Installment Plans Ease Holiday Financial Stress of Inflation

As consumers struggle with tight finances, particularly during the holiday season, access to installment plans like buy now, pay later (BNPL) has become a popular financial management tool.

This trend is observed in countries like the U.K., where financial regulator Financial Conduct Authority reported a 10% increase in the use of BNPL amid an ongoing cost-of-living crisis.

And it’s not just in the U.K. For many U.S. consumers, BNPL has become a necessity, particularly for younger shoppers burdened by credit card debt and high interest rates. PYMNTS Intelligence research reveals that 28% of millennial and Generation Z consumers would abandon a purchase if BNPL were not available at the checkout. This shift in consumer behavior is reshaping the retail payments landscape, with BNPL becoming a must-have for shoppers.

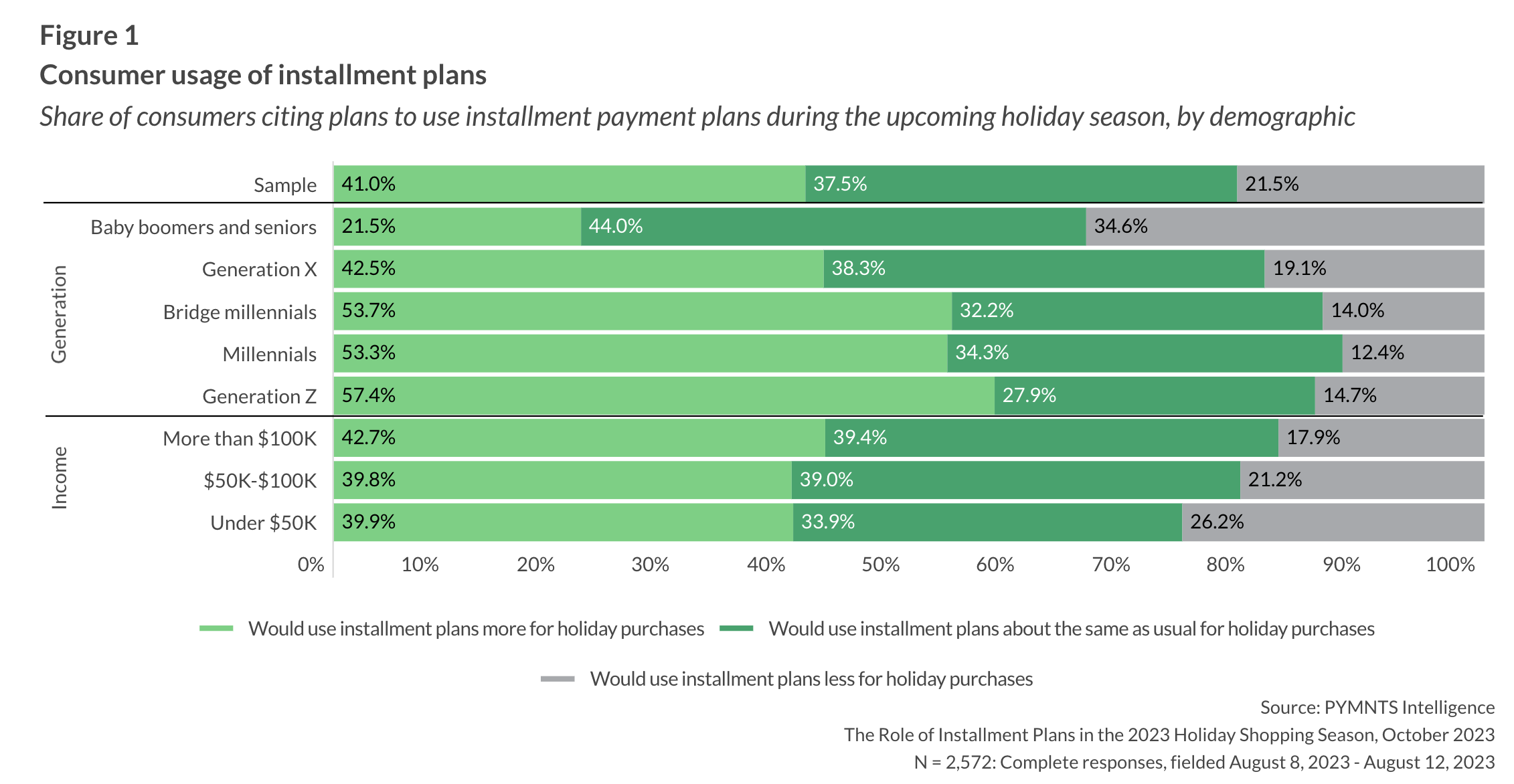

This trend is expected to continue into the holiday season, a period which two-thirds of consumers cite the most as a period of financial stress. It’s no surprise then that installment plans have become increasingly popular among consumers, with 41% of shoppers expecting to rely more heavily on these plans for their holiday purchases, per a separate study from PYMNTS.

