Economists Predict Post-COVID Rebound, But Many Digital Shifts Will Remain

Even as the economy rebounds, most consumers expect to keep their digital shopping habits, research shows.

This week’s start of U.S. COVID-19 vaccinations has economists predicting a big rebound for 2021, but PYMNTS data show that plenty of consumers’ pandemic-era changes to shopping and payments habits aren’t going away anytime soon.

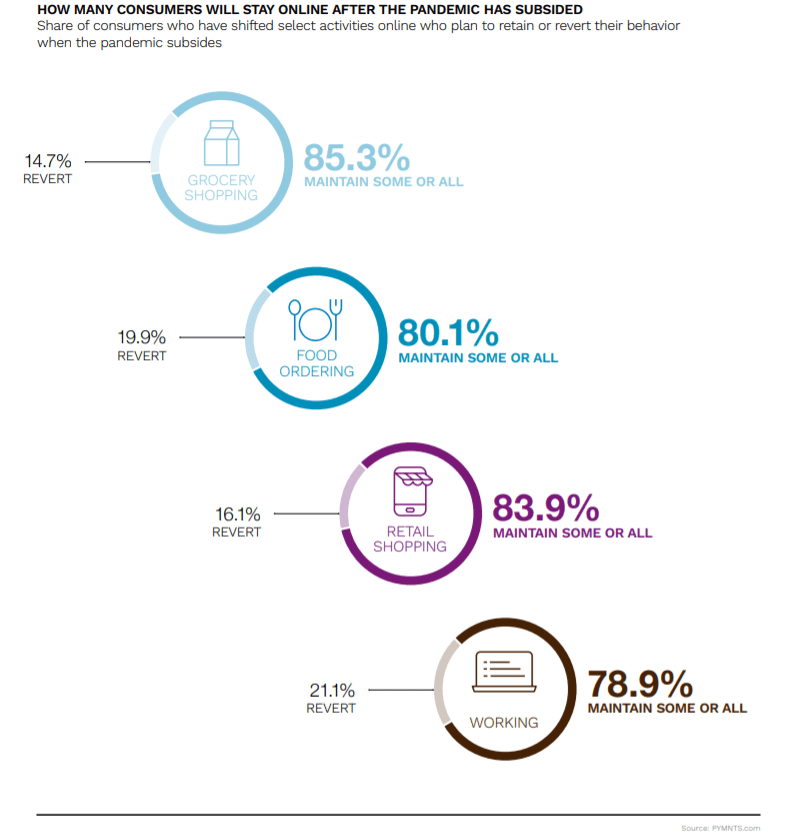

“The digital shift looks more permanent than ever, with eight out of 10 digital shifters planning to keep shopping as they do now after the pandemic has subsided,” PYMNTS concluded in the recent report “The Emerging Post-COVID-19 Consumer: Mapping the Evolution of Consumers’ Shifting Payment Preferences.”

The study, which involved surveying 1,958 U.S. consumers, predicted that many COVID-era behaviors will remain even as vaccines stem the pandemic. However, economists say the recent U.S. emergency approval of COVID-19 vaccines should lay the groundwork for a strong economic and market rebound.

“In a word, it’s vaccines,” Michael Schumacher, macro-strategy chief at Wells Fargo Securities, told CNBC this week. “As vaccine distribution picks up, we think it’s going to boost confidence dramatically. That’s when you see a lot more hiring going on.”

John Stoltzfus, chief investment strategist at Oppenheimer Asset Management, this week issued a report calling for the benchmark S&P 500 to gain a hefty 18 percent in 2021, based in part on “the successful rollout and acceptance by the public of vaccine(s) capable of stemming the spread of the COVID-19 pandemic.”

Stoltzfus also wrote that his target assumes the stock market will factor in “the success of said vaccine(s) in stemming the spread of COVID-19, as well as material progress in reversing the societal and economic disruptions wrought by the pandemic since Q1 2020.”

However, PYMNTS research indicates that some online habits that consumers adopted for the pandemic will stick around.

