A Day In The Life Of The Bridge Millennial

After three years of intensive research into the connected shopping habits of more than 5,000 U.S. consumers, PYMNTS published its third annual How We Will Pay Study in September, in collaboration with Visa. We tracked how consumer shopping habits have evolved with the release of new technologies.

As in past reports, we collected data from consumers of all ages, incomes and shopping habits, but there were two groups in particular whose behavior caught our attention this year: bridge millennials and super-connected consumers.

Super-connected consumers own at least six connected devices, while the average super-connected consumer owns as many as 7.7 devices. Their average age is 42 years old, 40 percent have a college degree and 51 percent earn annual salaries of more than $100,000. What’s more, 58 percent of super-connected consumers use their connected devices to make purchases.

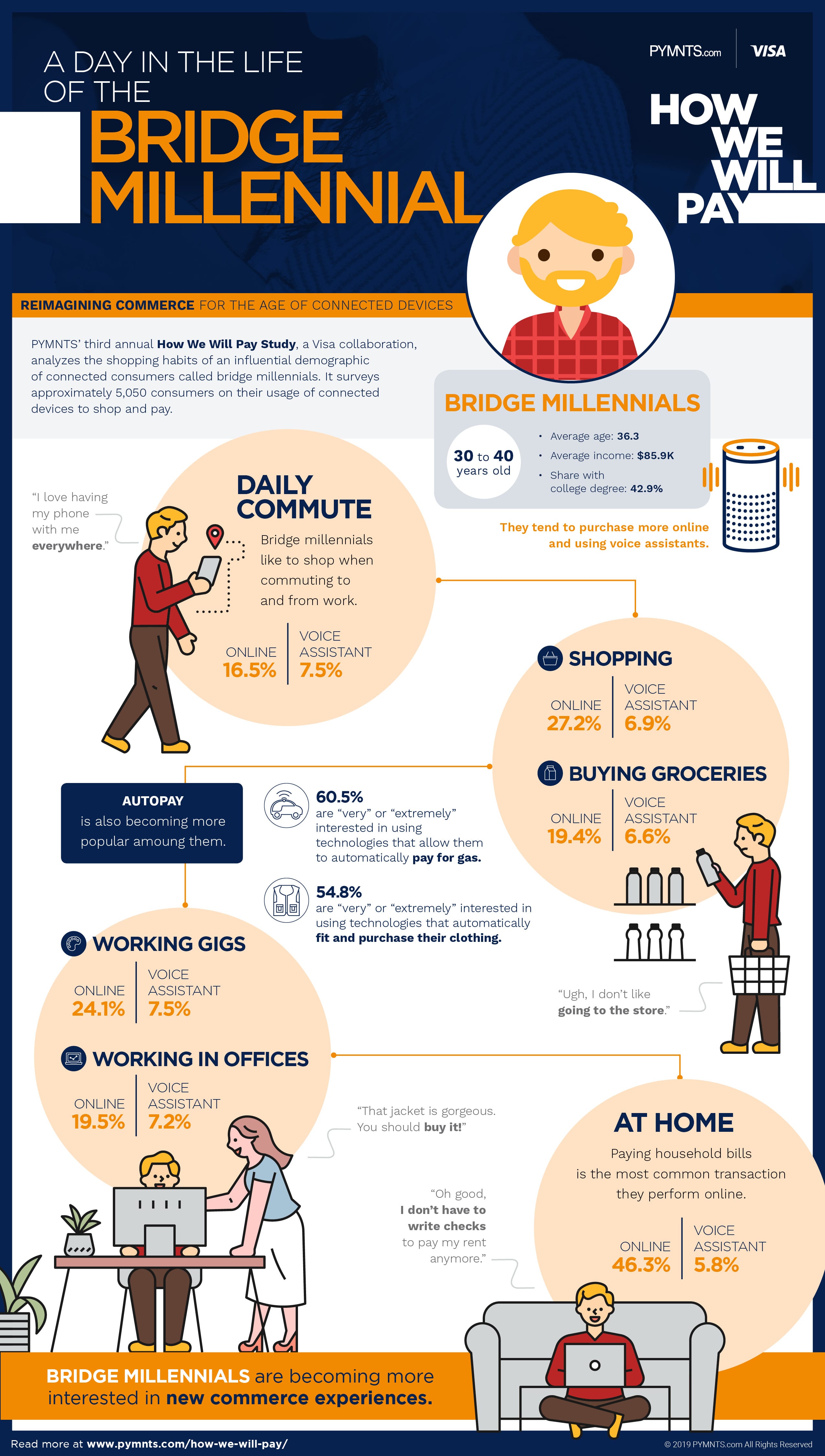

Bridge millennials are a bit different, however. This group is, on average, 36 years old and owns six connected devices. These consumers “bridge” the divide between millennials and the Generation X-ers, and are considered to be the first generation of connected consumers with spending power. According to our calculations based on data published by the Bureau of Labor Statistics, bridge millennials spend $10,435 more each year than millennials (who spend $56,646) and $10,859 less than their Gen X elders (who spend $73,681), on average. More than four out of 10 bridge millennials are college-educated and spend $100,000 annually; 59 percent of bridge millennials use connected devices to make those purchases.

Super-connected and bridge millennial consumers frequently use such devices to make purchases, but there are several important differences in how these groups have managed to integrate the devices into their everyday lives.

Super-connected consumers love the experience of using connected devices to shop and pay. They also tend to be more interested than the average consumer in trying new connected commerce experiences for themselves. They are much more interested than the average consumer in automatically paying at the pump (61 percent to 47 percent, respectively), using technology that can automatically purchase clothes (53 percent to 39 percent) and using apps to keep track of spending (52 percent to 39 percent), for example.

Bridge millennials engage in 14.1 activities each day and report making purchases while engaging in 6.4 of them. This means 45 percent of bridge millennials’ daily activities involve making a purchase.

Bridge millennials also tend to buy and use voice-assisted technologies long before other groups. Thirty-eight percent of bridge millennials own and use voice-activated devices, while 17 percent use those devices to make purchases.

The average super-connected consumer, on the other hand, engages in 12.5 activities each day and makes purchases during 4.8 of these activities. This means 39 percent of their day-to-day activities involve making a purchase. Super-connected consumers, therefore, own more devices than bridge millennials but are less likely to use the devices to buy eCommerce goods. They also tend to be avid users of voice-activated devices. Sixty-two percent own voice-activated devices and 13 percent use those devices to make purchases.

Bridge millennials and super-connected consumers also differ in the types of connected experiences they are most interested in. Forty-five percent of bridge millennials say they would like to have their voice assistants send them messages with links to items they might like to purchase, for example. The same amount say they would like their voice assistants to send them links to items in their internet search history.

As digital natives at the forefront of connected commerce, the behaviors of these two consumer groups could serve as a bellwether for connected shopping trends to come.