Slight Rebound for FinTech IPOs Marks Shortened Holiday Week

We wouldn’t call it a comeback.

But it’s a gain, nonetheless.

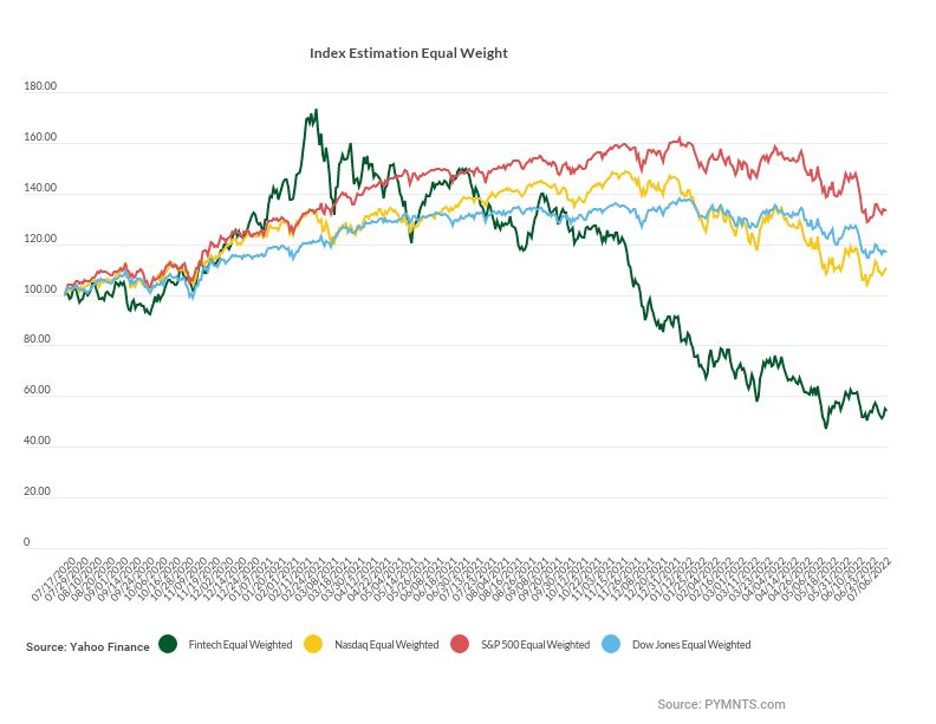

Coming into the close of a week shortened on Wall Street by the July Fourth holiday weekend, the FinTech IPO Tracker was up 2.9%.

But the hole is a deep one, as year to date, the group is down more than 41%.

The low single-digit gains seen in the past week belie the fact that there were double-digit percentage point gainers through the past five sessions, yes — and similar names posting double-digit declines, too.

And we haven’t even really gotten to earnings season yet, though some companies, here and there, have posted results for their most recent quarters.

Drilling down a bit, we see that OneConnect surged 38% on the week, with the firm’s initial debut on the Hong Kong stock exchange, completing its ambitions to have a dual listing in place (the shares trade in the United States, too, of course).

That performance was trailed a bit by Expensify, which gained 12%, and then by Payoneer, which was up 10.7% through the week.

In the case of Payoneer, the company announced a pact with Linnworks, where the latter firm’s platform allows retailers to integrate a range of third-party services. It also provides a range of tools to connect, manage and automate commerce operations.

The partnership will provide retailers with more options for receiving and making payments, as we noted in this space last week.

Read also: Linnworks Partners With Payoneer on Cross-Border Transactions

Affirm gathered 3.8% through the week, as Wall Street firm Stephens said gross merchandise value should surge in tandem with Amazon Prime Day next week. Assuming Affirm finances 50% Prime Day sales, as Yahoo Finance reported, this would double Stephen’s $5 billion Q1 GMV estimate and boost the annual GMV tally by 20%.

To the Downside

As for the most noteworthy performers to the downside, Triterras sank 38% in the past several sessions, in the wake of the company’s latest earnings report. Total transaction volume in the most recent period sank to $6.7 billion from around $10 billion a year ago, while revenues were up 2% in the period to $56.7 million.

Robinhood was off by 11% in the week, where the company gave back a chunk of the gains seen previously on the news that FTX might be exploring a bid for the investing platform (nothing incremental came out on that possible deal last week).

Paysafe lost 5.6%, after Mastercard and Paysafe announced at the end of June that they are expanding their collaboration to bring the Mastercard Send service to Paysafe’s payments platform in the United Kingdom. Funds can be sent to cards, bank accounts and mobile wallets. This is especially useful in industries such as insurance, eCommerce marketplaces, other forms of eCommerce and gaming, as had been reported last week.

Read also: Mastercard, Paysafe Expand Tie-Up With Faster Payments From Mastercard Send