PYMNTS Intelligence: Why ACH Dominates Business Payments

Restrictions on in-person interactions during the pandemic forced businesses to seek digital alternatives to paper checks as manual processes became impractical or impossible. In their search for solutions, many firms discovered, or rediscovered, the benefits of a familiar standby: the ACH transfer.

ACH payments, originally developed in the 1970s, enable money to be moved electronically between bank accounts. ACH has become one of the primary payment methods in the U.S. for business uses such as paying employees, taxes and vendors. ACH’s benefits include speed, low cost and a contactless process, a combination leading many organizations to expand its use in the pandemic era as a much-needed and near-total replacement for paper checks.

ACH also is growing rapidly for other uses, such as peer-to-peer (P2P) payments, for which its volume increased 42% year over year in 2020. Nevertheless, a recent survey revealed that while 78% of organizations leverage ACH for both credit and debit transactions, 92% of companies still choose to use paper checks for incoming payments and 86% use them for outgoing payments. As businesses realize the simplicity and cost savings they can achieve through ACH, growth in usage is likely to continue.

This month, PYMNTS Intelligence takes a close look at how ACH transactions are helping businesses increase their revenue by enabling them to save costs while offering their clients a more seamless payment experience.

ACH’s Benefits and Use Cases

ACH has come into its own as the pandemic has moved businesses online. A recent study found that ACH payment volume increased 11% year over year in Q1 2021, with much of it driven by the federal government’s disbursement of economic stimulus funds straight into consumers’ bank accounts. Meanwhile, same-day ACH volume rose 88%. These payments already were on the rise in 2020, with a Federal Reserve report showing that the number of ACH payments from the U.S. Treasury increased more than 10% in 2020 year over year, a bigger increase than in any year since 2008.

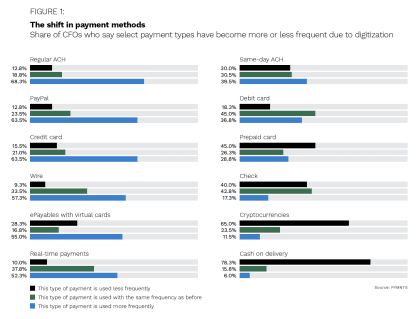

ACH is a natural go-to for firms to use as they digitize and innovate to keep up with the pandemic-driven digital shift. In a recent PYMNTS study, 68% of chief financial officers (CFOs) reported an increased use of ACH at their firms due to digitization since the pandemic’s onset, making ACH the No. 1 payment method in terms of being used more frequently.

ACH is a natural go-to for firms to use as they digitize and innovate to keep up with the pandemic-driven digital shift. In a recent PYMNTS study, 68% of chief financial officers (CFOs) reported an increased use of ACH at their firms due to digitization since the pandemic’s onset, making ACH the No. 1 payment method in terms of being used more frequently.

ACH has some obvious benefits over paper checks, even without the pandemic’s added impetus. While checks can take time to arrive or even get lost in the mail, electronic payments are a prompt and dependable payment method.

They require little or no labor to enter into a record-keeping system, as banks create an electronic record during every transaction. ACH payments also use fewer resources, with no need for paper, ink, labor or fuel to cut, transport and deposit checks, and ACH transfers often cost less to process than credit card payments.

The method has multiple business use cases, including ACH direct debit for recurring payments such as subscriptions or insurance premiums. A majority of U.S. employers also use ACH direct deposit to pay their employees, as it reduces the administrative overhead of checks and offers faster payments. The Internal Revenue Service also permits businesses to use ACH debit for paying tax bills. Internal fund transfers within organizations are also much more cost-effective with ACH than with traditional methods, such as wire transfers or checks.

B2B use cases are experiencing a boom as well, as economic pressures make suppliers’ wait times for checks increasingly untenable. Nacha, the ACH rulemaking body in the U.S., recently reported that B2B payments and healthcare claim payments are showing particularly strong growth in ACH usage. B2B ACH use grew 19% year over year in Q3 2021, and healthcare claim payments to medical facilities were up 16%.

For customers, “pay with your bank” ACH options are often just as convenient as credit card payments, and they offer an important alternative for those who lack credit or are debt-averse.

Businesses reap the benefit of reliability in offering this method to customers, as well: The typical life span of a credit card is about three years before it becomes lost, stolen or expired, while a bank account is typically held for 14 years, greatly reducing the chance of a missed payment. ACH’s security and ease of use have also made it the method of choice underpinning many P2P platforms, such as Venmo, which are especially popular with younger consumers.

ACH’s future still is bright, even as cutting-edge innovations, such as real-time payments and cryptocurrencies, gather force and become mainstream. In the march toward faster, more efficient and contactless payment solutions, ACH is a compelling first step.