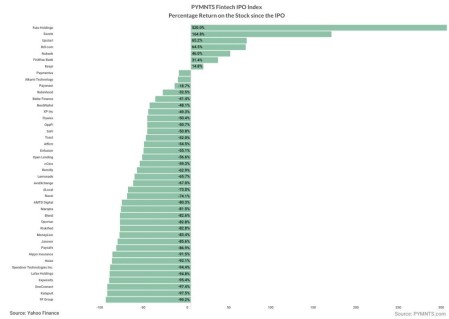

FinTech IPO Index Gains 2.3% as Digital Surges Ahead of Earnings

The FinTech IPO Index was 2.3% higher in a week that saw the platforms roar ahead — many of them by double digits — in anticipation of earnings reports that won’t come until next month.

Expensify shares were more than 33% higher for the week, followed by Lemonade, up 25.5%. MoneyLion’s stock surged 24.2%.

There were, of course, earnings reports to be had among the firms populating the index.

SoFi shares rose 2.1%. As PYMNTS reported this past week, SoFi Technologies’ cross-selling continues, and certain trends seem well in place as the interest rate environment becomes more benign.

Total deposits grew to $24.4 billion, with over 90% of SoFi Money deposits coming from direct deposit members. SoFi Money accounts as part of the overall “financial services products” came to 4.7 million, up 54% year over year.

Management stated on a conference call that financial services, as a percentage of revenues, was more than a third of the company’s consolidated top line. CEO Anthony Noto said the segment is a $1 billion business, as measured on an annualized revenue basis.

New member growth was up 35% year over year, to 756,000, and the total installed base was 9.4 million. Galileo accounts were up 17%.

“The one-stop shop continues to attract cross-buying behavior by our members,” Noto said, as 32% of new products were opened by existing members, while 20% of new members opened a second product within just a few weeks.

BNPL Names Show Mixed Results

As we head into the last few weeks of the year — and holiday shopping — buy now, pay later names also were in the news.

Affirm shares gained 4.2%. The company said it is upgrading its app.

The upgrades enable easier access to personalized payment terms and interest-free offers via its app. The changes come ahead of a holiday season anticipated to be marked by shifting consumer shopping habits. The updated app also lets users get live updates on how much they can spend with Affirm and look for credit offers with a new search function.

Marqeta has unveiled a new solution that delivers buy now, pay later (BNPL) payment options inside payment apps and digital wallets. The new Marqeta Flex is being developed with payment providers Klarna and Affirm and payments platform Branch.

Marqeta Flex is designed to expand the distribution of BNPL and provide these options to consumers when they need them, the announcement noted this week.

For consumers, the solution will present personalized BNPL options inside the payment apps they use, according to the company. It will also allow payment providers that offer BNPL options to access more consumers, and card issuers and digital wallets to access a variety of global BNPL providers through a single integration with Marqeta Flex.

Marqeta shares gained 7.4%.

In other BNPL related news, Shoplazza merchants doing business in the United States will be able to offer BNPL options through Sezzle. Sezzle shares lost 14%.

Shoplazza merchants will be able to meet consumers’ demands for alternative payment methods by integrating Sezzle BNPL service and offering Pay in 4 and Pay in 2 loans issued by WebBank.

Remitly posted earnings this week that showed active customers increased to 7.3 million, from 5.4 million, up 35%. Send volume increased to $14.5 billion, from $10.2 billion, up 42%. Revenues of $336.5 million gained 39%. Remitly’s stock was flat on the week.