Why Super Apps Could Have Superpowers

It’s what WeChat and Alipay already are in China, and what LINE is in Japan. Rappi follows suit in Latin America.

It’s what Grab and Gojek are investing hundreds of millions of dollars to become in South Asia. It’s Facebook’s global ambition, with or without Libra and Calibra.

It’s the path that Amazon, Google and Apple are blazing for its users, too.

According to Uber CEO Dara Khosrowshahi, it’s also Uber’s next big move.

The “it” is to become the consumer’s “Super App” – the everyday app that becomes the front door for how consumers interact with and purchase goods and services as they go about their everyday activities.

And, for those who aspire to be WeChat, it includes pretty much everything else.

In truth, these everyday apps don’t have to do everything – but to be effective, they must eliminate the friction associated with jumping among the slew of apps with cards on file that consumers use today to get things done, or to fill the gaps in access that exist.

As its moniker implies, a Super App is supposed to make it super easy for consumers to have more seamless access to the activities that are part of their everyday journey. And enabling payments for those goods and services within that Super App goes along for the ride.

The interest in becoming that everyday app – the one app to rule them all – is obvious: It provides the ability to monetize access to the consumers who use it and the interactions that happen inside of that ecosystem.

The opportunity for the Super App is to continuously engage those who are already part of its ecosystem by introducing new features and functions that make the app even more super-cool for those using it – and super sticky for the app itself.

The threat, depending on where one might sit in the Super App ecosystem, is that Super Apps create entirely new ecosystems that marginalize some of the same platforms that gave them their everyday app wings. Once people spend a lot of time on the app, it becomes attractive to integrate new features and functionalities into the Super App from third parties.

In fact, it’s already happening.

The Super App-Fueled Shift

Not that long ago, the conventional wisdom was that mobile operating systems – iOS and Android – would rule, because mobile devices would remain the primary channel consumers used to manage relationships with all of the companies they interacted with.

Then, the battle became one of getting mobile devices into consumers’ hands – and getting those consumers to download apps onto their phones for every company and brand.

The thinking was that more apps on more phones would make consumers stickier to their devices and to the operating systems that powered them.

But that’s not how things have played out over the last several years.

Super Apps have opened their own ecosystems to others to develop apps and skills that work only within their Super App environments. In doing so, they have become new, robust platforms built on top of the same operating systems that would like to achieve their own Super App status rather than playing host to the many others with similar, competing ambitions.

WeChat opened its ecosystem in 2017 for developers to create mini-programs that work within the WeChat ecosystem. LINE has done something similar with mini-apps. Between all the features that WeChat offers and the mini-programs now available from third parties, Chinese smartphone users live primarily in a WeChat ecosystem on their iPhones, not one driven by the App Store.

Amazon is creating an entirely new ecosystem around voice and skills for Alexa and is expanding the number and types of things Amazon Prime users can do within the Amazon ecosystem. It is also expanding the types of items consumers can buy from them – now including prescriptions, medical supplies, designer fashions, meal kits, and groceries from Whole Foods and online. Between all of the features Amazon offers and the expanse of its ecosystem and devices, consumers are starting to live more of their commerce lives in an Amazon/Alexa ecosystem using whatever mobile phones they own.

Google is trying to do the same thing by integrating payments functionality inside of Search for a range of activities, including food delivery and travel bookings, and also by revamping Google Shopping.

PayPal is enabling payouts into PayPal accounts for gig worker pay, has expanded its Xoom remittance platform to 32 countries and has launched its Commerce platform to add more value to its merchant and consumer base.

Grab and Gojek are adding more capabilities to supplement their ride-hailing roots so consumers have more places to use their wallets, and are providing access to a range of financial services to help them manage their money.

LINE users can buy insurance, shop at brand-name stores and get access to credit using LINE Score, which assesses their creditworthiness.

Uber has begun that journey by making Uber Eats part of the Uber app, creating its own currency called Uber Cash, enabling instant pay options via Visa Direct for its drivers and providing a growing range of capabilities for drivers to access inside of its ecosystem.

The more effectively these Super Apps and Super App contenders aggregate more functionality into their own ecosystems, the less dependent they are on the smartphone operating system providers that consumers use today to access them.

