If your business touches retail in any way, it might pay to follow a few important breadcrumbs.

Nike posted its lowest quarterly sales in two years, along with a $790 million quarterly loss, when it reported its Q1 2020 earnings in late June. A key driver of the results was a 50 percent reduction in wholesale shipments and canceled orders from physical stores that had closed. That quarter, Nike CEO John Donahoe said that digital represented 30 percent of Nike’s sales. He told investors that he plans to drive more than 50 percent of future sales through digital channels.

Last week, Constellation Brands purchased Empathy Wines, a direct-to-consumer (DTC) eCommerce business that sells wines from California vineyards. It reportedly purchased this digital upstart — one with a reported (and very small) $3.9 million in sales from selling 15,000 cases since its launch in 2019 — to build a strong digital presence. Constellation, a holding company that owns popular beer, wine and spirits brands including Corona, says that 90 percent of its sales today come from physical establishments — bars, restaurants, liquor stores and hotels, to name a few.

In May of this year, PepsiCo launched two DTC sites, it said, to meet consumers where they now live, work and shop — which is via digital channels. PantryShop.com and Snacks.com sell pantry staples (think Quaker Oats and Gatorade) and salty snacks (think Doritos and Cheetos) directly to consumers even as grocery and convenience stores still represent the bulk of PepsiCo sales.

Analysts now say that as many as 50 percent of U.S shopping malls will shutter by the end of 2021. It’s not a surprise, really — malls have been in distress for the last decade, as consumers have shifted more of their shopping to digital channels, and the dead malls have been piling up for some time. But the loss of distressed anchor stores — Sears, JCPenney, Nordstrom, Barneys — and the yet-to-be-announced closures of some Macy’s, Saks and Neiman Marcus stores, analysts say, will only accelerate their demise.

Worse yet, some analysts fear the triggering of break-lease clauses for retailers in malls if anchor stores leave. The hardest-hit are likely malls in the more suburban, less densely populated areas, which will require consumers to drive father if they want to shop there. All of this will only make malls an even tougher sell to consumers, and to retailers that want consumers to buy their stuff. And all of this is happening at the same time that consumers are shunning enclosed environments of any kind, including malls, over pandemic-fueled health and safety fears in favor of digital and digital-first options.

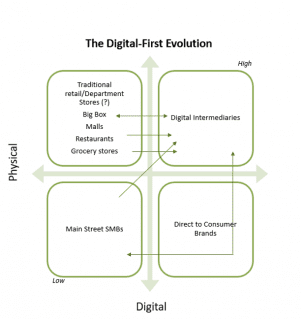

These four independent data points, together, signal a dramatic shift in how the retail landscape will look in a post-pandemic world.

And they set the stage for the inevitable clash between what has increasingly become the vicious circle of physical retail and the virtuous circle of digital.

How Much Will Digital-First Stick?

The global pandemic has surfaced any number of questions for businesses trying to chart a course toward a future that is without modern, historic precedent — and a future for which many of the elements that will shape it are largely unknown.

Among the many questions that businesses want answered is one that may already be quite knowable: How much of the consumer’s pandemic-fueled shift to digital will stick once the pandemic has passed.

Knowable, that is, if you follow the breadcrumbs and dig into the data.

Based on what we know from consumers, now a little more than 100 days into living under full or partial lockdown, the answer is that they very likely will.

In May, I made the case that we were witnessing what math geeks call a jump discontinuity, a sharp and distinct break from the past and an irreversible shift — a quantum leap — to something new.

In the past, innovations that have created the foundations for some of history’s greatest quantum leaps have evolved slowly over time — because breaking with the status quo means breaking free from the inertia that prevents consumers from trying something new, and keeps businesses from getting that something new to scale quickly.

The global pandemic has made inertia a moot point — and has made the quantum leap to a digital-first retail world an inevitable reality.

Here’s why I say that.

A month ago, we found a consumer who thought it would take until early 2021 before they would feel comfortable re-engaging in the physical world the way they did in January. We’ll soon know whether the recent spike in COVID cases in the U.S. has impacted that timeline.

Consumers consistently say that a vaccine is what will make them totally comfortable re-engaging, and from what we are hearing from the CDC, that is probably a year away. As hard and as fast as pharma companies are working, it will take time for a vaccine to be approved and then distributed to healthcare providers. The longer that takes, or the longer it takes for a reliable therapeutic to become available, the longer that consumers will have to buff up their digital shopping skills, the longer brands will have to buff up theirs, the longer digital intermediaries will have to capture more of the consumer’s attention, and the longer physical retail will have to keep up.

Today, we find a consumer who has become digital-first because she is now making decisions about everything through a “my-health-first” lens. We also find a consumer who’s had a taste of re-engaging in the physical world — to eat at restaurants or to shop in stores — at least once as lockdowns have loosened. The question yet to be answered is whether consumers have found those experiences satisfying enough to revert to their regular pre-pandemic frequency. The many with whom I have personally spoken say they have not, despite the best efforts on the part of shops and restaurants to make it as good as it can be under current reopening restrictions.

Maybe without good digital or digital-first options, consumers would accept these physical experience trade-offs. But with them, many consumers are just as likely to wait and to use convenient digital alternatives until they feel more comfortable.

Brands see this digital shift in their numbers, even as stores have reopened and physical sales have started to increase. A consumer who relies less and less on the physical store implies that brands will, in turn, rely less and less on physical retail as a viable channel for selling their products.

