Can Apple Pay Later Light a Fire Under Apple Pay Now?

Launched way back in 2014, Apple Pay was supposed to ignite contactless payments, with Apple devices as the conduit.

Consumers would move beyond using the physical wallet at the point of sale — especially the physical point of sale — and juggling plastic debit and credit cards.

The iPhone or Watch would be the gateway to using digital wallets. Merchant by merchant, payment by payment, we’d cement the Apple ecosystem, one transaction at a time.

It hasn’t worked out that way — not as some observers may have hoped, though progress has been made.

Might installments be the spark that ignites a fire under Apple Pay?

PYMNTS data show that three-quarters of U.S. retailers accept Apple Pay and nearly half of all U.S. consumers have iPhones. And in terms of the headline numbers, as relayed late last year in the report “Apple Pay At 8: Connected-Tech Consumers Lead The Way,” 44% of in-store digital wallet transactions are done with Apple Pay.

But in terms of the overall landscape, that slice of on-premise commerce is relatively miniscule, at 2.4%.

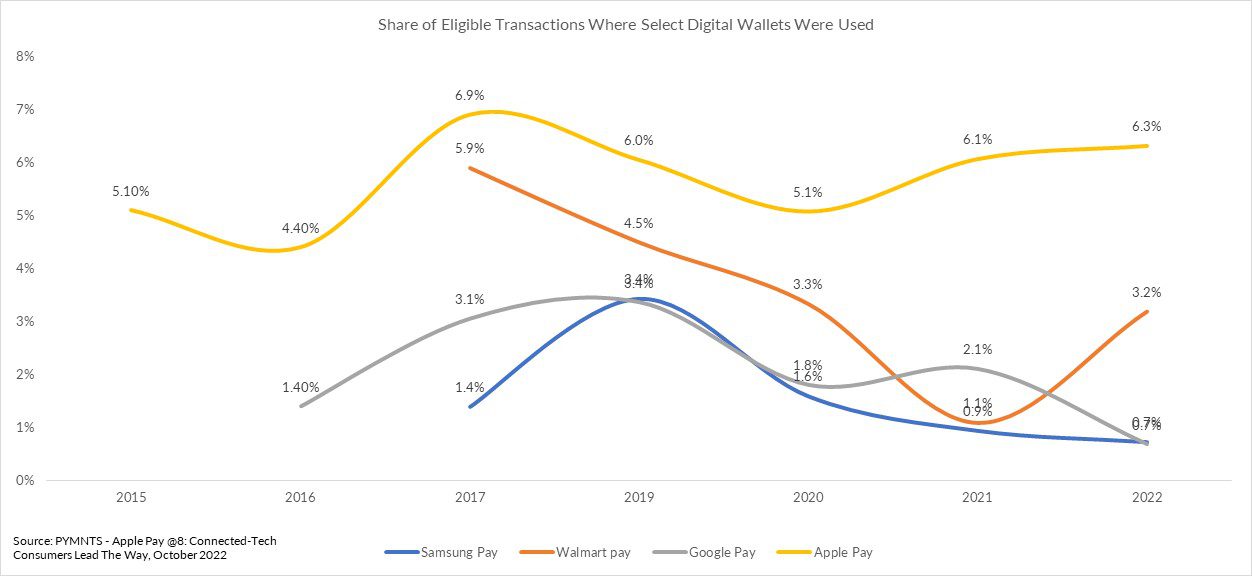

PYMNTS has found that Apple Pay, as shown in the chart below, only captures the “share of eligible” transactions 6% of the time. Eligible transactions, as defined here, can be described as when a consumer walks into a store where it’s possible to use Apple Pay. The consumer has an iPhone capable of working with Apple Pay and the merchant accepts Apple Pay. The 6% share has been relatively constant.

The tech behemoth’s foray into the crowded pay-by-installment arena is now official.

Apple said on Tuesday (March 28) that it had launched Apple Pay Later. The rollout’s being done across select, invited users, we reported. Through the service, users apply for loans ranging from $50 to $1,000 and the interest-and-fee-free loans are then repaid, broken up into four payments spanning six weeks. The service thus far is available in the U.S. only, and for in-app and online purchases.

The option will be offered at checkouts for merchants that accept Apple Pay.

There’s are a few important wrinkles here:

Apple Pay Later is enabled through the Mastercard Installments Program but the lending is done by Apple subsidiary Apple Financing LLC.

“Apple Financing plans to report Apple Pay Later loans to U.S. credit bureaus starting this fall, so they are reflected in users’ overall financial profiles and can help promote responsible lending for both the lender and the borrower,” Apple said Tuesday.

And, in addition, Apple has said that users will be asked to link a debit card from Wallet as their loan repayment method. This, Apple noted in its blog announcing the buy now, pay later (BNPL) offering, will “help prevent users from taking on more debt to pay back loans … credit cards will not be accepted.”

More (Financial) Services in the Mix

By conducting credit and making the lending decisions, Apple now branches more deeply into services, and specifically, financial services. Past earnings call commentary has revealed some general trends, where management had called out unspecified “revenue records” across categories that include payment services. CFO Luca Maestri said during the February call to discuss December quarter results that “Apple Pay is now available to millions of merchants in nearly 70 countries and regions. And we saw a record-breaking number of purchases made using Apple Pay globally during the holiday shopping season,” adding, “Both transacting accounts and paid accounts grew double digits. And so that bodes very well for the future.”

For Apple, the heat is on to get some heat under its Pay momentum. As reported at the beginning of the year, some of the largest banks in the U.S. are reportedly launching digital wallets, and Apple is of course in the crosshairs. The banks are developing a product that will let consumers make online purchases with a wallet tied to their Visa or Mastercard debit or credit cards.

For Apple, Pay Later’s been a long time coming — and we’ll soon see if the bet on installments pays off.