Super Apps are shifting the power away from mobile devices to these new interoperable, portable ecosystems that follow their users everywhere they want to take them.

“Have Super App, will travel” is the value proposition as consumers get more functionality with fewer moving parts to navigate and manage – across platforms, across borders, across devices, across shopping channels, across commerce endpoints, even across payment options.

As these Super Apps evolve, smartphones and their operating systems will become a means to an end and no longer the end to the means – important, but less so as more connected devices emerge that are capable of providing access to those apps.

Much like the physical store has become one of many places to shop, and no longer the only way shopping is done.

What Makes Super Apps Really Super?

No matter where they are in the world, the consumer’s everyday journey consists of a complex maze of activities, most of which touch money and how and where they spend it.

Today, consumers use bank apps, or bank-like apps from neobanks or telcos, to check their balances and pay bills. They use investment apps to manage their money, and payment apps and digital wallets to store balances and pay for the things they want to buy. They use ride-hailing apps to get around town, reservation apps when they want to eat out and delivery apps when they want to eat in. They use travel and hotel apps to book travel, transit apps to access public transportation access and merchant apps for shopping. They use email apps for work, calendar apps to organize schedules and gaming apps to play the latest video games. They use messaging apps to text with friends and colleagues, social apps to see what friends are up to and streaming apps to watch videos, listen to music and play games. They use dating apps to find romance, digital content apps to stay up-to-date with news and to read books and search apps to obtain information. They use map and navigation apps to get directions and fitness apps to track their health.

That’s a lot of apps – and a lot of app fatigue. It’s not surprising that so few consumers download new apps, and that so many more of them have opted into apps that aggregate access to goods, services and activities.

Each of those apps probably has a card on file to make it easier and more efficient to buy things from them.

That’s a lot of payment credentials on file for a consumer to manage – and a lot of payment acceptance options for merchant apps to enable and manage.

In a perfect world, an everyday app must provide a more integrated way for consumers to keep tabs on all of the things these individual apps now enable: planning, managing and spending their funds – and even enabling funds to come in from other sources.

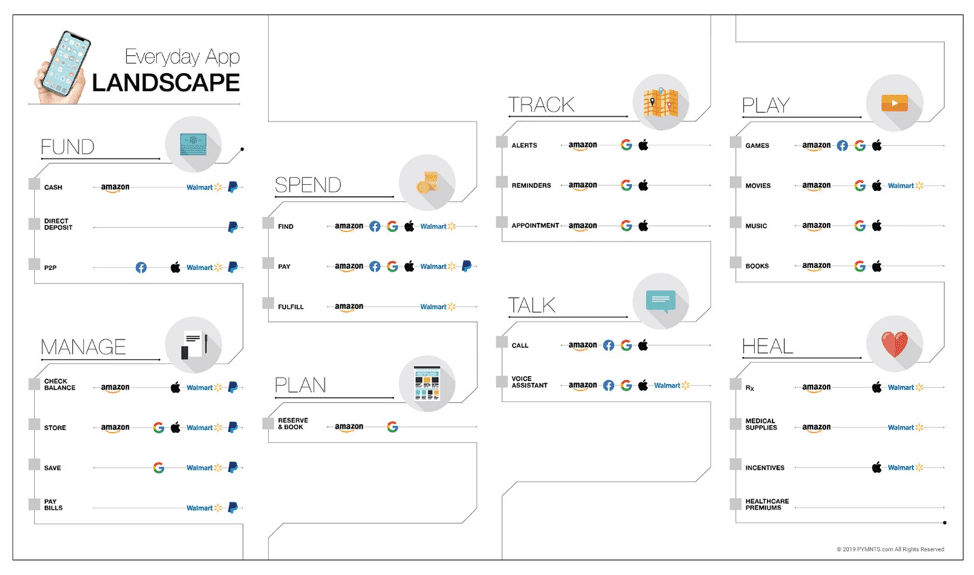

PYMNTS has taken a shot at breaking down everyday app functionality into a few buckets that capture the types of activities that might drive Super App interest based on the common types of apps and experiences consumers use every day – and bucketing some of the leading global contenders into those categories.

