Lower Costs, Easier Integration Could Boost Instant Ad Hoc Payments

The use of ad hoc payments by large enterprises to pay small to mid-sized businesses (SMBs) and individuals is on the rise — and exclusive data from PYMNTS Intelligence suggests lower costs and easier integration could be making them even more popular.

Ad hoc payments represent, on average, 30% of accounts payable (AP) volume in dollars, up from 24% in the last quarter of 2023. Gig economy companies make an above-average share of ad hoc AP payments — and these firms also use instant payment methods the most.

While senders report that instant payments represent 35% of their ad hoc payment transactions, the corresponding share rises to 39% in the gig economy industry. Meanwhile, more than half of the payments sent by large enterprises (those generating annual revenues of $1 billion or more) are instant, signaling that the rise of AP automation makes instant a more viable option.

These are just some of the findings included in PYMNTS Intelligence’s study, “How Instant Ad Hoc Payment Costs Impact Small SMBs,” a collaboration with Ingo Payments, which is based on a survey of 200 U.S. enterprise senders (those generating at least $50 million annually) about their use of instant payments to make disbursements to SMBs and consumers.

The report found that instant ad hoc payments continue to gain traction for both consumers and SMBs looking to get compensated faster. In the past, both payers and payees complained that ad hoc payments were problematic. In fact, 1 in 4 SMB receivers said poor payment timing was a top challenge when receiving ad hoc payments.

But recent, exclusive PYMNTS Intelligence data suggests friction points around timing and the costs associated with processing ad hoc payments may be subsiding, making them an attractive method of compensating SMBs, employees and gig workers.

Right now, it’s common for enterprises in certain industries — transportation, hospitality, property management, gaming and businesses operating in the gig economy — to issue ad hoc payments to SMBs and individuals.

These faster payments resonate with recipients. Eighty-one percent of SMBs say they now receive instant ad hoc payments in exchange for the goods and services they provide. In appreciation for this speed and convenience, 57% of SMB receivers say they’re even willing to pay a fixed fee for instant payments.

But in exclusive PYMNTS Intelligence data that was not included in our original “How Instant Ad Hoc Payment Costs Impact Small SMBs” report, the costs associated with instant ad hoc payments are going down, suggesting if SMBs are willing to pay for instant payments, those costs may be manageable.

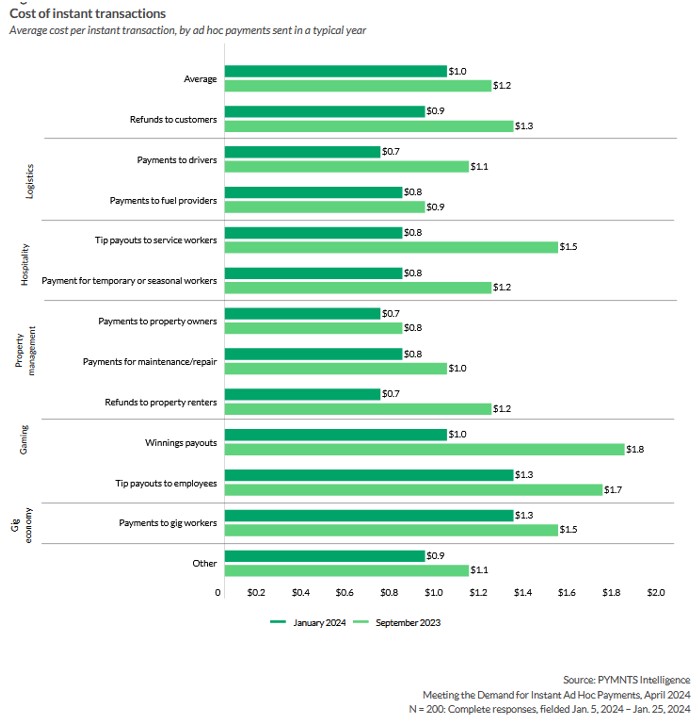

As the chart above confirms, the costs associated with processing instant payments have dropped across the board in the last year. As of January, the average cost of an ad hoc payment was about $1, down around 17% from September 2023. In the hospitality industry, the cost of an instant payment to a service worker was about $1.50 in late 2023; now that same payment can be processed for 80 cents. In the gaming industry, the cost of paying employees their tips used to be $1.70 per transaction; now the per-transaction cost is about $1.39. Processing fees associated with paying gig workers dropped from $1.50 in 2023 to the current $1.30.

But it’s not only costs that have dropped. As the second chart illustrates, past challenges associated with instant ad hoc payments have been reduced as well. Where 32% of payers identified the processing costs and fees of making instant payments to be a barrier in last year, less than 8% of respondents now identify processing costs and fees as a problem. Similarly, whereas 19% of respondents said the costs of integrating instant payments into their existing systems was a headache last year, only 7.5% say that integrating ad hoc payments is a challenge in 2024.

Enterprise senders recognize the importance of providing instant payments to their vendors, employees and gig workers. PYMNTS intelligence data also suggests that, in the past, they underestimated the magnitude to which receivers wanted instant payment options. Now, as the costs and friction once associated with ad hoc payments declines, it’s likely that large enterprises will be more accommodating toward facilitating instant ad hoc payments.