Payment Choice Is the Best Feature Merchants Can Offer Consumers

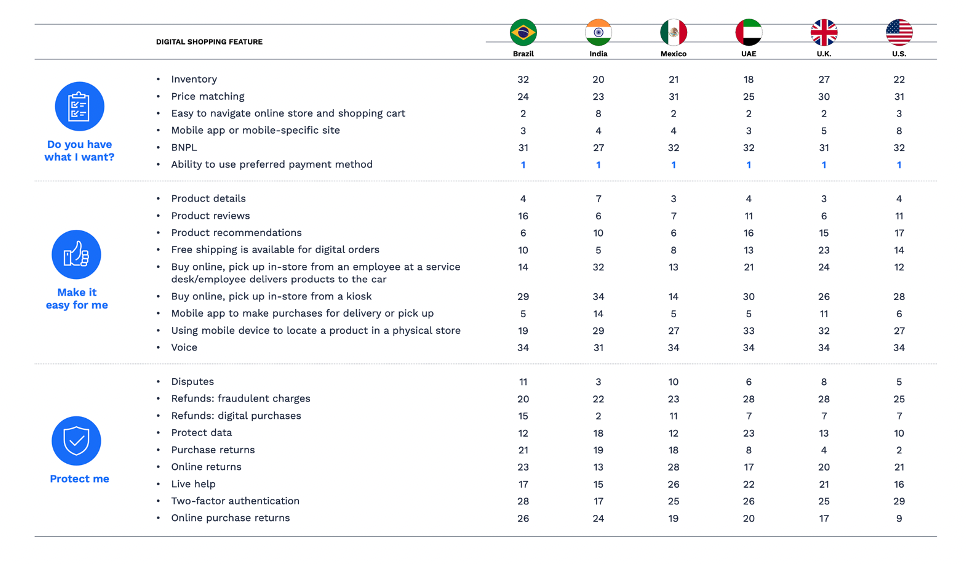

Consumers in different countries go for a diverse mix of shopping features, ranging from coupons and rewards to free shipping, availability of buy now, pay later (BNPL), or refunds in digital purchases.

Of all of them, payment choice has remained the most important shopping feature for retail consumers for three years in a row in all six reviewed countries, according to a PYMNTS Intelligence study. This highlights the importance for merchants to adapt to the shifting payment landscape and provide customers with their preferred payment methods.

The “2023 Global Digital Shopping Index” (GDSI) is a PYMNTS Intelligence and Cybersource collaboration that examines consumers’ shopping preferences and behavior. The GDSI measures 34 digital capabilities merchants say are available to consumers and the level of satisfaction consumers reach thanks to them. The study surveyed 13,349 consumers and 3,124 merchants across Brazil, India, Mexico, the United Arab Emirates, the United Kingdom and the United States.

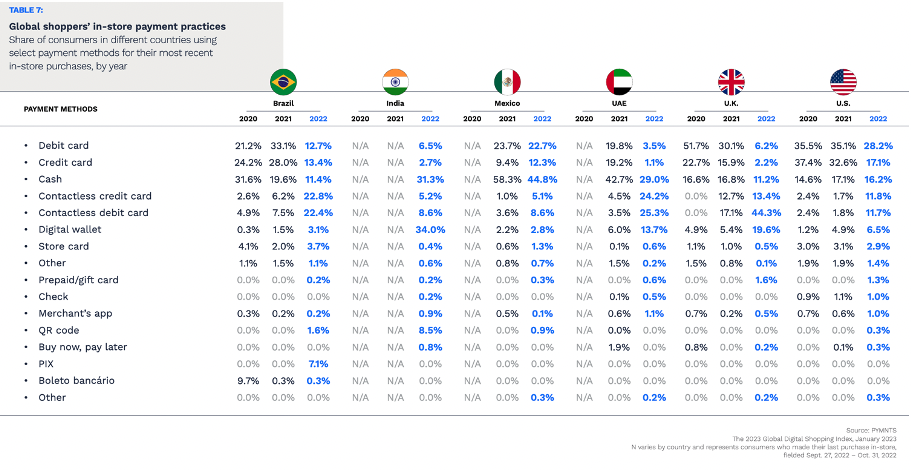

Adoption and preference of one payment method over another depends on the dynamics and singularities of each market. Credit and debit cards are still the most used payment methods globally, but digital wallets are gaining traction across geographies. When looking at in-store shopping, India is leading the way in digital wallet adoption, with 1 out of 3 consumers using this method to complete retail purchases, a share that is almost equal to cash. This is explained by the innovative and broad expansion of mobile commerce among Indian consumers. There, in-store shoppers typically use their smartphones to look up product information, compare prices or navigate the stores using mobile apps, enhancing their in-store shopping journeys.

Adoption and preference of one payment method over another depends on the dynamics and singularities of each market. Credit and debit cards are still the most used payment methods globally, but digital wallets are gaining traction across geographies. When looking at in-store shopping, India is leading the way in digital wallet adoption, with 1 out of 3 consumers using this method to complete retail purchases, a share that is almost equal to cash. This is explained by the innovative and broad expansion of mobile commerce among Indian consumers. There, in-store shoppers typically use their smartphones to look up product information, compare prices or navigate the stores using mobile apps, enhancing their in-store shopping journeys.

In the UAE, around half of shoppers opt for contactless cards for their in-store purchases. This payment system has grown by six times year over year, as many brick-and-mortar stores adopted contactless payments in the last two years.

Mexican consumers usually pay with cash (almost half of the time), but recently, many local retailers have begun accepting contactless credit and debit cards and digital wallets. Notably, consumers in Mexico, India and Brazil show a preference for local payment providers. For instance, Paytm is the most popular payment method in India, with 12% of consumers using it to pay in-store. Pix, Brazil’s national instant payment service, is gaining traction, as 7% of in-store shoppers use it.

Aside from the ability to use preferred payment methods, there is no consensus across countries on which feature is the most important. Ease in navigating online stores and shopping carts ranks second in 4 of the 6 reviewed countries, while the availability of refunds for digital purchases is key in India and returns are important to consumers in the U.S.