4 in 10 Consumers Would Start Using Pay-by-Bank If Perks Were Offered

Pay by bank, also known as account-to-account (A2A) payments, is gaining in popularity.

More consumers are turning to this payment method to shop, pay their bills or for peer-to-peer transfers because of its fast and convenient nature.

Despite this, only a third of U.S. consumers used pay by bank in the last three months, pointing to a slow adoption of the payment option.

Financial institutions looking to increase A2A payment adoption, however, can introduce incentives to encourage consumer usage of the method.

These are some of the insights drawn from “Tracking the Digital Payments Takeover: Consumer Familiarity Controls Account-to-Account Payment Growth,” a PYMNTS Intelligence and Amazon Web Services study that examines the appeal of A2A payments in specific scenarios, such as when making purchases, settling accounts or paying bills.

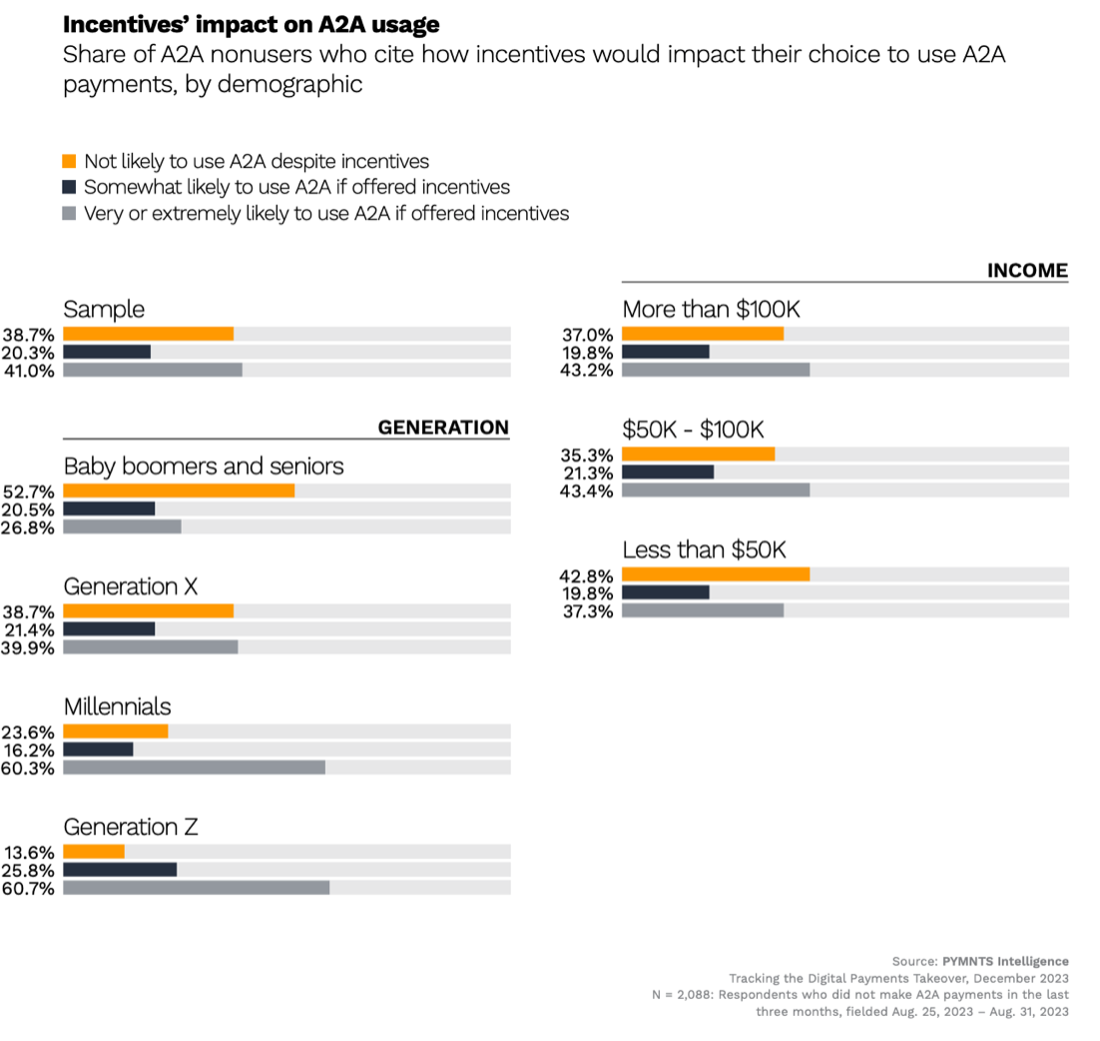

According to the study, more than half of consumers say they don’t use A2A options simply because they don’t know about them or because don’t know how to use them. Despite these limitations, four out of 10 consumers who have not utilized A2A payments in the last 90 days expressed willingness to switch if payment platforms introduced incentives such as discounts or rewards. This willingness goes up to more than 60% among millennials and Generation Z consumers.

In this sense, incentives coming from financial institutions are strategic levers to encourage further pay-by-bank adoption, with cashback, discounts and rewards topping the list of most desirable incentives cited by consumers.

“We have embedded economics and structures that are in place, including consumer incentives, for A2A payments to take hold as a viable payment rail outside of cards,” Craig McDonald, chief business officer at open banking FinTech Trustly, told PYMNTS in a recent interview.

“Any merchant is really trying to see how they can increase conversion and reduce their cost of payment acceptance,” McDonald said. “Merchants today want three things: a great UX, which means high conversion; a low cost, meaning less fees; and a non-refutable transaction, so no chargeback.”

However, for certain spending categories, the merchant’s actual cost of real-time transactions might equal or exceed that of debit, especially for low-value transactions.

“It’s why we believe that A2A represents a superior rail and delivers an optimal payment experience,” McDonald said.

Promotional efforts, combined with financial incentives like discounts, rewards or exclusive offers, could form an effective strategy to encourage more widespread consumer adoption of A2A payments.