How Consumers Shop Using Smartphones For Food Vs Retail Goods

Despite efforts by major supermarket chains as well as third-party delivery services, online grocery shopping still hasn’t seen mass adoption in the U.S. In fact, only 3 percent of food is bought digitally.

In the 2019 edition of the Remote Payments Study, PYMNTS collected and analyzed survey data from 2,300 American consumers to see how shopping habit have changed and evolved from last year. Research found that online grocery shopping still has a ways to go.

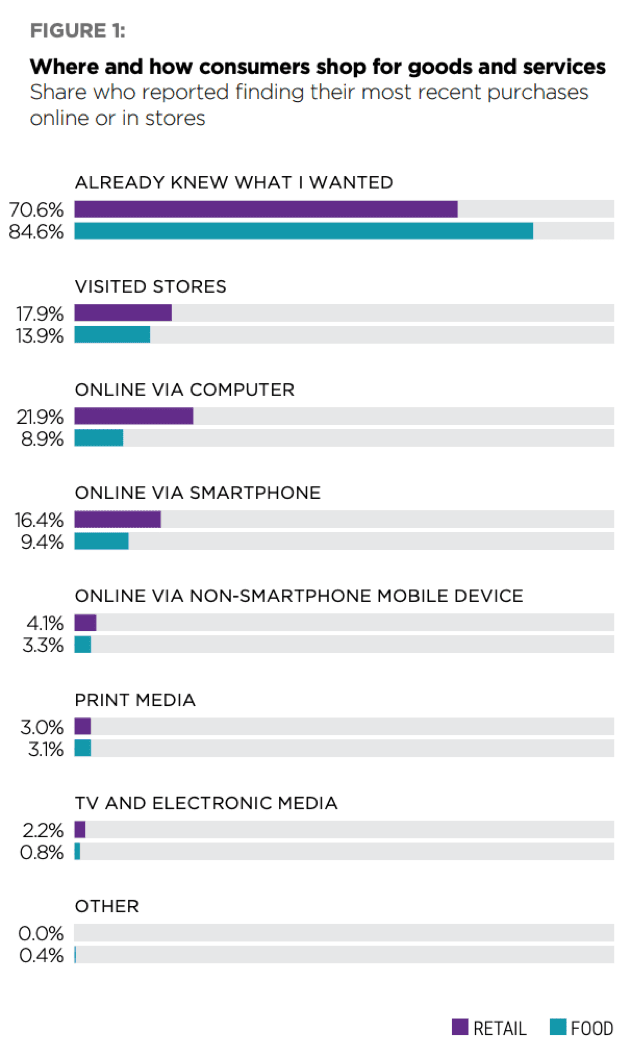

Digital tools for shopping are now ubiquitous, but various channels are used in different ways and differ by category shopped. When asked how consumers found their most recent food purchase, an overwhelming majority (84.6 percent) said they already knew what they wanted. This makes sense since grocery lists are common and most consumers know ahead of time the groceries they regularly buy.

Consumers still visit stores to get ideas, though; 17.9 percent went to a retail store for ideas while 13.9 percent went to a store to get an idea about food purchases.

Fewer (70.6 percent) knew what they already wanted to buy when it came to retail goods. Additionally, 2.5 times more found goods they wanted via a computer (21.9 percent) than those who browsed food on a computer (8.9 percent).

Traditional media like print and TV ads were much less influential on both types of purchases.

