Credit card vaults are essential to payment card industry (PCI) compliance. Vaults can do more than secure sensitive data to meet regulatory requirements. A recent survey showed that of the nearly 70% of online carts that shoppers abandon, 18% are because they do not trust a site with their credit card data.

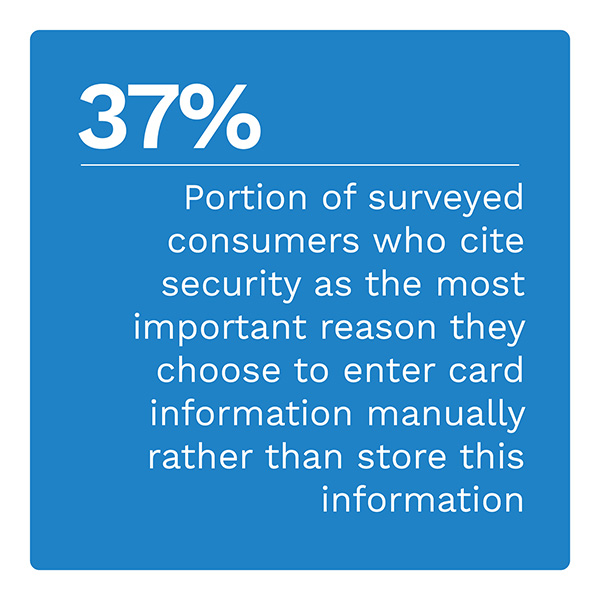

Checkout friction is a constant pain point for any business involved in eCommerce. In any discussion related to fraud and security, the need to balance friction against security concerns will likely arise. Payment method vaults offer the opportunity to simplify that balance without sacrificing convenience. Thirty-six percent of consumers view data protection as the most important function of vaults. Modern vaults can offer services such as card checks at the time of vaulting — protecting merchants and ensuring that legitimate transactions are processed smoothly.

Checkout friction is a constant pain point for any business involved in eCommerce. In any discussion related to fraud and security, the need to balance friction against security concerns will likely arise. Payment method vaults offer the opportunity to simplify that balance without sacrificing convenience. Thirty-six percent of consumers view data protection as the most important function of vaults. Modern vaults can offer services such as card checks at the time of vaulting — protecting merchants and ensuring that legitimate transactions are processed smoothly.

The “Payments Orchestration Tracker®” explores payments vaults’ developing potential for driving improvements to merchants’ bottom- and top-line growth.

Around the Payments Orchestration Space

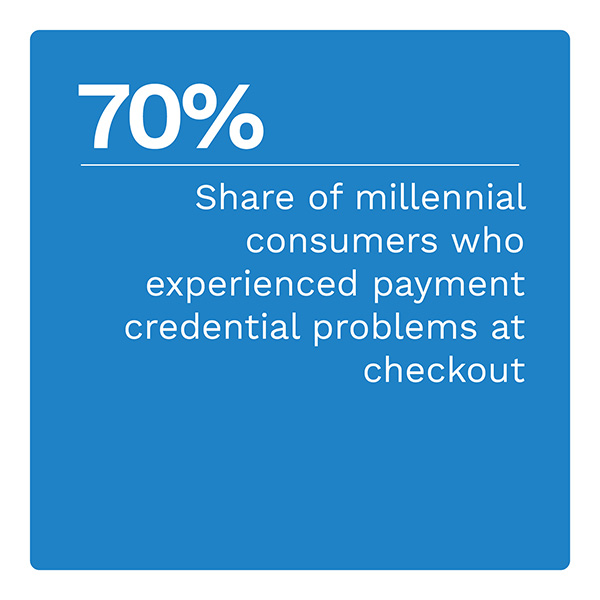

Already, 60% of consumers have payment credentials stored for subscriptions or fast online purchases. Among high-income consumers, that percentage grows to 65%. As consumers have had more contact with stored payment credentials, they have also encountered friction. Consumers may have several stored payment methods, each of which they store and keep active in a single merchant’s vault.

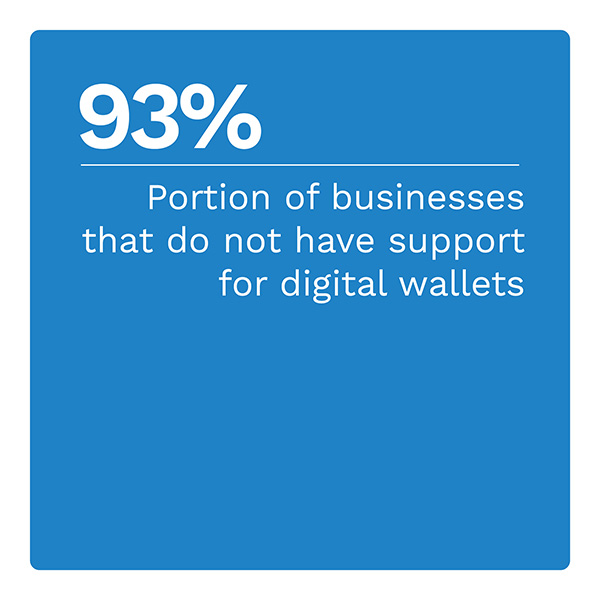

Most online merchants are leaving money on the table by limiting the payment options they provide to consumers. Ninety-three percent of businesses lack support for digital wallets such as Apple Pay and Google Pay. In contrast, 80% of surveyed consumers say they use stored payment credentials for at least some online transactions.

For more on these and other stories, visit the Tracker’s News and Trends section.

Driving Outcomes With Payments Vaults Innovations

Payments vaults bring value to merchants with security, compliance and credential optimization. Between efficiencies and the potential to increase authorization rates with network tokens and card-account updates, payments vaults already have value built in. In the past, merchants have seen vaults as a cost of doing business. They are now waking up to the potential for these to also aid in revenue generation.

To get the Insider POV, we spoke with Jordan McKee, FinTech research and advisory group lead, Technology, Media and Telecoms (TMT) at S&P Global Market Intelligence, about the value payments vaults offer merchants and consumers — and the potential for further innovation.

The Value of Payments Vaults to Merchants

One of the biggest pain points for consumers and merchants is expired payment credentials. With card life-cycle management solutions, vaults can ease that pain by providing dynamic updates to reissued cards. These connections to card networks or third parties have minimal impact on transaction activity when a provider reissues a card. Enabling life-cycle management reduces costs, false declines and customer churn due to failed payments. This enablement supports merchants in retaining transactions and protecting lifetime customer value.

To learn how vaults can help with life-cycle management and other payments necessities, read the Tracker’s PYMNTS Intelligence.

About the Tracker

The “Payments Orchestration Tracker®,” a collaboration with Spreedly, examines how payments vaults can help merchants by driving bottom- and top-line growth.