Employees must be able to meet their own essential needs, especially those in essential sectors like healthcare, transportation and sanitation. Unfortunately, many such workers have financial needs that do not fit neatly within the traditional two-week paycheck cycle. It’s been estimated that close to half of the U.S. population lives paycheck-to-paycheck, with very little financial cushion for emergencies or other unexpected expenses. The pandemic has only exacerbated these trends: More than 41 percent of lower-income U.S. workers report earning less since the pandemic began, according to PYMNTS research.

Employees must be able to meet their own essential needs, especially those in essential sectors like healthcare, transportation and sanitation. Unfortunately, many such workers have financial needs that do not fit neatly within the traditional two-week paycheck cycle. It’s been estimated that close to half of the U.S. population lives paycheck-to-paycheck, with very little financial cushion for emergencies or other unexpected expenses. The pandemic has only exacerbated these trends: More than 41 percent of lower-income U.S. workers report earning less since the pandemic began, according to PYMNTS research.

Digital alternatives to conventional payroll processes are emerging that allow workers to access earned wages before payday, without the delays and complications associated with paper checks. In the inaugural edition of the Next-Gen Payroll Tracker®, a partnership with ADP®, PYMNTS examines these trends and technologies and the role they can play in improving workers’ financial security and sense of wellbeing.

Around The Changing Payroll Landscape

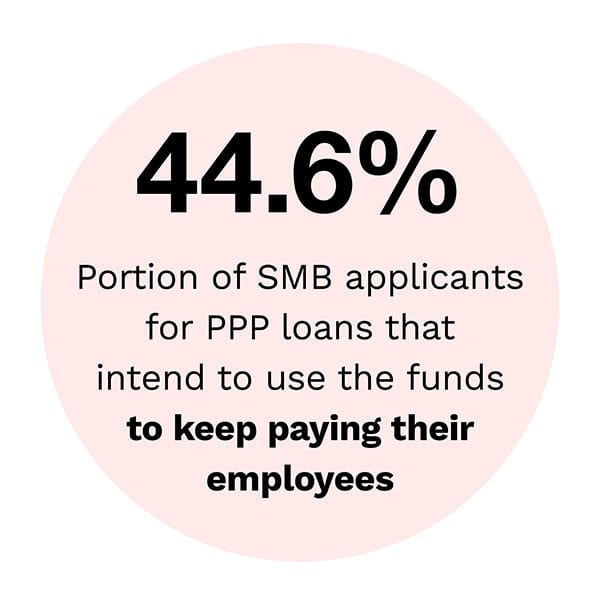

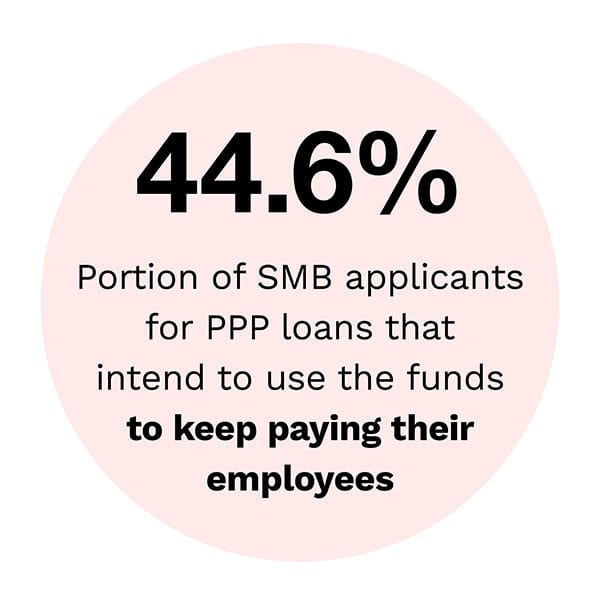

Governments around the world have launched stimulus programs aimed at supporting the payrolls of businesses forced to scale back or shutter operations during the pandemic. The centerpiece of these efforts in the U.S. is the Paycheck Protection Program (PPP). After a problematic start, PPP is now benefiting a majority of U.S. firms including small businesses, according to PYMNTS research, which also shows that nearly 80 percent of small- and medium-sized businesses (SMBs) plan to keep their PPP loans. This requires businesses to spend most of their PPP funding on payroll.

