A COIN By Any Other Name

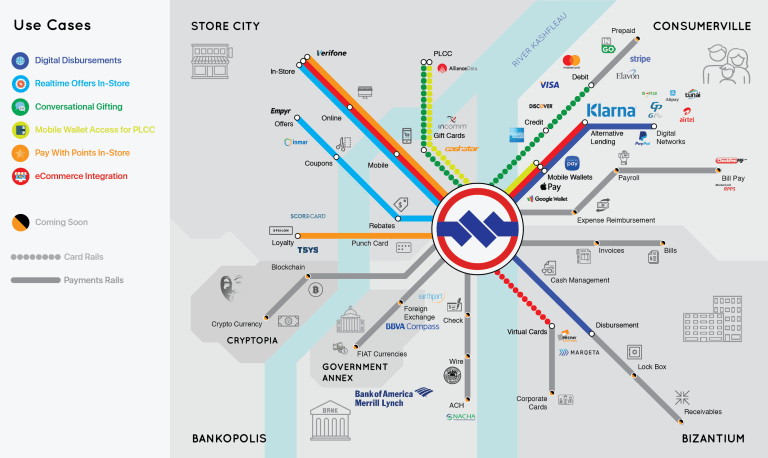

Payments are often described like the Tower of Babel, with disparate platforms trying to talk to each other without speaking the same language. It’s this inability to communicate that is causing connections to fall apart through the lifecycle, from initiation at the point of sale to back-end reconciliation. It’s an industry-wide problem that Modo is solving with its patented COIN technology.

Bruce Parker, CEO of Modo, told PYMNTS’ Karen Webster, “The whole reason we haven’t seen true proliferation of great ideas and great solutions and great experiences in payments comes down to a lack of interoperability.” Simply put, complexity is limiting coordination and hindering progress for our entire ecosystem and ultimately their customers.

For example, in the retail world issuers and merchants run into a brick wall when trying to enable acceptance of a new form of currency — like loyalty points — at the physical point of sale. Modo’s COIN technology knocked down this wall and enabled Verifone’s Points Redemption Network to work in tandem with FIS’ Premium Payback Network, to allow consumers to pay with loyalty points linked to their credit or debit cards at checkout, in real time.

“Treating points as a currency at the physical point of sale is a totally different transaction with settlement that can be all over the map,” Parker said. “Believe me, enabling two existing systems to work together like that is hard, but when you do it opens the doors to entirely new possibilities. All you have to do is connect the dots for all the different stakeholders.”

That’s what Modo’s does. The COIN sits behind the curtain enabling others to innovate, and that’s why they’re one of the more cutting-edge payments companies you’ve probably never heard of. Parker says the COIN streamlines the actions of those who do move money, by certifying that the state of ledgers that are party to the transaction are reconciled in real time, but never, ever holds, touches or moves money.

“We are not the system of record, but we talk to the systems of record,” Parker said. “What relying parties need more than anything else is to be told [during the transaction] what is needed and what else is involved.” Modo’s COIN translates instructions for each part of the process and, much like a stoplight, tells drivers when to stop or go or slow down, the COIN coordinates money movement.

The COIN has similar functionality as blockchain, but is a quick integration to existing systems and their ledgers, rather than an overhaul to a new model. It all comes down to simple accounting and communication. The ledgers must be in sync along every step of the payments lifecycle in order for a transaction to progress through the COIN.

“For any payments transaction, both sides of the transaction must agree to the rules for those transactions,” Parker said, adding that the COIN makes sure that before money is moved, the rules between those parties have been adhered to.

If Modo cannot get everyone to agree on the state of play at any point in the transaction, he said, the COIN will stop the transaction in its tracks until a resolution is found. Which often is automated. Parker explained that the COIN was designed backward starting from reconciliation. If the transaction has to be reconciled at the end of the process, shouldn’t it also be reconciled through every step in between as well?

“We know when a transaction qualifies as good funds,” he emphasized. “We know when to release money out the ‘other’ door; we know how to push value back through the network.” It’s this last piece — pushing value back through the lifecycle — that gives Modo’s customers a more seamless resolution process when things go wrong.

To paraphrase Dostoevsky, as per Parker, “Happy payments are all happy in the same way. But sad payments are all dysfunctional and sad in their own unique way.”

A more connected and interoperable payments ecosystem means different things for different participants, but Modo’s COIN will open the floodgates for incumbents to create new offerings at an accelerated pace as competition heats back up.

The Dallas-based Fintech is already working with Bank of America Merrill Lynch, Verifone, FIS and Klarna, and Parker hinted that the future looks bright heading into Money20/20 Europe.

“The breadth and scope of our initial partners has opened our eyes to what the COIN is capable of doing for our industry and the world. We believe payments, if done correctly can have a substantial impact around the globe, and we have very big plans on the horizon.”