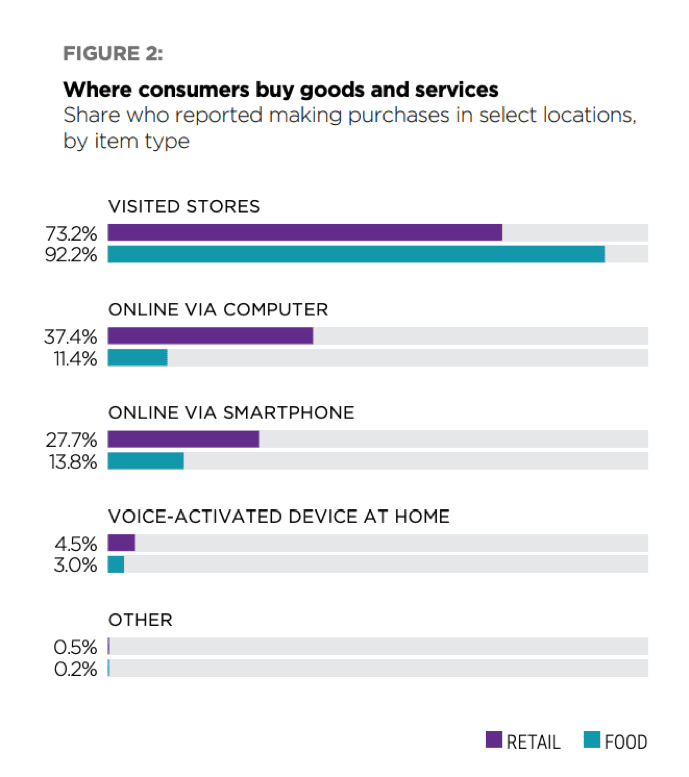

For purchasing, it’s a slightly different story but follows the same pattern. While consumers found what they wanted to buy via digital means — and even traditional ads — the bulk of purchases for both retail goods (73.2 percent) and food (92.2 percent) take place in a store.

This shows why there hasn’t been mainstream adoption of online grocery shopping despite efforts from major supermarkets like Walmart, Albertsons and others. Consumers are still reluctant to buy things like produce online where they can’t see the quality in person. Retail goods come with less risk and retailers make it easier to return merchandise like books and clothing.

Last week, Walmart reported that eCommerce sales gave the retailer a boost, growing by 37 percent, but this was driven largely by gains in apparel and home goods, not food.

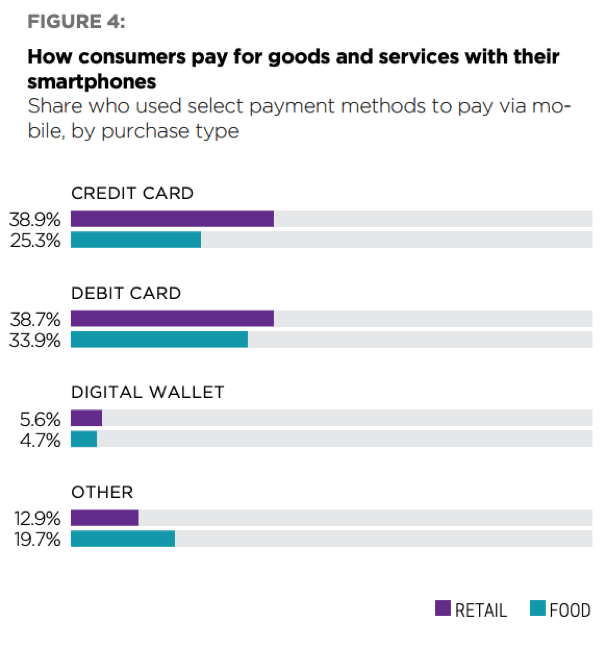

In comparing payment methods, digital wallet usage is still fairly low. Just 5.6 percent of consumers in Q1 2019 used digital wallets to make a retail purchase. Most use stored credit cards (38.9 percent) and debit cards (38.7 percent).

Consumers are downloading more mobile wallets than ever — including Apple Pay, Google Pay, PayPal and Walmart Pay, among others — but are just are not using them to buy.

