How Starbucks Killed My Favorite Payment Experience (And Called It A Success)

Like most people, I still make the majority of my purchases with credit cards. But the one place I’ve always used my phone to pay has been Starbucks. Why did I never think twice before using the Starbucks mobile app to pay for all my purchases there?

For the same reasons that it has become one of the most popular mobile payments experiences in the world — it was easy to use, accepted at most Starbucks, and had a rewarding loyalty program. The beauty of the experience was in its simplicity: 1) Go to any Starbucks and buy something, 2) Get a Star added to your app, 3) Earn 12 stars and trade them for one free beverage of your choice, no questions asked.

That was it. Straightforward, no twists, no complicated formulas, just an elegant loyalty program with tangible results for the customer. Granted, you had to reach gold status to be eligible, but that was also easy to achieve — just accumulate 30 stars in a year.

And as Gila Allswang explains in her blog, that gold status helped make customers feel special.

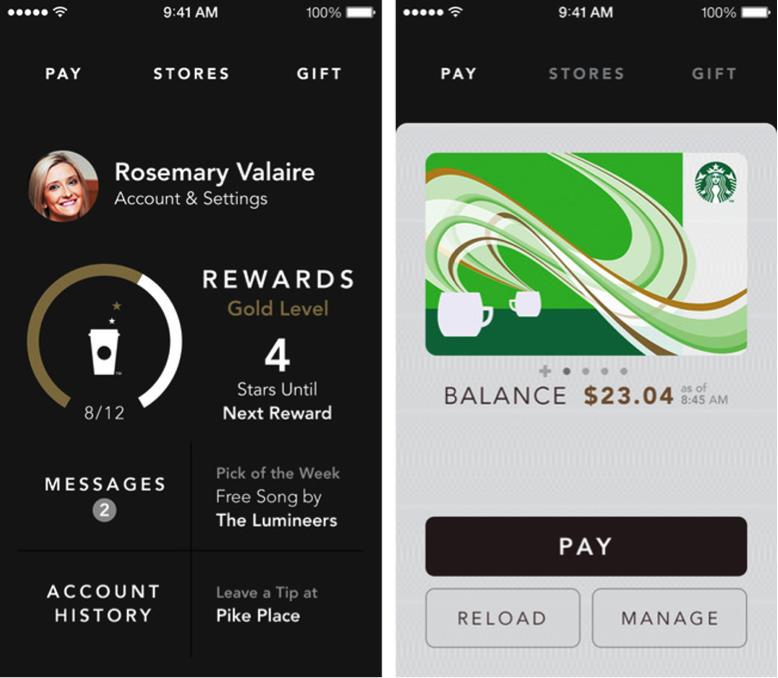

Another thing Starbucks did well was to present customers with the information they needed in a simple screen that made it easy to pay their tab or reload their account balance. This user interface was sublimely intuitive, as you can see for yourself in these screenshots:

Source: Gila Allswang’s blog

This superb loyalty experience extended beyond the app as well, leveraging surprise-and-delight best practices to engage customers at home. I certainly appreciated getting a free drink coupon for my birthday every year, attached to a best wishes email.

The New Program

So why fix something that not only isn’t broken, but which has been the most significant driver of Starbucks’ top and bottom-line growth, according to their CEO (see one of numerous Howard Schultz quotes here)? Because some clever users figured out a way to optimize their spending to get over rewarded.

Starbucks does sell some items priced at around $1, so a user could have spent as little as $30 over 30 visits to achieve Gold status. After reaching that Gold status, that user would be entitled to any of the most expensive drinks on the menu, like a venti Frappuccino, for free — after only 12 more visits totaling a spend of only $12. So in response, the brilliant change Starbucks made to the loyalty program was to make it spend-based. And they also increased the stars-gathered requirement for a free item to about a bazillion stars.

This is broken on so many levels, but there are already enough rants out there about the new loyalty program. What really bugs me is how they missed a few simple points:

This is broken on so many levels, but there are already enough rants out there about the new loyalty program. What really bugs me is how they missed a few simple points:

Cater to the masses.

In the consumer-driven U.S. economy, you tailor your programs to the mass consumer who loves to spend and appreciates the experience, not to the optimizing consumer who’s great at clipping coupons, using the right cards and mailing in rebates. Why else are return policies in the U.S. some of the most liberal in the world? Shouldn’t retailers be obsessing over that set of customers who always seem to bring back what they bought, leading to restocking losses? NO, of course not! Like any good business, you run the numbers and conclude that the increase in sales and profit due to the favorable perception of the return policy outweighs the minor restocking and related losses brought about by the actual returns.

Loyalty is about habit formation more than it is about dollars spent.

If your experience can get the consumer in your door every morning on their way to the office, a gold star is the least you can give them. Trust me, most will spend more than $1 once they’re inside – much more. Your top priority should be building that consumer’s muscle memory by rewarding them for their daily visit, not requiring them to spend a certain amount in order to achieve the reward.

Simplicity is key to adoption of a program.

