What Mobile Payments Can Learn From Debit Cards (Circa 1995)

We’ve been trying to ignite mobile payments now for more than a decade and we’ve barely moved the needle. Karen Webster says that it’s time to stop looking at our navels and even the future for inspiration – but back to the annals of payments history since we’ve actually done this before. Like back to 1995 when debit ignited. She channels her inner debit card ignition muse, circa 1995, to offer 5 ways to get mobile payments off the ground – so that you can channel your own and get this mobile payments party started.

If we’re really serious about igniting mobile payments, maybe it’s time to stop looking to the future for our ideas and inspiration, and instead look back in time to how another transformative payments innovation got off the ground.

Like back to 1995.

1995 was the year that “Toy Story,” “Apollo 13” and “Batman Forever” were breaking box office records. It was the year that Mariah Carey’s “Fantasy” topped the pop charts and the 26-year old millennials now working in FinTech startups were sipping from juice boxes in kindergarten class.

1995 was also the year that debit cards ignited.

So what does that have to do with getting mobile payments off the ground right now?

I’m gonna tell you.

SAY HELLO TO CHECK CARDS

At the start of the 1990s, if the parents of millennial prodigies wanted to get cash from an ATM, they used a special piece of plastic in their wallets called an ATM card. ATM cards were issued by banks, had a mag stripe on the back and were linked to the cardholder’s checking accounts. The EFT (aka PIN Debit) “rails” that made it possible for that money to be withdrawn had two distinct characteristics: money could only be withdrawn if a PIN was entered first in order to authenticate the consumer, and funds were immediately taken from the cardholder’s checking account.

PIN Debit rails were typically operated by regional networks owned by banks – STAR, PULSE, NYCE and Shazam, to name a few. Visa and Mastercard also operated their own national ATM networks, Plus and Cirrus, respectively, which they each independently established in 1982 and took care of transactions when cardholders were outside of their local or regional networks.

At the turn of the 1990s, some 20 years after the first ATM in the U.S. was unveiled, there were 80,000 ATMs for consumers to use to get their cash. By then, nearly all of them were part of regional or national networks, meaning that consumers could use their ATM cards to get cash from most ATMs in the country.

There were starting to be a few merchants – mostly supermarkets — that had PIN pads that enabled cardholders to use their ATM cards to pay for things at stores. But most merchants didn’t have PIN pads at that time.

What all those merchants did have then were the electronic POS terminals that the card networks had subsidized for them to install back in the 1980s. Those terminals made it possible for consumers to use any of those bank-issued credit cards at any store, regardless of the bank that issued it. These terminals were connected to a set of network rails that settled and cleared those transactions for the merchants and the banks.

But what the card networks didn’t have then was much success getting debit products off the ground.

Visa and Mastercard both initially attempted to launch debit products back in mid-1970s. Consumers were writing a ton of checks then – some 24 billion of them – so substituting a plastic card for a paper check seemed like a no-brainer.

But banks weren’t interested. They made money from checks, so why rock the boat. And consumers didn’t seem that interested in using plastic — which they thought of as credit — to zap money from their checking accounts.

So, when the 1990s rolled around, the U.S. debit scene looked something like this:

There were lots of consumers who liked paying for things using the funds available in their checking account. But they did it by writing checks in stores. Yes, all of you millennials who don’t carry a checkbook, back in the stone age of the 1990s, people did and used them, regularly. It, for example, was not uncommon for people to write checks to pay for their groceries each week – or use cash.

There were a lot of consumers running around with bank-issued ATM cards —in fact virtually all of the consumers who were writing those checks. And there were regional EFT networks that connected the ATMs of pretty much all the banks in the country so that all cards could be used at pretty much any ATM. By the mid 1990s, there were an estimated 220M ATM cards in the hands of consumers.

But PIN debit had scant merchant acceptance. What the PIN networks had, however, was a persuasive, merchant-friendly value proposition – low network fees and the potential for reduced chargebacks. The combination of PIN plus real-time funds availability would blunt the risk that a consumer couldn’t pay for what they wanted to buy, and merchants would be able to decline a transaction right then and there. All that the merchant had to do was cough up the money to install PIN pads.

The card networks had ubiquity of merchant acceptance with electronic terminals that could enable transacting via mag stripe products for any bank on their network. They also had a lot of banks that had issued credit cards with mag stripes and a lot of consumers with checking accounts. But they also had banks that were dubious that money could be made on debit products given the EFT value proposition of next-to-nothing network fees. What the networks needed was a debit product that consumers could use at their ubiquitous merchant locations and a way to get banks on board so that they could harness the potential of their checking account customer base.

Here’s what happened.

BRING IN THE PIN PADS AND CUE BOB DOLE

The EFT networks offered a break on their already-low interchange fees so that merchants would install PIN pads. Consumers with issuer-branded ATM cards could then use the cards already in their wallets at those merchants instead of writing a check. Those cards would carry the logo of the PIN debit network on the back of the card in addition to the bank attached to the consumer’s depository account. Merchants started installing PIN pads.