For instance, the “Emerging Post-COVID-19 Consumer” report found that 85.3 percent of U.S. shoppers plan to continue some online grocery buying, while 80.1 percent intend to keep ordering at least some meals online:

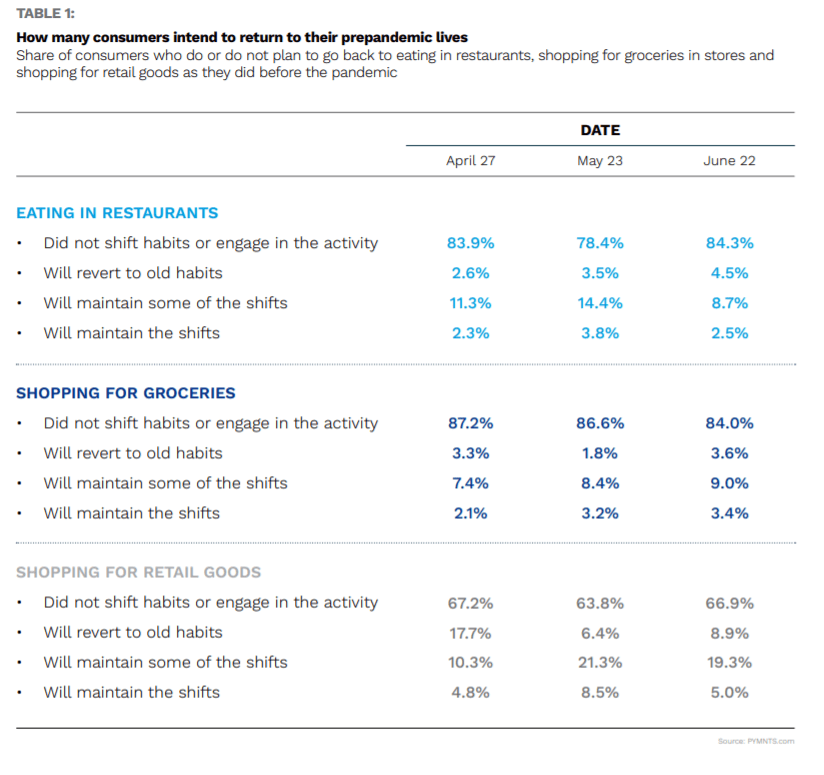

PYMNTS’ recent “How We Shop” study, conducted with PayPal, showed similar results. That study found that roughly three times as many consumers who shifted to online grocery or retail shopping or cut back on dining out will maintain their pandemic-era habits as those who plan to return to their old ways:

PYMNTS’ recent “How We Shop” study, conducted with PayPal, showed similar results. That study found that roughly three times as many consumers who shifted to online grocery or retail shopping or cut back on dining out will maintain their pandemic-era habits as those who plan to return to their old ways:

But that doesn’t mean every stay-at-home or work-from-home stock will benefit.

But that doesn’t mean every stay-at-home or work-from-home stock will benefit.

James Chen, a certified market technician and director of trading and investing content at Investopedia, recently wrote that on one hand, some stay-at-home stocks like Amazon and Netflix look poised to hang onto their gains.

“The market is betting that many of these habits – like getting more and more things delivered or spending more time indoors – will linger well into 2021 and beyond,” Chen wrote. “The initial public offering success of DoorDash Inc. is a recent example of the market getting behind pandemic habits being hard to give up.”

But he noted that other pandemic-era winners have already begun to pull back from their pandemic highs. For example, Zoom Video Communications was trading some 31.7 percent below its $588.84 intraday peak as of Tuesday morning (Dec. 15).

“Companies like Zoom and Peloton Interactive Inc. … have since seen the market start to cool on their post-COVID-19 prospects,” Chen wrote. “The market is giving a weak signal that the group experience will prevail in a world where spin classes and in-person meetings are once again safe. Overall, investors are still debating which of our new digital habits will be sticky and which ones will be discarded once we can leave our houses with confidence to participate in the real thing.”

Read More On COVID-19:

- World Bank: Global Growth Still Lower Than Pre-COVID

- FTC Says Grocery Giants Profited From Pandemic-Era Supply Chain Problems

- IRS Launches Voluntary Disclosure Program for Businesses That Filed Dubious ERC Claims

- Walgreens Looks Aisle to Aisle to Cut Costs