Online Marketplaces Prioritize Digital Wallets and BNPL for Payment Options

Online marketplaces like Amazon, eBay and Rakuten are increasingly embracing embedded payments options for consumers, such as digital wallets and buy now, pay later (BNPL).

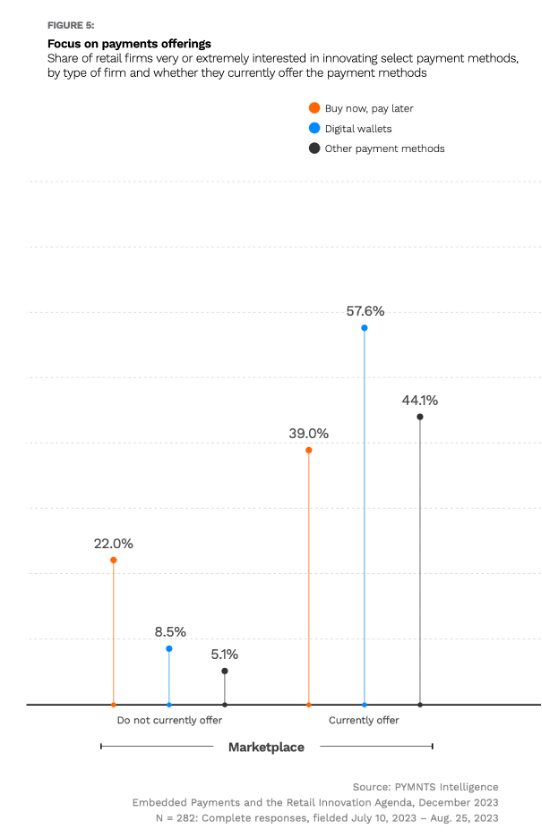

According to “Embedded Payments and the Retail Innovation Agenda,” a PYMNTS Intelligence and Carat by Fiserv collaboration, 58% of eCommerce platforms accepting payments from digital wallets show interest in innovating the process, alongside 39% of those offering BNPL.

The research also found that 22% of marketplaces that do not currently offer BNPL plan to start doing so in the future.

These findings suggest that marketplaces are exploring a holistic payments strategy.

“Embedded Payments and the Retail Innovation Agenda” is a study examining the state of play of PayFacs, marketplaces and independent software vendors (ISVs) in the retail sector, taking a deep dive into the innovation strategies and challenges these players face.

With 30% of eCommerce platforms ranking customer experience as the cornerstone of their innovation strategy, it is not surprising that providing BNPL schemes might be a priority for them.

Jacqueline White, president of i2c, told PYMNTS that not too long ago, BNPL was still a relatively new concept. Now, the payment option may drive a new wave in retail.

Marketplaces seem to be on the frontline of BNPL adoption. However, the growing demand for BNPL might be outpacing merchants’ rate of adoption, as more consumers are looking to use BNPL to pay for necessities, and only one-third of acquirers allow merchants to endorse BNPL plans, per another PYMNTS Intelligence study.

“We’re not anywhere near saturated with BNPL from a growth perspective,” White noted.

According to White, 2024 could be the year that BNPL reaches ubiquity, as new BNPL offerings are tailored to the unique use cases and credit profiles of each user — all of which are tied to the point of sale, whether online or at a brick-and-mortar register.

By embedding payment offerings like BNPL into their platforms, eCommerce marketplaces can woo more consumers while generating revenue from payment processing fees. According to “The Rise of Embedded Payments,” another PYMNTS Intelligence study, roughly two-thirds of marketplaces expect their share of revenue from such fees to be higher in the next 12 months.

Amid an uncertain economy and high interest rates, businesses that offer more popular payment methods may stand out from their competitors. By enabling consumers to pay with digital wallets or BNPL, retailers have a chance to attract and retain more shoppers and offer them a better experience.