At the same time, Visa launched an aggressive campaign to get issuers at the top 50 banks to issue another type of debit card, signature debit, which would not require a PIN. But signature debit came with a different advantage: those cards could be used at the terminals that merchants already had in their stores. Instead of a PIN, a signature would be used to authenticate the consumer. These transactions were done offline, and cleared and settled two or three days later. Consumers would be issued a mag stripe card that they could use at all merchants as a debit product – instead of writing a check – and at all ATMs to withdraw cash.

To get banks interested, Visa gave issuers the same interchange fee they got on credit cards and showed them they could turn them into a profit center. They also funded a massive advertising campaign featuring Deion Sanders, Bob Dole and Daffy Duck to convince consumers that they could use their “check card” at any merchant that accepted Visa cards. Visa signed up a ton of banks in a relatively short period of time. By signing on with Visa, those banks were prevented from also issuing Mastercard’s MasterMoney product that debuted later that decade, giving Visa a running head start in the signature debit market. Unlike credit cards back then, banks could only issue Visa or Mastercard, but not both.

EFT’s value proposition was merchant-centric: Install PIN pads and tap into consumers with ATM cards at lower fees with lower fraud risk.

Visa’s value proposition was bank-centric: Get a new revenue stream by giving consumers a single card that would substitute for a check in a store and give them access to cash at any ATM. ATM cards would no longer be needed.

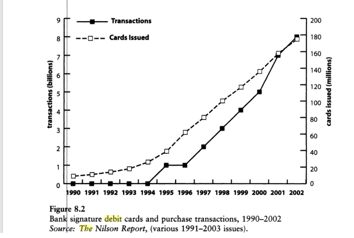

In 1991, there were a paltry 7.6M debit cards in the U.S. By 1997, there were 58M. Debit card volume grew over that same period of time from $5.9B to $58B. In 1996, a year after Visa’s campaign launched, it reported 1.2B debit card transactions accounting for nearly $50B in volume. By 1996, there were 500,000 PIN pads at merchants, up from a few thousand at the start of the decade. By 1998 – just two years later – that number had grown to 2M.

Debit had ignited.

But that ignition happened with two very different strategies.

In the interest of making this story about debit ignition and not debit, I’ve skipped over a lot of the details that make the history of debit story interesting and even somewhat controversial.

In the interest of making this story about debit ignition and not debit, I’ve skipped over a lot of the details that make the history of debit story interesting and even somewhat controversial.

But if you want a little light summer reading on the story and the history of debit, I’d suggest that you read Chapter 8 of Paying With Plastic (Evans, Schmalensee, MIT Press, 2005). I know that I’m also skipping over the details of debit today – which are as rich and interesting – but that’s another story for another day.

The story that is relevant for today, though, is that as a payments industry, we obviously know how to ignite new products and even get new technologies in the hands of consumers and merchants – because we’ve done it.

Electronic terminals and debit prove it.

So, it’s time to take the lessons of history, and channel our inner-debit ignition muse to get mobile payments moving.

In five easy steps.

DON’T LET TECHNOLOGY FORCE-FEED AN IGNITION STRATEGY

Debit ignited by leveraging existing technologies that could be easily enabled at merchants – or that already existed at those merchants – to enable payment via a checking account using a plastic mag stripe card. Mastercard and Visa simply used the technology merchants already had and paid for while the EFTs subsidized the technology that merchants would need to use their cards. No one expected merchants to go sink money in a new technology out of their own pockets.

That has not been the case with NFC and mobile payments.

We’ve unfortunately spent the last 10 years forcing mobile payments into an in-store NFC technology mold that hasn’t knocked the socks off of consumers by simply substituting a tap for a swipe and asked merchants to foot the bill. We’ve let technology drive mobile payment’s ignition strategy, instead of the value created when a consumer with a mini computer in her hand encounters a merchant who’d like to use that computing power to help him sell more stuff to her.

NFC as an ignition strategy has also ignored the many, many dependencies that such a strategy requires to get the critical mass needed to achieve ignition: enough merchants with enough NFC-enabled terminals, enough consumers with enough of the right handsets or cards and enough of a value proposition for both to care. Absent all three, mobile payments ignition is left up to chance: the hope that one day *something* might happen to move things along, and at that point, there’d be infrastructure in place to support it.

That fails to account for the one thing that’s essential to mobile payments ignition: critical mass.

WITHOUT CRITICAL MASS, YOU’LL END UP IN CRITICAL CARE.

Without critical mass, there’s not a hope or a prayer for mobile payments ROI. It’s the reason, I surmise, that no one’s jumped in to offer merchant subsidies to juice the installation of contactless terminals like was done in the 1980s for credit cards and the 1990s for PIN debit. There must be too many doubts about NFC’s ability to deliver critical mass in a relevant time frame to make that juice worth the squeeze.

But critical mass does explain why debit took off. The PIN and signature debit networks eliminated a consumer and merchant friction. Checks were a pain to write for consumers and merchants leading to friction and checkout, and checks were expensive for merchants because of the handling and fraud. Debit cards enabled consumers to pay with a card they were already carrying for using at ATMs in a way that wasn’t that different from credit cards they were also carrying. Debit cards eliminated check friction for merchants using terminals and processes they already had for credit cards or with new simple to use PIN pads.

