56% of eCommerce Firms Lack the Right Tools to Fix Failed Payments

Imagine a consumer attempting to make a purchase, only to get rejected at checkout. This was not because of money problems or fraud, but due to a false decline.

These legitimate purchases mistakenly marked as fraudulent don’t only create friction in the payment process but also discourage frustrated customers from returning, resulting in lost revenue for businesses, as highlighted in “Fraud Management, False Declines and Improved Profitability,” a PYMNTS Intelligence and Nuvei collaboration.

According to the report, there is a significant impact of false declines on eCommerce companies’ profitability. In the United States alone, it is estimated that nearly $160 billion was at risk due to false declines year, with $81 billion ultimately being lost despite recovery efforts.

Beyond the monetary toll, failed payments bring forth additional repercussions. These include adverse effects on a company’s reputation and a surge in staff workloads, cited by 62% and 59% of respondents, respectively; and expenses associated with tracking and resolving failed payments, cited by 56%.

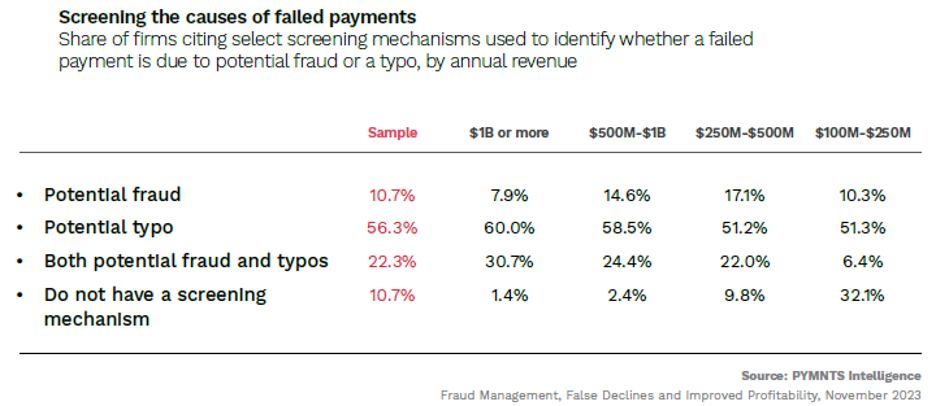

The report identifies a mix of potential fraud and typos as the key factors behind these failed payments, and currently, 89% of online retailers utilize some form of screening tools to pinpoint these causes.

However, the majority (56%) of firms exclusively rely on screening mechanisms to detect typos, often overlooking the potential for fraud as a contributing factor. Similarly, nearly 10% solely depend on screening mechanisms for identifying typos. In total, only 22% of firms have screening tools equipped to detect both potential fraud and typos. The situation is even more challenging for the 11% of firms without any technological measures in place.

Against this backdrop, implementing robust screening mechanisms becomes essential to effectively minimize the occurrence of failed payments. And firms that have successfully achieved this through strategic partnerships not only recognize the importance but also have tangible results to substantiate the positive impact of such measures.

The report reveals that 86% of companies attribute their enhanced profitability over the last 12 months to proactive assistance from payment service providers (PSPs). These providers play a vital role in bolstering the financial performance of online retailers by adopting a comprehensive approach to managing fraud and minimizing false declines.

However, despite partnering with PSPs, online retailers still face uncertainty over failed payments due to potential fraud and false declines. The report finds that 11% of all eCommerce transactions failed in the past year, but most merchants still couldn’t identify the root cause. Overall, 82% of firms say it is difficult to determine their cause despite the ripple effects on revenue and customer satisfaction.

To improve the customer payment experience and boost profitability, firms must prioritize innovation of their anti-fraud tools. The report reveals that nearly all eCommerce firms are actively innovating their anti-fraud tools or planning to do so within the next 12 months. This upgrade of payment technologies will position businesses to better balance minimizing fraud and false declines, ultimately enhancing the customer payment experience.