Brands could naturally pull back on physical store efforts in favor of other channels that increase their odds of making sales — and making them at full price. Shifting more heavily to digital channels isn’t simply a way to diversify across shopping channels — it’s a conscious realization that some, maybe even many, of the physical channels that once drove margins and sales are likely to become less relevant, and even faster than what was once expected.

After all, those brands also have to blunt the impact of the pandemic on their own sales, and growing concerns over the uncertainty of a consumer’s ability and appetite to spend money with them today and tomorrow.

For physical retail, this jump discontinuity is being fueled by consumers who, despite the reopening, may be as comfortable going to physical stores as they once were. According to a PYMNTS study a month ago of a national sample of some 14,000 U.S. consumers, two-thirds reported being uncomfortable shopping in a physical store due to concerns of contracting the virus.

Going to physical stores now carries a multitude of uncertainties for the consumer — uncertainty over the new in-store shopping experience, uncertainty about their own perceived health risks when shopping there, and uncertainty related to the selection they will find when they arrive.

The ability to try on clothes or shoes or hats or coats or jewelry or makeup before buying was one of the big benefits of the physical store experience — and a boost to physical store sales. That, too, is causing friction now, as consumers either can’t try things on, don’t want to try things on or need to make an appointment in advance to do so.

All things considered, we have a consumer who, with an abundance of digital channels available, may not feel they are missing out if they avoid going to the physical store.

With fewer consumers shopping in physical stores and better digital alternatives readily available, there are fewer opportunities for physical retail to make itself an attractive alternative in a timeframe that is relevant to both the consumers’ interests and the brands’ bottom lines.

The Path Forward

The virtuous circle of digital — and digital-first — is now fanning the flames of the vicious circle of physical retail. Consumers aren’t going to return to physical for many months, and physical can’t survive that loss of demand — which means consumers won’t have as many physical choices as before once they feel comfortable reengaging.

In other words, getting a consumer to think and act differently will require more than physical retail channels going more toward digital.

The big question between now and then is whether physical retail — and the physical retail business model — can make the same quantum leap to digital that their customers already have, and one that digital-first retailers had a head-start creating many years ago.

Some physical retailers, including many big-box brands, have created new experiences that blend the digital and physical — and in creative new ways, including culling VIP lists and offering advance looks at new merchandise, new markdowns or new experiences.

At the same time, digital-native brands have doubled down on making the digital experience personalized — and as good as, if not better than, dealing with a sales associate in a physical store. They’ve made live chat actually live, in real time, with a real person who can answer questions on products, send images via text and use digital tools to create personal shopping pages with curated items — all with the goal of increasing a consumer’s propensity to buy.

Brands are also more forcefully and strategically expanding their direct-to-consumer channels, taking ownership of that customer relationship in an effort to shift the digital-first consumer to their own digital-first DTC channels that offer better inventory, pricing, distribution and margin control. They are also examining their options with the digital intermediaries that consumers trust, which create a friction-free, digital-first shopping experience — even perhaps forcing these digital intermediaries to make their own brands more visible and shoppable.

Speaking of digital intermediaries, they are solving the distribution and logistics issues that have prevented many businesses, particularly those on Main Street, from being able to go digital in any meaningful way — especially since so much of their traffic is hyperlocal and comes in and out of their stores. The integration of digital tools and new business models has even turned traditional players into digital intermediaries themselves, boosting consumer choice by providing access to unique, digital-native brands.

Digital commerce and payments platforms make it easy for businesses to get online, accept digital payments and enable a touchless and contactless experience, in or out of their stores, using contactless cards and scannable QR codes.

As a result, the digital experiences offered by brands — and the digital intermediaries that consumers now use to find and buy things — are becoming more refined, more valuable and more feature-rich every day.

And, therefore, they are becoming stickier for consumers who try it and discover that they really like it.

Physical retail can make the quantum leap, but it will be at the hands of digital players who will force its reinvention — or otherwise contribute to its demise.

Take Main Street SMBs, those most hurt by the lockdowns, a segment of physical retail that may even have the best of all digital/physical retail options. Direct-to-consumer brands may find them to be an attractive outlet to capitalize on the hyperlocal shopping experiences with which consumers in those communities feel most comfortable. Digital platforms help them create digital storefronts, and integrate with digital intermediaries to solve their logistic challenges or utilize digital platforms to solve them on their own.

At the other extreme, marketplaces and aggregators, depending on which segment of the market they serve, stand to gain the most, as they use their technology platforms to seamlessly integrate physical into a digital-first experience. These intermediaries have also benefited the most from the pandemic-fueled lockdown, as many of them took their own quantum leaps into digital years ago.

But in the end, the vicious circle doesn’t bode well for physical retail. Even before the pandemic, consumers were getting turned off to brick-and-mortar stores, as foot traffic declined and inventories were depleted.

Now, they are finding that many of the stores where they used to shop aren’t there. Often, that will require them to take a longer trip to a store they do like — or settling for one they are less happy with.

So, they’ll stick with digital and will tell their friends — and physical will see more of a decline.

Some of this would have happened without COVID-19. But the sudden jump to physical has accelerated the vicious circle of its decline — at least for traditional physical — and boosted the virtuous circle of growth for digital.

And it will happen sooner than anyone thinks. Just ask any consumer.