’s digital presence may be growing slower than other parts of the economy, it is nonetheless trending upwards, and grocers are noting the need to build toward their longer-term omnichannel futures.

“In online grocery today, the biggest shift is from independent retailers relying on others in a way that is not sustainable and not profitable to independent retailers, taking the reins and taking control and investing in this channel, because of all the value that it can create,” Jeff Anders, co-founder and CEO of eGrocery technology company Grocerist, told PYMNTS in an interview earlier this year.