The Innovation Lessons Behind Walgreens’ Breakup With Theranos

“If you can’t beat them, join them.”

That’s been a law of the natural retail world for as long as head-to-head competition has been the means by which one brand sinks and another brand swims. However, at the rate retail startups are not just launching but also actually disrupting the industries they target, who established merchants should “join” starts to become a much trickier proposition.

And like Walgreens is now painfully aware, sometimes the mad dash to gobble up innovative startup partners can lead merchants down a dark path.

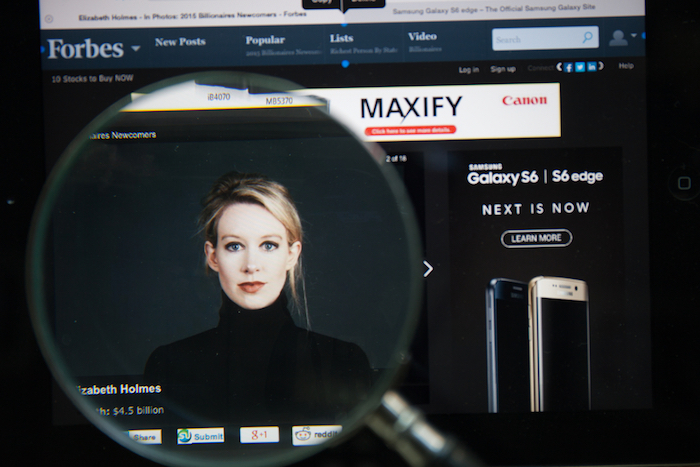

It may have been a long time coming, but Walgreens has, as of Sunday (June 12), officially announced that its operating partnership with Theranos Wellness Centers has been torn up and tossed aside. Walgreens had previously been conducting Theranos-run, limited-capacity blood tests at select locations in Arizona, but with a foot solidly put down by Brad Fluegel, Walgreens’ senior vice president and chief health care commercial market development officer, the embattled partnership is kaput.

“In light of the voiding of a number of test results and as the Centers for Medicare and Medicaid Services (CMS) has rejected Theranos’ plan of correction and considers sanctions, we have carefully considered our relationship with Theranos and believe it is in our customers’ best interests to terminate our partnership,” Fluegel said in a statement.

The decision to formally cut ties with Theranos comes months after an expose from The Wall Street Journal blew the proverbial stopper off the vial of blood when it came to the blood-testing company’s claims of not only accuracy but cost efficiency as well — a key tenet of the Walgreens neighborhood pharmacy ethos. But if something untoward was going on with Theranos’ claims of ultra-efficient blood tests as far back as Oct. 2015, why would it take another eight months for Walgreens to kick the partner to the curb?

The easy answer — and no less true — is formalistic: It takes time to disentangle contracts like that while making sure not to step on any legal toes on the way out. However, there is the possibility that Walgreens was hoping against hope that the Theranos rumors turned out to be unfounded.

Why? Because if Theranos was on the up and up, it would have been a lucrative ally going forward.

In a 2015 column for VentureBeat, Alliant’s employee benefit consultant, Tom Greene, explained that retail health brands like Walgreens can see the storm clouds on the horizon brewing in a fight between their ilk and the traditional health providers that have managed to silo so many of their profitable treatments for so long. Thanks to the paradigm-changing Affordable Care Act, though, it’s suddenly become a cheaper and more convenient option for millions of Americans to seek low-risk care at neighborhood health outlets rather than hospitals and emergency rooms.

And any merchant that establishes itself as a go-to, low-cost resource in this turbulent period of health care stands to make a killing (no pun intended).

“There is no doubt that retail is making a big bet on health care,” Greene warned. “If it succeeds, the payoff will be enormous. But just as Uber is at war with the taxi industry, retailers will soon be at war with the large, publicly traded health care chains. The nation’s largest health care chains will not sit idly by and watch their market share erode. In order to win the loyalty war, the nation’s retailers will have to embrace an Uber-like ecosystem that places a premium on convenience, availability and access.”

One can’t fault Walgreens for taking a chance on Theranos, especially considering the potential payoff. But where history might prove it wrong is how long it held onto what it thought was its golden ticket.