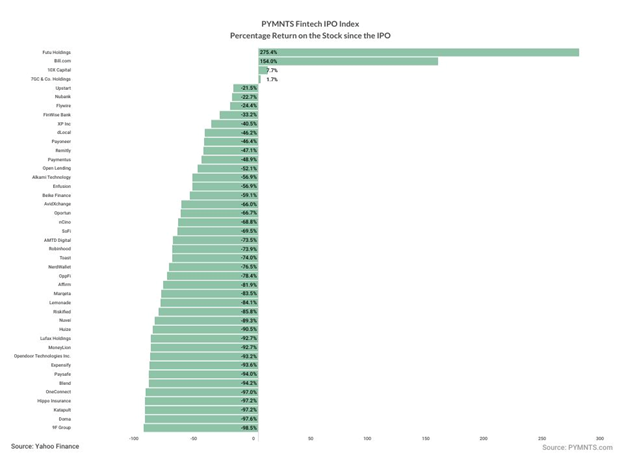

FinTech IPO Index Loses 4.7% as Platforms Lead to the Downside

The platforms led the FinTech IPO Index 4.7% lower this past week, as the year-to-date gains have been winnowed down to about 16%.

AMTD shares sank 21%.

The company extended a $50 million share repurchase program to the end of the first quarter of next year, with 60% of the amount earmarked for October and November of this year. Separately, the company announced this week that it had completed the acquisition of the New York-based art publication the Art Newspaper.

Lending Platforms Lose Ground

Upstart stock lost 13.2%. Cross River Bank said in a release this week that it launched its first broadly syndicated securitization, backed by $250 million of personal loans originated by the bank through Upstart’s platform.

Oportun shares sank 11%. In an announcement, the FinTech said Castlelake, a global alternative investment firm specializing in asset-based opportunities, have struck an agreement where certain Castlelake funds and affiliates will provide a $200 million private structured financing solution to Oportun.

Oportun will use the funds to finance personal loan originations. The transaction follows a $400 million whole loan flow sale agreement between the two companies, per the most recent announcement, through which Castlelake will acquire personal loan production originated by Oportun over the next year.

XP announced this week that during the third quarter client assets totaled 1.1 trillion reals, up 17% year over year (YoY). The company’s net inflow was 48 billion reals, up 38% YoY. Active clients grew 10% through the third quarter as compared to the second quarter, and 16% YoY, totaling 4.4 million as of September.

XP shares slipped 1.9%.

BILL, which lost 12%, said that it had introduced technology to help SMBs and accounting firms get “better control and visibility” of their accounts payable workflows. The company said that SMBs and accountant customers of BILL using Intuit QuickBooks Desktop software, including QuickBooks Enterprise, QuickBooks Premier, and QuickBooks Pro, will be able to view purchase orders, as well as match and pay invoices in one workspace. Purchase order and receipt details can now be synced from QuickBooks Desktop to BILL, according to the announcement.

Paymentus detailed in a release that new integration with MRI Software, a provider of real estate software solutions, to expand the utility billing and payment capabilities available to MRI clients.

The partnership, Paymentus said, enables renters to receive, manage, and pay bills from national, regional, and local utility providers connected to the Paymentus Instant Payment Network,

Paymentus shares lost 2.1%.

Meanwhile, dLocal shares slid 4.9%.

The company said it partnered with ACE Money Transfer, a U.K.-based online international remittances service provider, to broaden payout services across APAC and EMEA.

And as noted in this space this week, Etsy says it is working with Payoneer to help more sellers get paid in their local currencies. Etsy Payments service is now being extended to sellers in Thailand and Ukraine, with plans to include Japan, Chile, Argentina, Peru and India (export sales only) in the coming months.

Riskified shares were 0.7% lower. As reported here this week, the company has teamed with Plaid to enhance risk protection for ACH bank payments.

This collaboration aims to empower online merchants, marketplaces and trading platforms to approve ACH payments with confidence, safeguarding against fraud and the risk of insufficient funds, the companies said in their joint announcement.

The integration between Riskified and Plaid enhances Riskified’s existing ACH protection capability to shift fraud liability and protect against ACH “insufficient funds” returns.

Riskified’s platform complements Plaid’s Signal offering, which is a transaction risk scoring engine that provides merchants with new data attributes to better assess the return risk of transactions.