Venmo’s Growth Was Steady in the Quarters Leading to Amazon’s Decision to Pull the Plug

The news that Amazon will stop taking Venmo payments prompts much speculation as to the why behind it all, roughly 14 months since the 90 million active Venmo customers in the U.S. began to be able to use the option on Amazon (though they can still use Venmo credit and debit cards).

For Amazon, the impetus may have been to avoid paying fees on the payment method, or concerns over volume.

But beyond the headlines, we note that Venmo had been consistently been ranking at the top spot, or within the top five spots (depending on the month) of our monthly monitoring of credit card apps. Venmo parent PayPal also has garnered the top spot in our buy now, pay later (BNPL) provider rankings too (and Venmo, we note, has a BNPL feature).

As of this writing, PayPal’s stock, which had dipped in morning trading on Friday (Dec. 8), had reversed course and was actually up headed into the final hours of the day.

Steady Volume Growth

In PayPal’s most recent third-quarter earnings results, the company noted that total P2P payments volume (PayPal, Venmo, and Xoom) increased 4% to $97 billon and represented 25% of TPV. Venmo represented the bulk of that, as TPV increased 7% to $68 billion. In the second quarter, the volumes were remarkably similar, and thus consistent: Venmo TPV increased 8% to $67 billion.

Management noted on the most recent earnings call that in expanding the Venmo ecosystem, PayPal and Venmo branded credit and debit cards can be added in the Apple and Google Wallets.

Last month, PayPal detailed that Venmo Groups allows members to add expenses, view amounts due, split and settle transactions.

And as reported in September, the stablecoin known as PayPal USD (PYUSD) debuted on Venmo, offering select users a regulated, dollar-denominated stablecoin that is 100% backed by U.S. dollar deposits, short-term U.S. Treasuries and similar cash equivalents.

There’s still room for PayPal, and by extension, Venmo, to make inroads, especially with younger consumers, to make some headway in social media-driven commerce. The sweet spot of users, we estimated as far back as the depths of the pandemic, was defined by “Generation Venmo,” some 65+ million consumers back then who had downloaded and used the app, skewed younger and a bit more educated than the general population.

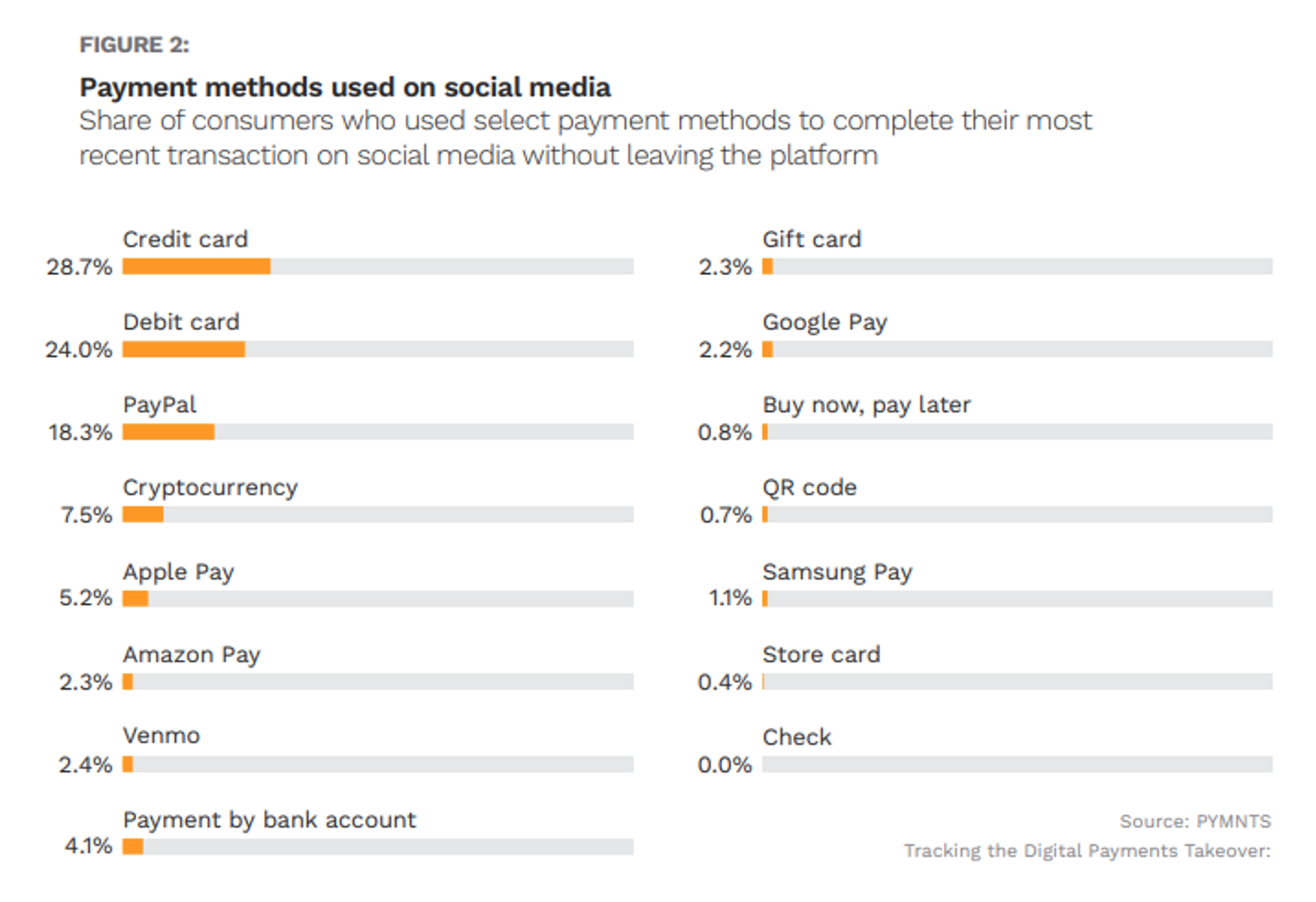

In the PYMNTS Intelligence and AWS report “Tracking the Digital Payments Makeover: Monetizing Social Media,” and as documented in the accompanying chart, cards dominate social media payments, PayPal trails a bit with a high-teens percentage point market share, and Venmo has a 2.4% slice.