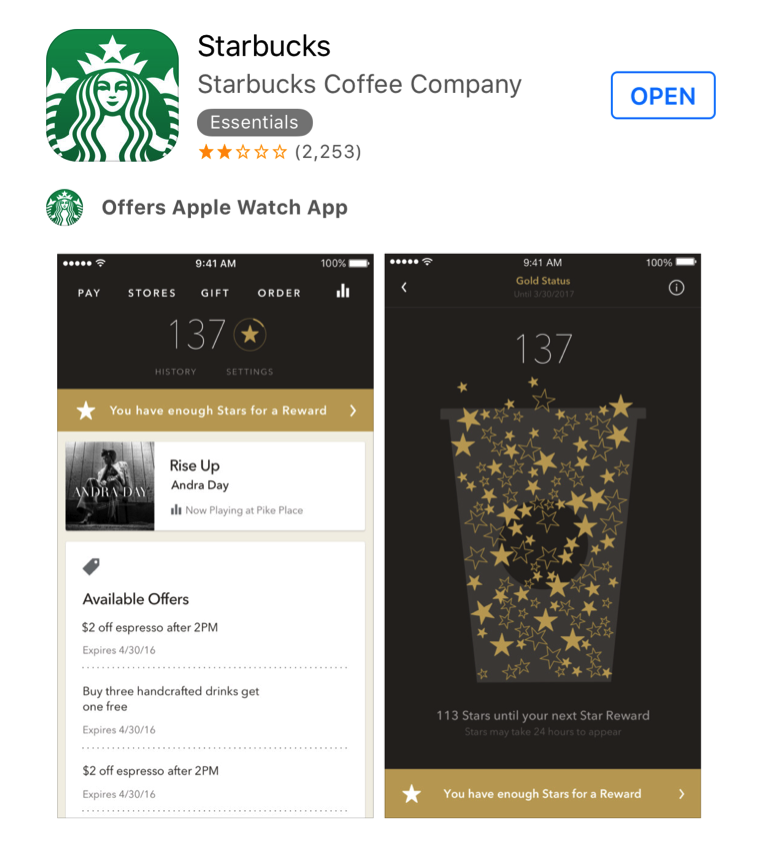

Most people can figure out how many purchases they’ve made out of 12 at a glance, but my head starts to hurt when I try to figure out how much more I need to spend to earn the 113 remaining stars in the image above. In its previous incarnation, the Starbucks loyalty program set the gold standard on simplicity (pun intended) — visit 30 times to get gold status, and every 12 subsequent visits gets you a free drink. That program’s simplicity has really been lost in its new incarnation.

Going beyond the mechanical.

This last one has become a pet peeve of mine. Loyalty programs have caught on like wildfire in the past few years; every retailer wants to have one because they’re in. In order to satisfy this significant demand, cookie-cutter loyalty programs are being mass-deployed with so little focus on user experience that the programs become downright mechanical. Consumers are conditioned by a certain spend-to-reward ratio and they don’t expect anything more or less out of the program, certainly not a wonderful experience. While most retailers are catching on to this dissatisfaction and transforming their loyalty programs to be more engaging, Starbucks went the other way and introduced a more mechanical dollars-and-cents model.

But we’re seeing huge uptake!

The proof is in the pudding, no? And if Starbucks is telling you that they had an increased number of user sign-ups for the new program, why not put the issue to rest?

Because the numbers are blatantly misleading. Take, for example, this story touting the growth in user signups due to the new program, which says “About 900,000 customers joined the company’s rewards program in the second quarter, Starbucks reported on Thursday. That’s a boost of 8% versus the first quarter of the year … ” Hold on a second. Starbucks’ second quarter ended on March 27, and the new program (which was announced in late February) went into effect on April 12. I don’t think we’ll see the financial impact of the new program until several months from now, perhaps even next year. Another story indulges in the same flawed wishful thinking based on Q2 numbers, but also mentions one prominent analyst that gets it right: “Analysts at Deutsche Bank, on the other hand, aren’t so bullish. The bank downgraded Starbucks shares to hold on April 12 over concerns that changes to the loyalty program could have a negative impact on same-store sales.”

I’m absolutely baffled, Starbucks! You had managed to build the simplest, most beautiful loyalty experience out there, one that had driven unprecedented top and bottom-line growth for you. Don’t find fault in that simplicity because of the rare unscrupulous user, and definitely don’t throw the proverbial baby out with the bathwater. It’s much better to be penny-foolish and pound-wise than the other way around.

…………………………..

Navneet Singh

Navneet is an entrepreneur as well as a seasoned executive in the payments and commerce industry. He was most recently SVP of Product at Vantiv, America’s second largest payments acquirer, where he led the creation of Vantiv’s omnichannel developer platform with best-in-industry risk, security and integrated payments capabilities.

Before Vantiv, Navneet has served as VP of Product at SK Planet Inc. where he led mobile commerce, and as CPO at GoPago Inc, a pioneer in mobile POS solutions which was acquired by Amazon. Prior to GoPago, Navneet spent six years at Google, where he led product and engineering in Google’s Mobile division. Navneet holds BS & M.Eng degrees in Computer Science from MIT, as well as Business Management from the MIT Sloan School of Management.

Thanks to Michael Lesniak for his help with editing this blogpost.