How Truck Factoring Revs America’s Retail Engine

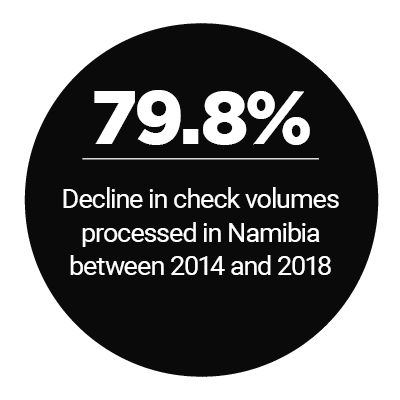

Businesses and consumers are unlikely to change their payment preferences until two conditions are met: they both feel the pain of slow legacy systems and are presented with an easy-to-adopt alternative. Namibia recently advanced one prong of this approach and made the push for greater digital payments uptake by doing away with domestic check processing altogether. Meanwhile, around the world, a number of financial players have been working to smooth transitions to real-time payment rails for businesses and consumers alike.

The July Faster Payments Tracker™ examines the latest on these efforts.

Around the Faster Payments World

Starling Bank, for instance, is working to promote adoption of the U.K.’s Faster Payments Service through a collaboration with Bottomline Technologies. The companies launched a software as a service (SaaS) offering to help businesses access the real-time system.

Similarly, several Nordic banks are at work to create a cross-country real-time payment rail, and they recently partnered with Mastercard to help with efforts. Under the deal, Mastercard will provide the infrastructure for the Project 27 (P27) payment rail initiative, with the system expected to launch in 2021.

The country of Namibia, meanwhile, has been seeking to discourage use of checks, which are largely seen as an insecure, legacy payment method. The country recently announced that it will no longer process checks on its national payment system.

Find all the latest headlines in the Tracker.

How Factoring Keeps Truckers on the Road

Truckers play an important role in shuttling deliveries across country to retailers and merchants, handling 71 percent of the freight tonnage moved in America in 2017. However, while they wait the typical 30 or more days for their invoices to be paid, trucking businesses can struggle to pay the expenses they need to keep their operations running.

In this month’s feature story, Apex Capital Chief Strategy Officer Brian Carlgren and Chief Information Officer Jerry Wallace explain how factoring companies aim to ease those cashflow pains via quick, mobile funding.

Get the full story in the Tracker.

Deep Dive: How APIs Can Help Drive Faster Payments

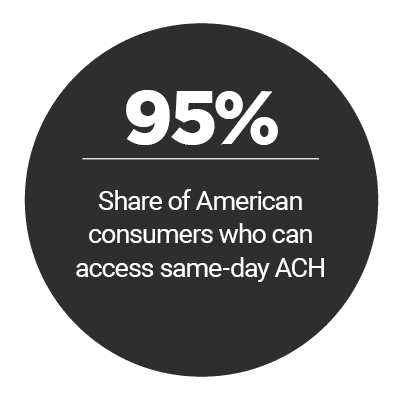

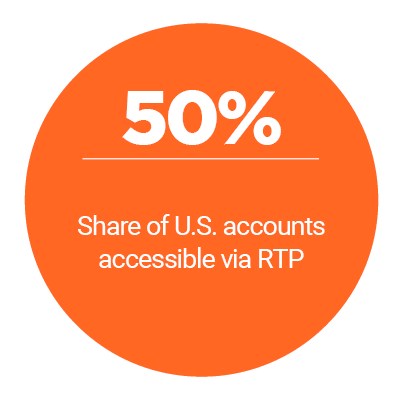

Real-time payment system advocates seek to make the rails as close to ubiquitous as possible. Application program interfaces (APIs) are one impactful way that financial players can facilitate consumer and business adoption of these real-time rails and drive up participation.

This month’s Deep Dive examines the ways in which APIs are being leveraged around the world to promote real-time payments use, as well as how APIs can provide services that enable greater transaction speeds, even in countries that have yet to launch real-time systems.

Find the Deep Dive in the Tracker.

About the Tracker

The PYMNTS Faster Payments Tracker™, powered by Fiserv, is your go-to resource for staying up to date on faster payments developments and initiatives on a month-by-month basis. The tracker highlights the contribution of different stakeholders, including institutions and technology providers coming together to make this happen.