Revolut Launches Expense-Splitting Feature

Revolut Ltd., the British financial technology (FinTech) company, has introduced what it describes as a simple way to track, split and settle expenses instantly, in one place.

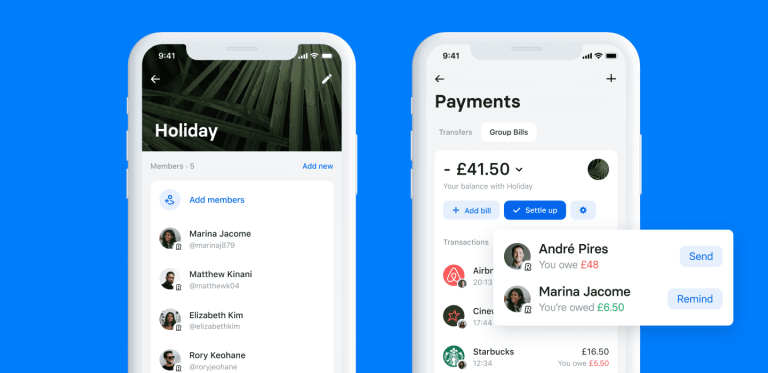

Group Bills promises to ease the management of group expenses. Instead of splitting one bill at a time, the platform allows customers to stay on top of shared expenses with roommates.

With the new service, users add bills to their “group” and track them in one place. When it’s time to make payments, the app can make instant transfers when customers are on Revolut.

“From two to 20 people, splitting group expenses has never been easier,” the company said in a statement. “No need to have those awkward conversations: Simply send a payment reminder and Revolut will send an automatic notification to your friend about payback.”

The service can split bills with accuracy without users having to do the math, Revolut said. Group Bills determines how much each person needs to pay, and also adds a name and photo for security.

Revolut, one of the biggest players in the crowded FinTech sector, has yet to be profitable. Last week, the company said its losses more than tripled in 2019, despite a surge in revenues and customer numbers. The company posted a total loss of $139.6 million (106.5 million pounds) in 2019, up from $43.4 million (32.9 million pounds) in 2018. Revolut attributed the losses to its expansion into new markets and the introduction of new products.

Still, the five-year-old app-based challenger bank, which boasts 10 million customers, is popular. PYMNTS’ latest Provider Ranking of Digital Banking Apps put Revolut at No. 3, behind Chime at No. 1, with Nubank holding onto the No. 2 spot.

Last month, Revolut secured $80 million in funding at a $5.5 billion valuation as part of its Series D round that launched in March. The latest infusion of cash comes from TSG Consumer Partners, a San Francisco-based private equity company.

In February, Revolut raised $500 million in a round led by Menlo Park, California-based TCV, one of the largest growth equity firms. Also in July, Revolut expanded into cryptocurrency trading with help from New York-based Paxos Trust Co.