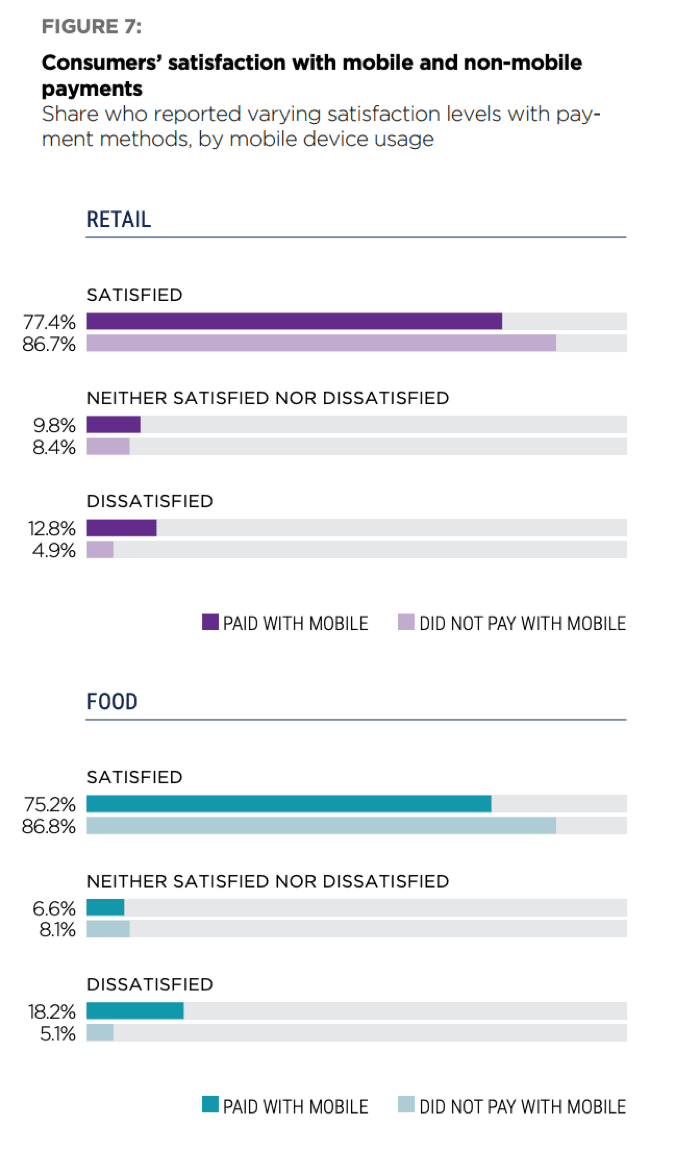

Despite low mobile wallet usage, consumers aren’t dissatisfied with the technology. More than three-fourths (77.4 percent) of those whose latest purchase were retail products and who used smartphones to pay report being “somewhat” to “extremely” pleased with them. This is slightly more than the 75.2 percent whose last purchases were food items.

Very few (12.8 percent) flat out said they were dissatisfied with mobile payments for retail goods while slightly more were dissatisfied with mobile payments for food (18.2 percent).

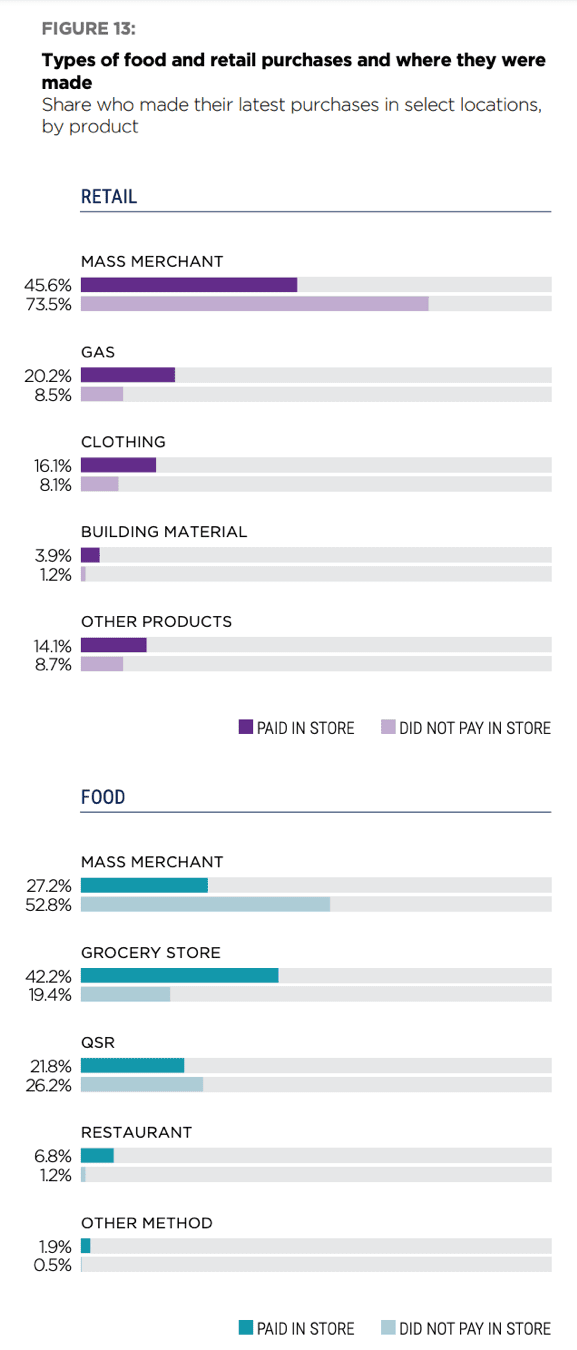

Where consumers make payments depends not just on product category, but also product type.

The results showed that mass merchant purchases make up most of consumers’ remote transactions, regardless of whether the consumers purchased food or retail items. In fact, 52.8 percent of those whose most recent remote purchases were in food bought from mass merchants.

Far fewer (19.4 percent) used remote payments to buy food from a grocery store, which reinforces the previous point about low online grocery shopping adoption. Buying food remotely from quick service restaurants (QSRs) is more popular (26.2 percent). More pay in-store at a full-service restaurant (6.8 percent).

Consumers are open to new ways to use their smartphones to meet their demands for in-store or remote shopping experiences, though using smartphones and mobile wallets for actual purchasing is lagging behind researching and browsing on devices.