Nearly 9 in 10 Manufacturers See Real-Time Payments a 2024 Priority

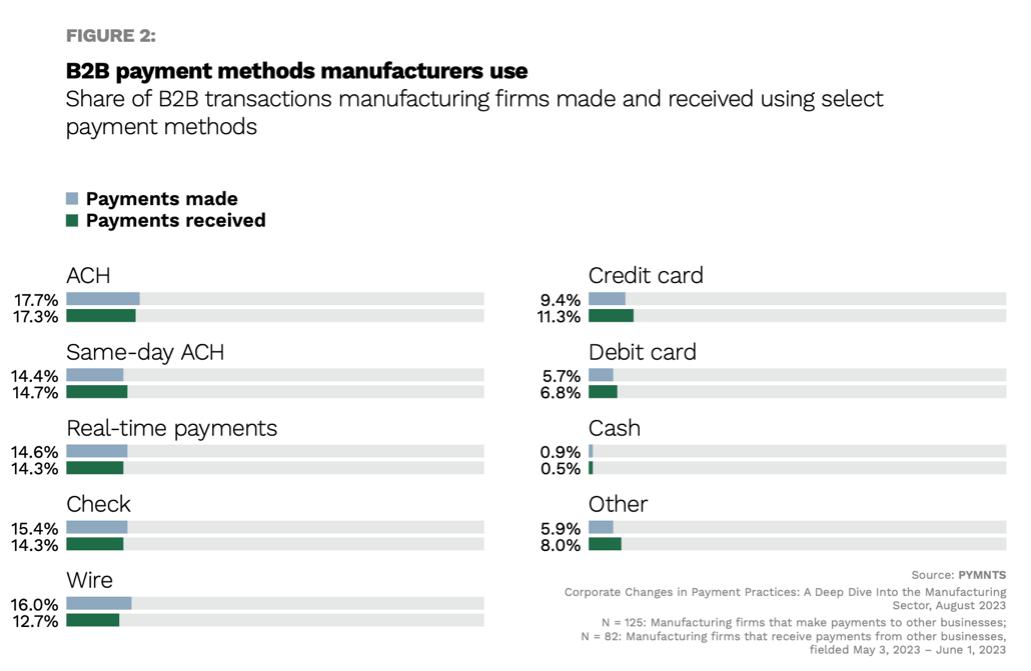

Real-time B2B payments are transforming industries in which the number of payment transactions is very high — such as the manufacturing sector. According to a recent PYMNTS Intelligence research in collaboration with The Clearing House, virtually all U.S. manufacturing companies used real-time payments last year, a level of usage that is par to other traditional methods, such as wire transfers, ACH or checks.

“Corporate Changes in Payment Practices: A Deep Dive Into the Manufacturing Sector,” a collaboration between PYMNTS Intelligence and The Clearing House that explores developing trends in real-time payments in the manufacturing sector. The study reveals that, despite widespread adoption, real-time systems only account for 15% of all payments issued by manufacturing companies. This is far behind the level of adoption in other industries, such as insurance (24%) or real estate (20%), per PYMNTS Intelligence data, sectors in which cash flow management usually works in shorter cycles. So, as compared to other sectors, there is still room for further usage.

Real-time payments are valued by enterprises for their speed and availability to track payments, two features that differentiate them from the other payment options. Beyond these, manufacturers see other benefits in the use of real-time payments. The feature they highlight most when using real-time payments is the ability to improve B2B relationships with clients or suppliers.

These factors lead 86% of respondents to see real-time payments are a priority in their operations in 2024, and nearly 6 in 10 plan to make more real-time payments next year, a much higher proportion than for any other payment method.

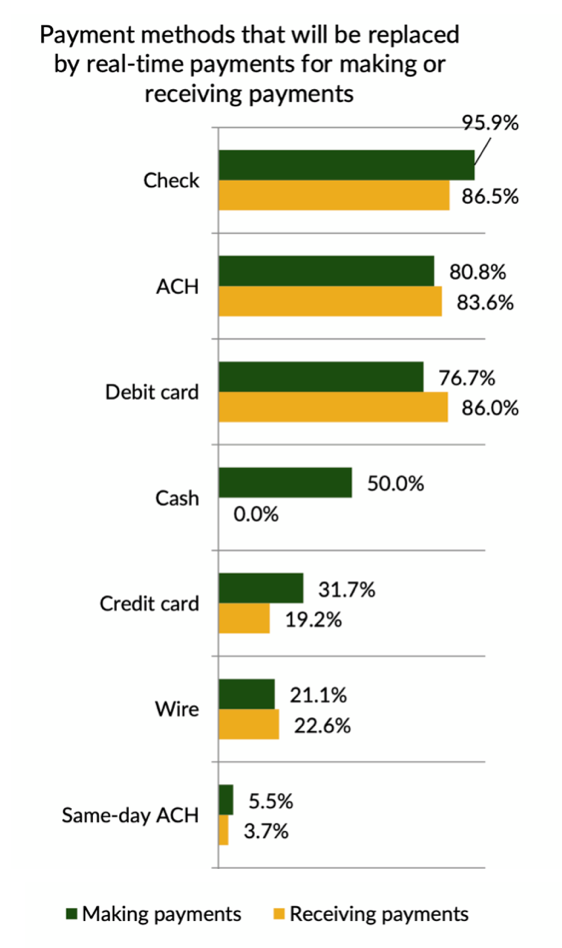

Not only are manufacturers planning to increase their real-time payments capabilities for the next year, but they also expect that these payments will replace other methods of payment. Ninety-six percent of firms that expect an increase in the usage of real-time payments think these transactions will replace payments currently made with checks, and 81% made with standard ACH. In both cases, checks and ACH, the transaction normally takes several days to clear. So, processing time explains this preference, as it also complicates the clash flow management for recipients.

For all these reasons, half of manufacturing firms are currently improving their ability to make and receive real-time payments or plan to do so in the next six months by collaborating with external partners. With this data in hand, and while the FedNow® Service is still in development, growth prospects for this payment method in the manufacturing industry are promising. Enterprises from the manufacturing industry are getting used to this system, and more have understood the real value of using it in their day-to-day business. If the prospects of adoption and usage are confirmed, real-time payments are positioned to soon become the leading B2B payment method in the manufacturing sector.