Bringing Omnichannel’s Attention Back To The Curb

The concept of curbside pickup is nothing new in the world of omnichannel offerings.

In fact, the concept dates back to 1921 in Dallas, where motor vehicles were booming in popularity and two entrepreneurs realized that drivers might like the convenience of having food brought to their cars instead of having to park them and go inside to eat.

What followed over the next four decades was the evolution of a once familiar retail fixture – the carhop – who first walked, and then later roller skated their way into creating a convenient way of serving the customer. Drive-thrus in the 1960s made carhops a thing of the past.

But curbside service – where retailers allow customers to order ahead and pickup from the store without having to leave the comfort of the front seat of their car – seems to be making a comeback.

Recent headlines show that big retailers are taking a second look at the benefits curbside has to offer and looking at ways to incorporate the service into their omnichannel initiatives.

Pulling Up To Convenience

Enabling curbside pickup allows retailers to tap into another way to provide the convenience omnishoppers crave – it also provides yet another way to diversify their business and stand out among the competition.

“The idea of curbside pickup is that shoppers are demanding the ability to get purchases however they want and wherever they want,” said Laura Kennedy, director of retail insights at Boston-based Kantar Retail.

“A few years ago, the idea of having items delivered to you in two hours would seem like the future, and Amazon is doing that now,” Kennedy recently told the St. Louis Post-Dispatch. “Retailers are having to find new ways of fulfilling shoppers’ orders.”

Not only do merchants need to find new ways to keep products in consumers’ hands, but they also need to do it quickly.

Findings released by strategic retail advisory firm HRC Advisory shine a light on just how big of a bite eCommerce continues to take out of the brick-and-mortar pie. The data show that operating earnings from sales have declined by up to 25 percent as a result of a shift from in-store to online.

“There are a number of ways retailers can strategically mitigate and ultimately offset the negative impact of eCommerce on their operating earnings and return to their historically higher brick-and-mortar performance,” Antony Karabus, CEO of HRC Advisory, went on to state. “To start, retailers need to reexamine the cost structures of their physical stores and infrastructure and become more efficient omnichannel operators to staunch the losses from extremely high online fulfillment costs.”

Its seems as though big retailers are heeding the warning.

The Curb Factor

Walmart announced the expansion of its free curbside pickup into eight new cities, marking growth of the program into a total of about 200 stores across the U.S. and a footprint in roughly 30 cities.

“The data we’ve collected gives us confidence that, with existing customers, we are getting a larger share of their wallet and that’s complemented by new customers we are bringing into the fold,” said Walmart Head of eCommerce Operations Michael Bender.

Walmart’s variation on curbside provides consumers with access to nearly 35,000 items to choose from — comparable with in-store selection. Once an order has been placed online, shoppers can then schedule a time to meet with their personalized shopper at Walmart to pick up their items.

Integrating the personal shopper aspect to curbside is new for Walmart, but it’s designed to bring a new level of personalization to the experience by focusing on picking the version of an item the customer really wants, such as green bananas versus extremely ripe ones.

Another major retailer making significant investments in the omnichannel-focused curbside play is CVS.

In an effort to enhance and streamline how customers interact with CVS stores, CVS Health has partnered with Curbside, a start-up specializing in mobile ordering and fulfillment support. The partnership will support “new and more convenient ways for our customers to shop with us, ultimately making it easier for them to enjoy a healthy lifestyle in a way that works best for them,” explained Helena Foulkes, EVP of CVS Health and President of CVS Pharmacy.

Customers will have the ability to shop their local CVS Pharmacy right inside the Curbside or CVS mobile app, then place an order and pick up right at the curb. CVS said trials of the service conducted throughout 2015 proved that not only did the chain’s shoppers respond positively to the idea of collecting their orders without ever leaving their cars, but it was popular enough to drive repeat usage in short windows.

Branded as CVS Express, the service is running in targeted markets now and is expected to expand to all of CVS’ 9,600 stores by the end of the year.

Curbside has quickly made a name for itself among retailers by helping them to capitalize on the power of mobile – using that to fuel in-store sales through the convenience of pickup.

The service works by gaining insight into product availability at a local retailer location in order to ensure accurate fulfillment. Curbside also provides a retailer’s employees the the necessary tools to quickly pick and pack a customer’s desired items, while also providing real-time alerts so store associates know when the customer is waiting at the curb.

“We’ve entered an era where everyone is driving around with a smartphone in their pocket,” Curbside’s co-founder and CEO Jaron Waldman explained to the St. Louis Post-Dispatch. “What we did is look at what could we do to make retail more suited to mobile commerce.”

Curbside’s Driving Force

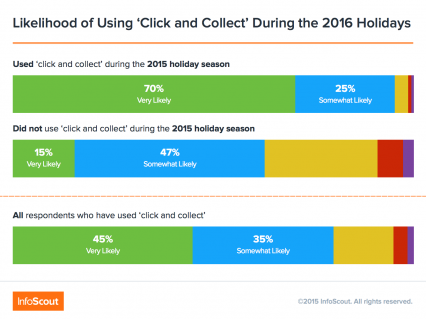

Earlier this year, consumer research company InfoScout found that click and collect offerings have real staying power – because once consumers use it, they love it.

The firm surveyed more than 1,000 U.S. consumers, discovering that of the almost 35 percent of shoppers who have tried click and collect, half (49 percent) experienced it for the first time just in 2015.

As the offering becomes more mainstream, it’s expected that the popularity (and demand) among consumers will growth as well. The study showed that 95 percent of shoppers who used click and collect during the holiday season last year already plan on using it in 2016 for their holiday shopping – no wonder so many retailers have hopped on board with curbside in recent months.

“When asked about the reasons why they chose Click and Collect for their purchase, one word really stood out among our survey respondents open-ended answers: convenience,” the InfoScout blog post stated.

Though much has changed since the days of the carhop, it’s clear there’s still power at the curbside. And today’s omnishoppers still desire what customers back in the 1920s did: the ability to experience convenience from the comfort of their own vehicles.

Are retailers ready to answer the call, again?