Another component of stimulus funding in the U.S. is direct payments to citizens. However, the IRS had trouble distributing checks to millions of people because it lacked current address or banking information for many of them. The government turned to a solution that is gaining popularity in the private sector: prepaid pay cards. It is using the cards to disburse stimulus funding to approximately 4 million consumers.

Advertisement: Scroll to Continue

Pay cards are appealing because they allow money to be paid out quickly and securely, including to those who may have limited banking access or histories. For similar reasons, employee pay cards have become an attractive option for businesses — and the pandemic appears to be spurring greater adoption of these solutions. Canadian pizza chain Topper’s, for example, has started a program that allows delivery drivers and other workers to receive same-day card and mobile wallet payments for earned wages.

For more on these and other recent headlines about payroll innovation, check out the Tracker’s News and Trends section.

Westgate Resorts On How Flexible Payments Help Workers’ Financial Security

Hotels, restaurants and resorts depend on their ability to make guests feel safe and comfortable — and doing so will be especially important if they hope to coax a jittery public to return as the pandemic eases. This means these businesses will be relying on essential workers like never before to ensure establishments meet high standards for sanitation and safety. Yet, such workers must also be able to meet their own basic economic needs. Enabling workers to receive their earned pay the same day they request it can play a vital role in helping them make ends meet. For this month’s Feature Story, PYMNTS interviewed Karen Sims, senior director of financial services for Westgate Resorts, about why the company decided to offer flexible payment options and why they are uniquely beneficial in the current socio-economic environment.

Hotels, restaurants and resorts depend on their ability to make guests feel safe and comfortable — and doing so will be especially important if they hope to coax a jittery public to return as the pandemic eases. This means these businesses will be relying on essential workers like never before to ensure establishments meet high standards for sanitation and safety. Yet, such workers must also be able to meet their own basic economic needs. Enabling workers to receive their earned pay the same day they request it can play a vital role in helping them make ends meet. For this month’s Feature Story, PYMNTS interviewed Karen Sims, senior director of financial services for Westgate Resorts, about why the company decided to offer flexible payment options and why they are uniquely beneficial in the current socio-economic environment.

Deep Dive: The Digital Technologies Driving HR Innovation During The Pandemic And Beyond

Digital payroll solutions have steadily been transforming HR processes in recent years, though the pandemic has demonstrated their value in new and compelling ways. Cloud-based payroll platforms, for instance, allow managers to handle the sensitive work of running payroll without having to rely on on-premise software systems. In this month’s Deep Dive, we examine how these digital innovations are being put to use during the pandemic and how they could allow firms to emerge with more agile and efficient payroll operations in its wake.

About The Tracker

The Next-Gen Payroll Tracker®, a partnership with ADP®, examines the technologies and trends transforming the conventional paycheck paradigm.

The United States economy is steadily reemerging from the COVID-19 pandemic-induced shutdown. Businesses are reopening to a different reality than the one that existed just three months ago, however. Firms are adopting new safety policies concerning everything from sanitation to public occupancy limits. Many of these tasks will fall to essential workers — and this has brought to the surface an issue that has long been a priority for forward-thinking organizations: the need to prioritize employee financial wellbeing.

The United States economy is steadily reemerging from the COVID-19 pandemic-induced shutdown. Businesses are reopening to a different reality than the one that existed just three months ago, however. Firms are adopting new safety policies concerning everything from sanitation to public occupancy limits. Many of these tasks will fall to essential workers — and this has brought to the surface an issue that has long been a priority for forward-thinking organizations: the need to prioritize employee financial wellbeing.