Both PIN and signature debit networks leveraged that density of demand by consumers to unlock enough value at enough merchants to get the ignition flywheel turning. They also didn’t tell consumers that their cards only worked at a few stores here and here and only if they carried them in purple leather wallets.

That means for mobile payments to achieve critical mass, solutions need to work across devices, across operating systems, across shopping channels, across technologies and across tender types. And it means that mobile payments ignition strategies need to address the density of demand problem first, and figure out there there’s the density of supply available for those with the demand to transact.

THE PRICE BETTER BE RIGHT

PIN and signature debit used pricing in two very different ways to ignite the debit market.

The PIN debit networks used low fees to build a density of supply – merchants with PIN pads. It worked. The number of locations with PIN pads quadrupled in three years.

Signature debit networks gave banks the incentive to build the density of demand – merchant acceptance of those products was already in place. By giving banks an incentive to get customers to adopt “check cards,” and not requiring merchants to invest in new technology at the POS, Visa was able to ignite signature debit, even though the fees to merchants were much higher than those of the PIN debit networks. Banks delivered millions of consumers to merchants who could use those products anywhere they shopped.

The situation with mobile payments is sufficiently complicated given the lack of a “standard” way of enabling mobile payments at physical stores. But igniting mobile payments will require a thoughtful approach to aligning fees with the value created, including for those who bring a density of demand to the merchant and that don’t require costly and time-consuming changes to their POS, thus creating and enabling a density of supply.

MAKE MERCHANTS A PART OF THE GAME

Matchmakers in payments have many stakeholders to please. The networks have to please the banks who collect interchange from the merchants. They have to make sure consumers find enough value in what their issuers offer that they use their products. They have to make sure that merchants accept their card products so that consumers can use them when they want to at all of the merchants they shop. Each and every stakeholder is important, and keeping that balance in alignment is why payments matchmakers have a very tough job.

Most of the time when the term “merchant-friendly” gets thrown around in payments, it’s in the context of making it cheaper for them to accept card payments. The clash between networks and merchants over that point has been well documented, and merchant litigation over interchange has been the full employment act for lawyers now for decades. It’s been a pretty successful one, too, as merchants have managed to shave billions off their fees over that same period of time.

It could be that mobile payments gives us an opportunity to rethink what “merchant-friendly” should look like. As in perhaps the most “merchant friendly” strategy of all is just making it easy for merchants to actually accept the mobile payment method that most consumers have and want to use at their stores.

PIN debit was merchant friendly because it gave consumers with a card already in their wallet a new place to use it: their stores. They got sales as a result. But even more importantly, PIN debit eliminated a major friction — just think about standing in line when someone in front of you pulls out a checkbook. Signature debit took off because merchants didn’t have to invest any money to get it up and running and could instantly serve the millions of consumers who walked into their storefronts with those cards. Visa also spent $37M in advertising in 1996 to build awareness, buzz and demand. If not a single consumer walked into those storefronts, those merchants weren’t out of pocket for any technology upgrades or investment. It was a low risk, high reward “merchant-friendly” opportunity.

Attention, all mobile payments innovators: Go back to your white boards and create a mobile payments scheme that is, indeed, “merchant-friendly.”

MAKE CERTAINTY MOBILE PAYMENTS’ ‘KILLER APP’

Every innovation needs a killer app. For the smartphone, it was the app store. For debit, it was merchant acceptance. For mobile payments, it’s certainty.

Apple Pay with its very slick NFC technology-based solution that thousands of issuers in the U.S. now support at the 2 million merchant locations they claim hasn’t ignited. When Apple says that they claim 3 out of every 4 contactless transactions, they are claiming to be the biggest player in the baby pool of mobile payments. Trial is up, adoption is down and it’s been that way for 18 months. Nineteen out of every 20 consumers who could use Apple Pay don’t. And the 4K consumers we ask every quarter tell us that they don’t even try anymore because it’s not accepted at enough of the places they like to shop.

The most successful in-store mobile payments play right now is a coffee purveyor, which does offer that certainty at every one of their stores. Starbucks uses QR codes and loyalty wrapped around payments that now drives more than 20 percent of its total revenue. Its mobile order ahead function now accounts for 5 percent of their total volume, too. Starbucks customers know that at every single Starbucks they visit, they can use their mobile app to pay, and now order ahead and skip the line.

It’s why Walmart Pay will be interesting to watch. Ubiquity within all of their stores via the Walmart.com app makes it easy for consumers to “opt-in” and creates certainty for the 100 million consumers who walk into their stores every week. If they enable Walmart Pay, they will be able to use it at every Walmart they visit.

It’s why certainty matters and why having it as mobile payments “killer app” is what will get mobile payments humming.

When consumers know that they can use their mobile phones to shop but also pay in the places they like to shop, mobile payments will take off. Merchants will jump in and accept that method of payment when they’re certain that consumers will, in fact, show up because merchants don’t want to be in the payments business, they want to be in the selling stuff business.

And right now, plastic cards in their stores check that box just fine.

Whaddaya think – time to party like it’s 1995?