Census Data and Earnings Season Continue to Underscore eCommerce’s 4Q Bounce

The eCommerce bounce — at least for the fourth quarter — has been considerable.

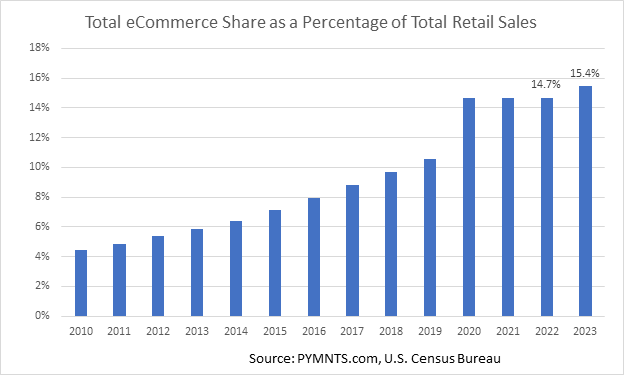

And as measured as a percentage of overall retail sales — after plateauing through the last few years — eCommerce is gaining some ground again.

As measured through Census Bureau data and PYMNTS Intelligence analysis, total retail sales continue to climb, and came in at $7.2 trillion for 2023, up 2.1%.

There’s a shift here, we note: Inflation was a key driver of retail sales growth, extending back to 2020, but in the past year, the inflationary impact had been relatively muted. In fact, towards the back half of the year, depending on where you looked, the impact of inflation on retail products in particular had lessened … and thus the read across here is that people are buying more — the baskets are fuller.

And for the eCommerce slice of the pie, total digital sales grew faster than the overall pie itself, surging 7.6% year over year in 2023, to $1.1 trillion. The share of total retail sales has jumped to 15.4%, from 14.7% in 2022.

The chart below shows that, beyond the pandemic-related great digital shift, and after a breather as economies opened back up and we all went back into the brick-and-mortar settings, eCommerce has gotten a renewed tailwind.

The staying power, this time around, and in a post-pandemic world, is testament to the fact that merchants have been figuring out where, how and when to engage with their consumers on their mobile devices. A digital search online may culminate in a digital payment made in the aisles. A trip to the store may give rise to commerce done with a few clicks that sends an item to the doorstep.

Other, separate, PYMNTS Intelligence data, gleaned in collaboration with Visa, has revealed that the lines of commerce are becoming increasingly blurred. In the latest iteration of the Click-and-Mortar™ report, which is global in scope, we found that 33% of consumers shop in stores without digital assistance — and that means that the majority of consumers, at two-thirds, use technology as an aid and enabler across their commerce journeys.

The data show that “remote shoppers” are 26% of the overall consumer base; consumers who buy online and pick up in store represent another 10%. Digitally assisted, in-store shoppers come in at 25%.

The recent earnings commentary and data from the likes of Walmart, as detailed here, show double-digit gains in eCommerce sales. The December quarter shows that overall eCommerce sales gained 23% in the quarter, and the number of sellers on its online marketplace gained 20%, alongside double-digit increases in store-fulfilled pickup and delivery (where payment was done online), which gives further evidence of eCommerce’s tailwinds.

Amazon’s own results, shown here, represent an acceleration of eCommerce, at 8% growth year over year in the fourth quarter, up from the 2% gains logged in the year ago fourth quarter, also as measured year over year.