FinTech IPO Index Leaps 8.9% Thursday but Upstart Signals Tough Times Ahead

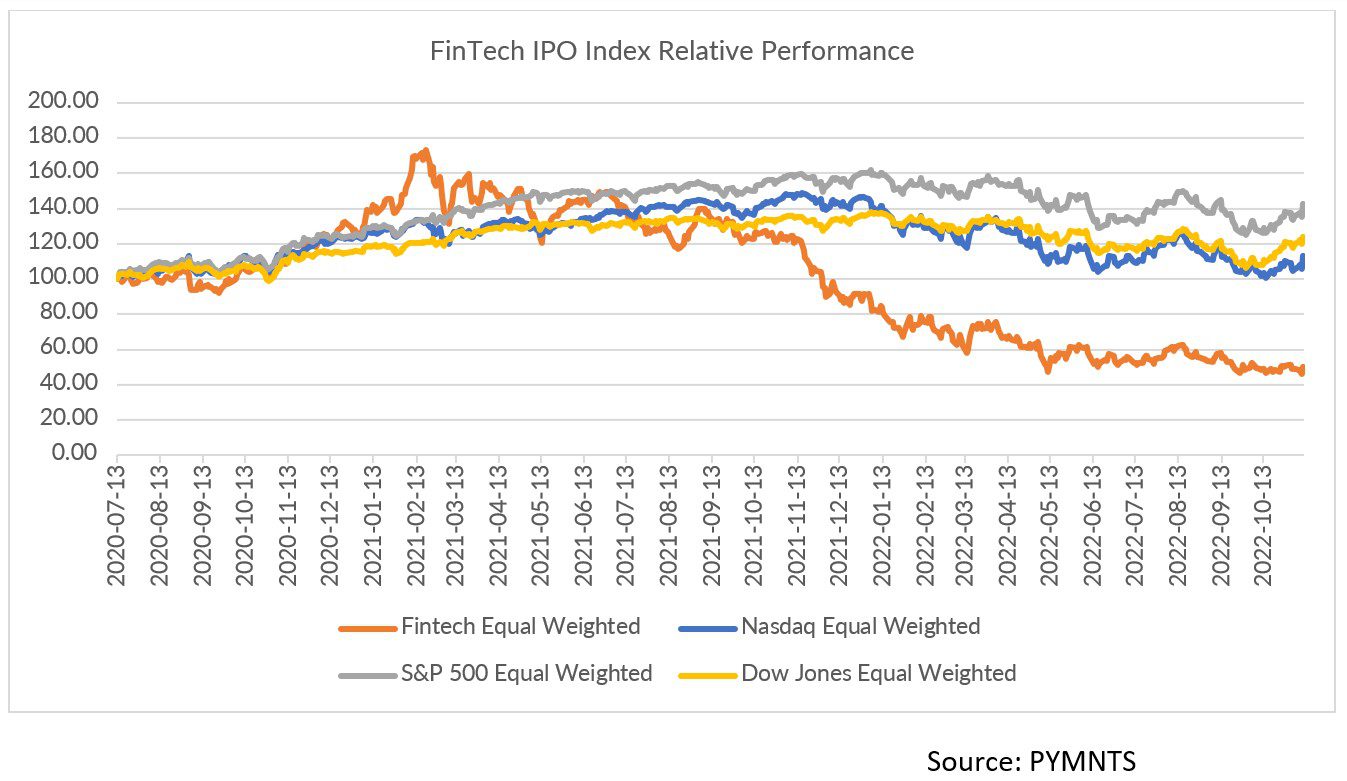

As impressive as Thursday’s (Nov. 10) historic market advance was — including the 8.9% jump in the FinTech IPO Index — a one-day rally does not a recovery make.

Even with the massive uptick, the past five trading days have seen the FinTech IPO group inch up by only 2.2%, retracing some losses seen during earnings season, but only by a bit. Year to date, the Index stands 45% lower.

If commentary from earnings season is any indicator, we’re in for a rocky time of it once Thursday’s euphoria fades. Consumers are growing cautious, FinTech platforms are seeing pressure on loan volumes and credit metrics bear watching.

Shares of AI-lending platform Upstart plunged more than 20% Tuesday (Nov. 8), after the company said rising interest rates and a slowing economy saw its tally of new loans cut in half. Total revenue fell 31%.

“Higher interest rates and significantly elevated risk in the economy means we’re approving about 40% fewer applicants than we would have a year ago,” Upstart Co-founder and CEO Dave Girouard told analysts on the company’s Q3 earnings call. The confluence of events led to a 48% drop in loan originations to $1.9 billion.

Volatile Macro and Volatile Stock Prices

Affirm’s results showed that Upstart’s pressures are no one-off issue.

“In light of the current volatile macro-economic environment and the continued and pronounced slowdown with a particular large merchant partner, we are reducing our outlook for FY’23,” executives wrote in their shareholder letter (the merchant partner is Peloton).

A forecast of $20.5 billion to $21.5 billion in gross merchandise volume fell short of expectations. The implied guidance, management said, is about 30% growth; the previous forecast had been around 40%. The company said in its filings that its 30-day delinquency rates, ex-Pay in 4, were 2.7%, up from 1.5% from the same quarter ending in September last year. Affirm’s shares are down 22% month to date.

Oportun Financial, however, with some of the same trends in place, has soared by nearly 50% through the past several sessions. This week, the company reported that revenue was up 57% year on year to $250 million. Members numbered 1.9 million in the most recent quarter, 9% higher than a year ago. Aggregate originations were $634 million, down 4% year over year. The 30+ day delinquency rate stood at 5.4%, compared to 2.8% for the prior-year period.

“Lowering our approval rates and shifting our focus towards returning members enabled us to drive down early stage delinquencies and first payment defaults, which ended the quarter below 2019 pre-pandemic levels,” the company said.

Open Lending, which focuses on automotive lending technology, said that the company facilitated 42,186 certified loans during the third quarter of 2022, compared to 49,332 certified loans in the third quarter of 2021, representing a 5.8% decrease. Total revenue was $50.7 million, down nearly 14%. Management noted on an earnings call that the most significant factor weighing on unit growth and originations for the auto retail sector has been affordability.

Beyond earnings, we’d be remiss in not mentioning that the crypto meltdowns this week surrounding FTX had some impact. Robinhood sank 24% through the past five sessions headed into Friday’s trading. As has been widely reported over the past several months, Robinhood had been seen as a potential buyout target for FTX.