PYMNTS Intelligence: How Payments Orchestration Can Help Merchants Cope With Payments Outages

Digital payments have become must-haves in the retail world as customers have come to expect that their credit card transactions will be processed successfully without false declines, lag time or outage-caused interruptions. The global transaction value for digital payments was estimated at $7.4 trillion last year and is projected to reach $15 trillion by 2027, representing a CAGR of 12%.

Merchants face a wide variety of obstacles in implementing digital payments, however. Payment card services can go offline unexpectedly, for example, or a customer’s contactless payment method can fail to function for no apparent reason. A declined digital payment can lead to an abandoned purchase, especially in online commerce, meaning that any unexpected error can result in losing a customer either temporarily or permanently.

Forfeiting digital payments is not a practical option, so businesses must implement multiple payment gateways to ensure that every payment goes through. This month, PYMNTS Intelligence examines how payments orchestration systems can make the lofty goal of zero downtime a reality.

Potential Hiccups in Payment Processing

Digital payments can become unexpectedly nonfunctional at any moment, and these outages are next to impossible to anticipate or predict. Earlier this year, for example, hundreds of Mastercard credit and debit users throughout the United Kingdom reported having problems using their cards at retailers across a variety of different issuing banks, including HSBC, Monzo and Santander.

Both contactless and chip-and-PIN payments were affected, with some users saying they tried multiple cards and none of them worked. Although Mastercard fixed this problem in a timely matter, it was not quick enough for merchants that lost revenue to customers abandoning purchases because they did not have cash or a working card on hand. A PYMNTS study found that 58% of consumers would purchase less often from a business where a card payment was declined.

Other payment snafus can occur on a geopolitical scale. Russia’s invasion of Ukraine that began earlier this year caused massive worldwide sanctions, including several major companies pulling out of Russia and dozens of Western nations suspending trade. One of the most hard-hitting sanctions, however, was the European Commission’s disconnection of seven Russian banks from the SWIFT network, intended — along with sanctions against Russia’s two major financial institutions (FIs) and central bank — to restrict Russian citizens’ access to cross-border payments. International merchants with Russian customers are not cut off entirely — other networks, such as TARGET2 and CHIPS, are still online — but integrating an entirely new payment network can be a monumental task even for a large bank or business.

Merchants and other businesses cannot be expected to cope with these payment complications all on their own, nor should they lose customers for reasons beyond their control. Payments orchestration systems help them seamlessly route payments through new gateways at a minimum of merchant and customer friction.

The Benefits of Payments Orchestration for Payment Diversity

Payments orchestration systems harness multiple payment gateways on the back end while presenting a single stream to the merchant and customer, allowing merchants to seamlessly leverage an alternative payment gateway if the first one goes down. This can result in higher payment card success rates by mitigating outages and leveraging higher success rates that one vendor may have in certain geographic areas or with specific transaction types.

It also provides merchants with flexibility to experiment with different payment methods for improving seamlessness and lowering processing costs. Businesses could potentially implement multiple payment gateways in-house, but this requires dedicated IT and payments staff at great expense. Leveraging a third party not only offers a more seamless integration, but also enables advanced payments orchestration systems such as smart routing, which automatically selects the optimum gateway for a given customer’s transaction type or location.

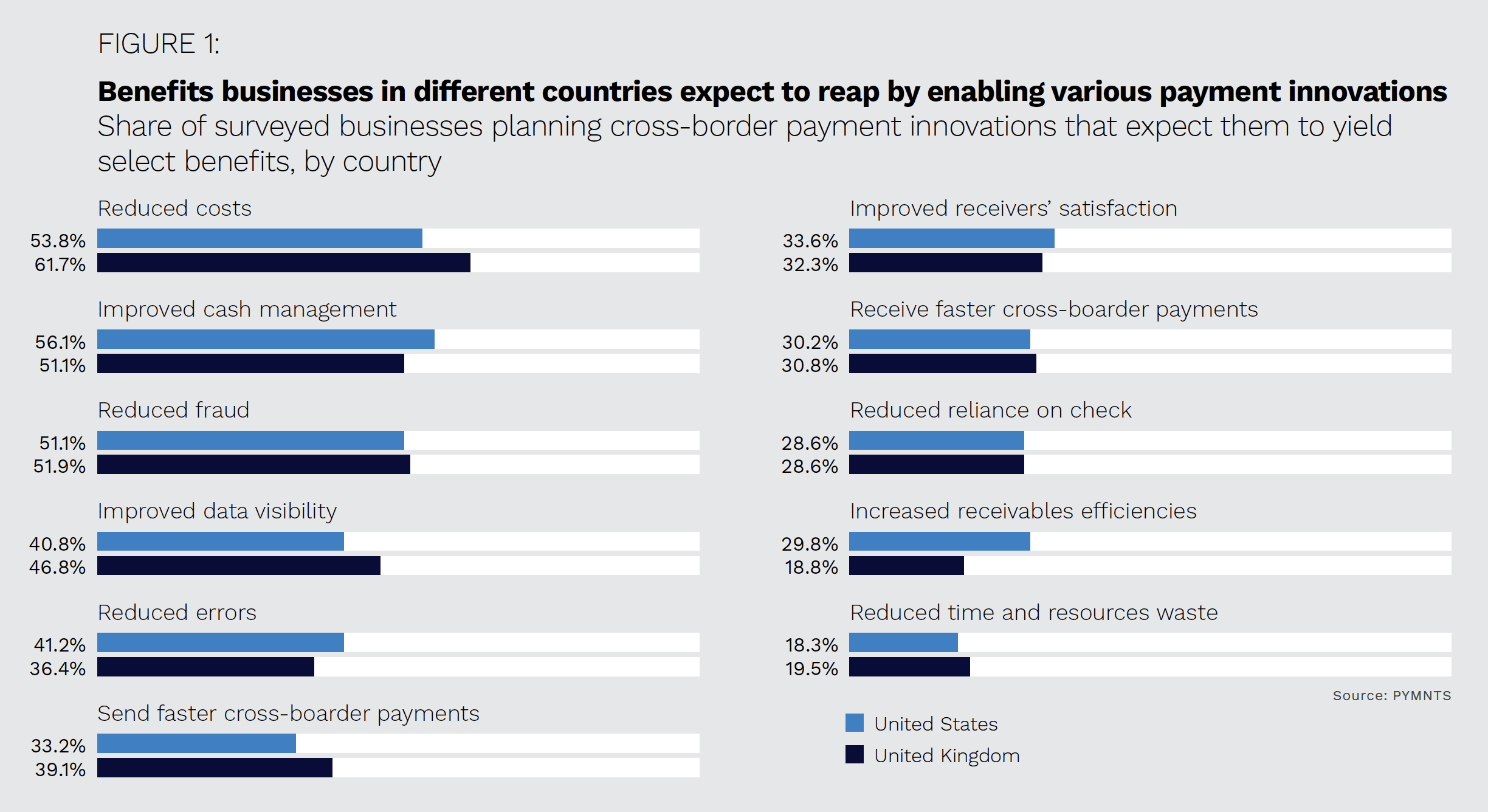

Businesses anticipate a wide range of benefits from implementing payments orchestration options. In the U.S., 54% of merchants believe that payments innovations such as these reduce overall costs, and 41% expect them to reduce errors. U.S. merchants also anticipate faster international transactions on both sending and receiving ends of cross-border payments at 33% and 30%, respectively.

Payment system outages are an inevitable happenstance during the course of business, but the lost revenue from customer abandonment and employee headaches are solvable issues. Payments orchestration systems are a critical tool for closing that gap and enabling a superior payments experience and customer relationship.