Those with their sights set on becoming the consumer’s Super App in the U.S. – Google, Apple, Amazon, PayPal, Facebook, Uber, Walmart – are all at different places along that continuum. No one has it all, yet everyone is using their assets as leverage into the areas where they have a gap.

The question then becomes: Who is best-positioned to become the consumer’s Super App front door?

The question then becomes: Who is best-positioned to become the consumer’s Super App front door?

The answer may vary based on where in the world one is, and who can fill the gaps that are most critical in enabling important everyday app capabilities.

In emerging economies, that may be access to a bank account and/or a place where incoming funds are received. Apps like Grab and Gojek, and WeChat and Alipay started out as digital wallets, but have become essential ecosystems as funds from wages, other earnings and government benefits are deposited into those accounts. Managing spend – and providing places to spend, save and invest those funds – has flourished as a natural extension of the digital repositories where funds are received.

In developed worlds, where bank apps and bank relationships are already well-entrenched, commerce is the starting point for aggregating features and capabilities that today require multiple apps to manage. There, Amazon clearly has an advantage – and voice is becoming a differentiating enabler.

Amazon is integrating Alexa into tens of thousands of third-party devices, and bolstering Alexa’s skills to include searching for content that might otherwise be diverted to Google. Amazon is offering incentives to homeowners to make their homes smarter with Alexa – and third-party devices to make their cars smarter, too. Amazon gets that they don’t have search covered (beyond search on their platform for what to buy), and is using the Echo and the Echo Show to prompt users to turn Alexa into their helpful everyday assistant.

Google, on the other hand, has to crack closing the loop on commerce. Google Shopping is an effort to keep searches for products inside the Google ecosystem, storing credentials in the browser for an easy payment experience. Google is also integrating commerce into searches for flights and food.

But Google has a long way to go to catch up with Amazon – which has nailed the last mile to eCommerce and is expanding its commerce reach into more and more of the segments consumers use every day.

Facebook is an advertising platform that hasn’t yet cracked commerce – and it’s not clear that they will, outside of Instagram.

Apple is sort of an odd duck when it comes to commerce. They support a lot of commerce apps –including Uber – in the App Store. But Apple makes money on commerce only for digital apps – and only when those digital apps collect money through the App Store. And Apple Pay doesn’t seem to be really integrated into an overall commerce strategy or doing much to habituate usage.

In the U.S., there is more than just a passing interest in the concept of a Super App.

In research PYMNTS did over the summer, we found that about a third of all consumers expressed strong interest in the “app of apps” concept, with 11 percent of those we studied expressing an extremely strong interest. Only 13 percent said thanks, but no thanks. The majority of consumers, 54 percent, were on the fence – they were a little or somewhat interested in having a single app as the gateway to a more streamlined interaction with the many apps they use every day.

When asked who that is, consumers say it’s Google (45 percent), followed by Amazon (29 percent), Apple (27 percent) and PayPal (22 percent). Facebook, Samsung and Walmart are favored by 15.6, 15.3, and 14.3 percent of consumers, respectively – more or less a statistical dead heat.

When measured by interest, the one-third of consumers with a strong interest in using an everyday app would pick Google and Amazon, in that order, to deliver it.

Google’s ability to go beyond commerce to apps like email and calendaring provides more of the everyday app reminders, such as when to pay bills, that consumers say is helpful in managing day-to-day activities.

Not surprisingly, it’s why Alexa – at least mine, via the Echo Show that sits in my kitchen – is now starting to remind me when deliveries are coming and prompting me to provide her with more information to help manage the day-to-day.

From where I sit, it appears the race is on to capture a big part of the Super App market.

There’s an incredible opportunity for Super Apps to create a new way for consumers to reduce the friction in their lives. Several of the leading players, not to mention the upstarts, already have key pieces of what’s needed to do this. And they will have even more as innovators provide new tools that make Super Apps even more portable, even more interoperable and even more voice-enabled.

Those who succeed can own an ecosystem that creates new opportunities to monetize their Super App status, but also less dependence on the platforms – and commerce flows – that others control.