Similarly, younger consumers, particularly Gen Z and millennials, are more likely to increase their use of installment plans during the holiday season. In fact, nearly 60% of Gen Z shoppers plan to do so, along with 54% of bridge millennials and 53% of millennials. This trend is not as prevalent among older generations, however, with only 43% of Generation X and 22% of baby boomers and seniors planning to increase their use of installment plans.

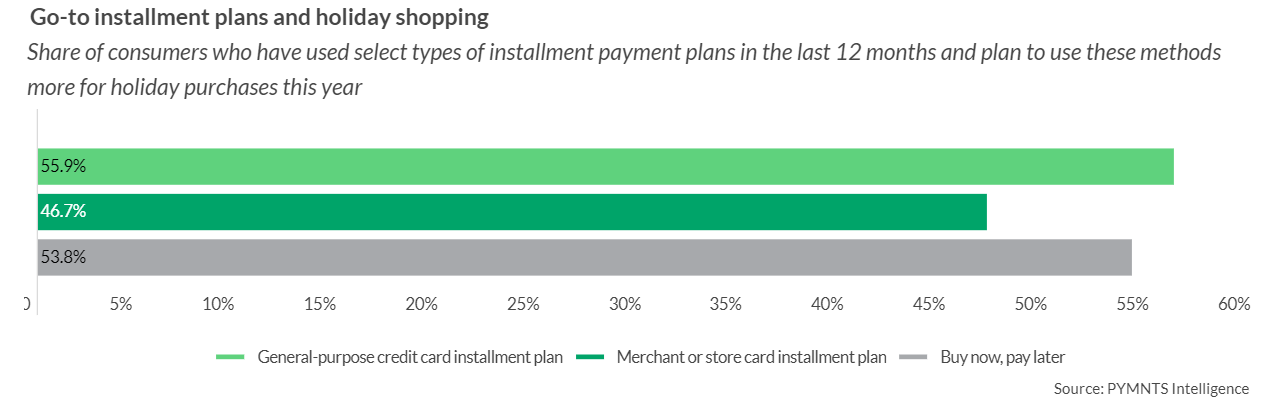

Apart from BNPL, the report also highlights two other types of installment plans that are expected to see similar increases in usage during the holiday season: general-purpose credit card plans and merchant-offered plans.

Credit card plans currently lead the way, with 56% of respondents who plan to use installment plans more during the holidays having already used this type of plan in the last year. BNPL and merchant plans are not far behind, with corresponding shares of 54% and 47%, respectively.

Against this backdrop, merchants can boost their bottom lines by offering multiple plan options this holiday season. As noted in the report, 22% of shoppers would be very or extremely likely to switch from a merchant that does not provide installment plan options using their existing credit cards to one that does. Additionally, 54% would be at least somewhat likely to make the switch.

And among consumers planning to increase their use of installment plans during the holiday season, nearly 40% would be highly likely to switch to a merchant that offers such an option, while more than 70% would be at least somewhat likely to do so.