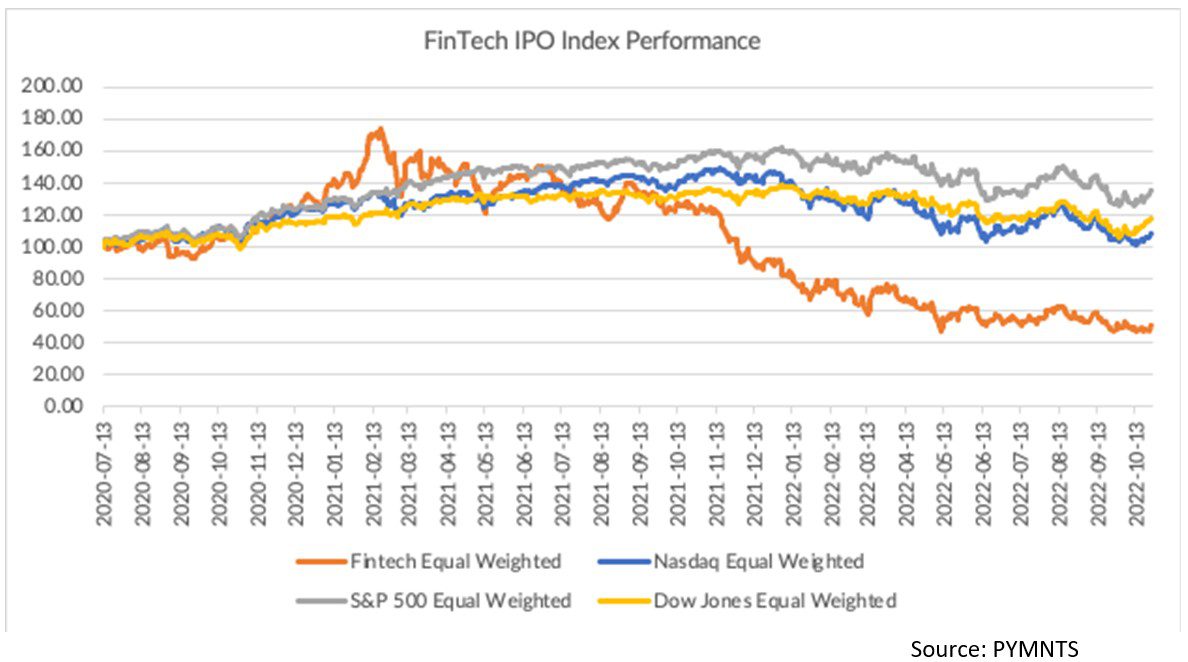

FinTech IPO Index Posts 4% Gain as Software Firms Surge

Earnings season will be the tell, of course, as to how long the FinTech IPO rally lasts.

But even with the volatility of daily trading headed into the end of the week, even with a bumpy Thursday, software as a service is sparking renewed investor attention, and, indeed, enthusiasm.

Across the five days leading into Thursday’s trading, several SaaS names showed double digit gains. The group’s rally has helped push the Index 4.2% higher for the week, and barring a frightful performance into Halloween, October has been positive, too, up 2.7%.

Maybe the software names, beaten down as they’ve been, are in the midst of a relief rally. But then again, the product announcements and partnerships that have marked the group in recent days also speak to the fact that platform firms are still — earnings volatility aside — transforming and simplifying financial services.

OneConnect, having rocketed up 23.8%, has been a standout.

The company said last week that it has launched OneCosmo, billed as a one-stop omni platform for all-in-one digital banking solutions, in the United Arab Emirates (UAE). Per the announcement the solution was jointly developed with Brazil-based tech company Pismo and OneCosmo allows customers to launch financial products, underpinned by real time data, in a matter of weeks due to pre-integrated and pre-configured features.

Crypto Makes Some Headway

Marqeta’s 5% gain through the past week has come on the heels of the announcement that its new “banking as a service” offerings will include dozens of APIs that in turn will help banking partners issue “demand deposit” accounts (such as checking accounts) to customers. Those accounts, according to reports, will be marked by early-pay capabilities and instant funding. Coinbase and Branch are among extant customers of the services.

And, separately, as reported Wednesday, Blockchain.com Visa card, which is powered by Marqeta, debuted, with , with 50,000 waitlist sign-ups.

Nubank parent company Nu Holdings gained roughly 1% through the week, as Nubank is launching its own crypto. The crypto, “Nucoin” will be available to all of the bank’s customers beginning next year. In terms of roadmap, the cryptocurrency will “be the basis for creating a rewards program,” Nubank said, and as PYMNTS reported, with customers who accumulate the currency earning benefits such as discounts. Eventually, the bank hopes that nucoins will be traded in the cryptocurrency market.

Not all names in the software sectors wound up in positive territory.

OppFi lost 6% this week, with the release of preliminary results that third quarter performance was in line with expectations. Revenue is expected to be approximately $124.2 million, and adjusted operating profit is expected to be $0.8 million. The company said, too, that profitability will rebound in 2023 “based on the strategic credit adjustments undertaken in July, which have already generated substantially lower early delinquency rates that are near pre-pandemic levels for both new and refinanced loans.”