PayPal’s Bet to Boost Security May Pay Off in Broader Usage

As consumers’ eCommerce activity grows, so does their use of digital payment methods.

Merchants looking to boost engagement can offer these payment options to maximize conversions.

Of all digital payment methods, PayPal, Apple Pay and Venmo are currently the three most used in the United States. PayPal is the most popular platform, representing 12% of all online non-grocery retail purchases. In comparison, Apple Pay represents just 3% of non-grocery purchases, according to a report by PYMNTS Intelligence, which was created in collaboration with Amazon Web Services.

The report, “The Digital Payments Takeover: Catching the Coming eCommerce Wave,” details how consumers expect their use of payment options for online shopping to change.

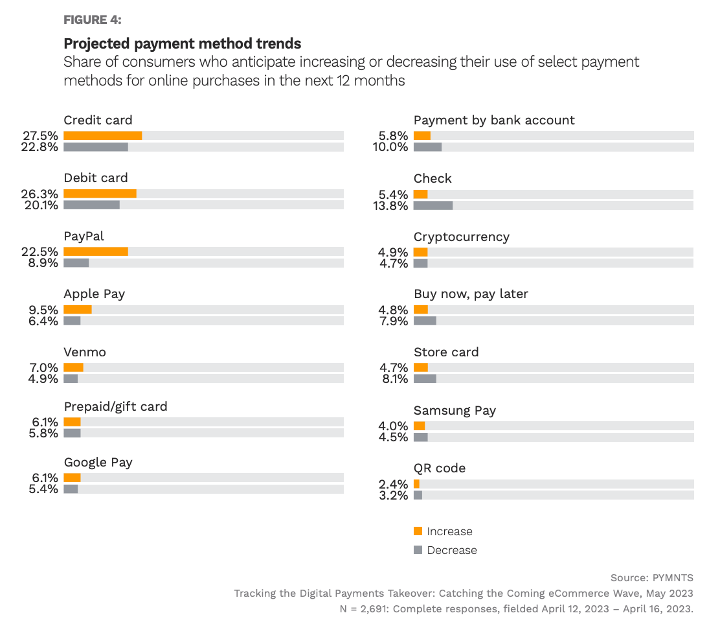

According to the study, 23% of consumers plan to increase their use of PayPal for online purchases in the next year, meaning that on top of its current lead, the digital payment method has the best usage prospects of all. Only 9% of PayPal users plan to decrease their usage, resulting in a net positive of 14 percentage points, the maximum of all reviewed payment methods, doubling even debit cards, which had the next most positive usage prospects.

Per Alex Chriss, the new CEO of the company, PayPal was used by over 70% of adults in the U.S. in the past five years.

“With the recent launch of Venmo Team accounts, we are now seeing adoption of our core products and services across the entire addressable market in the U.S.,” Chriss said during the company’s recent earnings call on Wednesday (Nov. 1).

Venmo is a social payment service that allows customers to make and share payments with family, friends, and now, small businesses. PayPal recently announced that customers can now add their eligible PayPal and Venmo cards to Apple Wallet. This integration allows users to make payments with a tap of their iPhone or Apple Watch, both in-store and online.

In addition to its wide acceptance, one of the key reasons behind PayPal’s success is its focus on security — and consumers’ resulting trust.

Sixty percent of consumers say they trust PayPal more than their bank with payment credentials. This credibility and security are key when it comes to being top of wallet. Per PYMNTS Intelligence, one in three consumers report that having control over their payment information is an essential factor that would make them more comfortable when shopping online, and that might sway customers’ future choices when deciding how to pay.